Best Crypto Exchanges 2025 – Find the Right Platform for Your Trades

When searching for best crypto exchanges 2025, the top-rated platforms that blend low fees, robust security, deep liquidity and intuitive tools for today’s market, top crypto exchanges 2025, you’re really comparing a handful of key qualities. A good exchange must let you move money quickly, keep your assets safe, and charge you as little as possible for each trade. That’s why most traders start with the same three questions: How secure is the platform?, What does it cost to trade?, and How much liquidity does it offer? Answering those questions gives you a clear picture of whether an exchange belongs in your toolbox.

Key Factors That Define the Best Crypto Exchanges

First up is crypto exchange fees, the set of charges applied to deposits, withdrawals and each trade. Fees can be a flat rate, a percentage of the transaction, or a maker‑taker structure that rewards liquidity providers. Second, there’s exchange security, the collection of protocols, audits and insurance measures that protect user funds from hacks and breaches. Look for two‑factor authentication, cold‑storage wallets and regular third‑party security audits. Third, exchange liquidity, the depth of order books that lets you buy or sell large amounts without huge price slippage matters for fast execution, especially when you trade volatile assets. Together, these three entities form the backbone of any solid exchange evaluation.

Security influences everything else. If an exchange’s safety nets crumble, your funds could disappear regardless of how low the fees are. That’s why many top platforms invest heavily in multi‑signature wallets and routine penetration testing. They also offer insurance funds that cover certain loss scenarios, adding a safety net for traders. When you pair strong security with transparent fee schedules, you get a trustworthy environment where you can focus on strategy rather than worry about potential theft.

Fees, on the other hand, directly affect your bottom line. A platform that charges 0.2 % per trade might seem cheap, but if it adds hidden withdrawal costs or high spreads, the total expense can balloon. Some exchanges implement a tiered fee model: the more you trade, the lower your maker‑taker fees become. Others provide discounts for using the native token to pay fees, which can be a clever way to shave off a few basis points. Understanding the full fee structure helps you calculate the real cost of each trade and avoid nasty surprises.

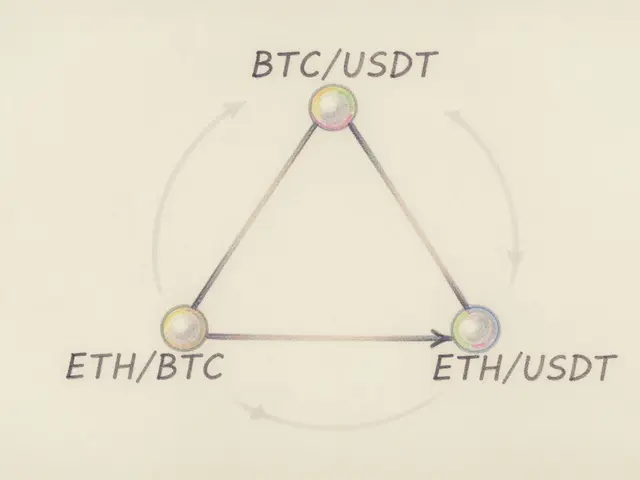

Liquidity closes the loop by ensuring that low fees and strong security actually translate into smooth trading. An exchange with thin order books might freeze your trade or force you to accept a worse price, negating any fee savings. Platforms that aggregate liquidity from multiple sources—often through cross‑chain bridges or partnership networks—deliver tighter spreads and faster fills. High liquidity also supports advanced order types like stop‑limit or iceberg orders, giving you more control over execution.

Armed with this framework, you’ll be ready to scan the list of articles below. Each piece dives into a specific exchange, breaks down its fee model, security posture and liquidity depth, and shows you how it fits into the broader 2025 landscape. Whether you’re a beginner looking for a simple interface or a pro trader needing deep order‑book data, the collection gives you the actionable insights you need to pick the perfect platform.

A detailed Deliondex crypto exchange review covering fees, security, liquidity, user experience, and how it compares with Binance, Coinbase, and Kraken.

Jonathan Jennings Jan 8, 2025