Understanding the Common Reporting Standard and Crypto Taxation

Crypto Tax Compliance Checker

Tax authorities are finally catching up with the crypto boom. The Common Reporting Standard (CRS) is a global information‑sharing system that now pulls crypto holdings into the tax net, while the new Crypto‑Asset Reporting Framework (CARF) tracks every transaction. Together they reshape crypto taxation for anyone holding, trading, or issuing digital assets.

Key Takeaways

- CRS 2.0 expands reporting to crypto holdings, stablecoins, NFTs and CBDCs.

- CARF records cross‑border crypto transactions and feeds data to CRS.

- 120+ jurisdictions will exchange crypto‑related information by 2027.

- Financial institutions, investment entities, and custodial wallets must adapt.

- Compliance deadlines start Jan12026, with staggered rollouts across regions.

What Is the Common Reporting Standard?

The Common Reporting Standard (CRS) was created by the Organisation for Economic Co‑operation and Development (OECD) in 2014 to combat tax evasion through automatic exchange of financial account information. Today more than 120 countries have signed on, and the first reports started flowing in 2017.

Initially CRS covered traditional bank accounts, investment funds, and insurance products. The reporting financial institution (RFI) collects data on each account held by a foreign tax resident, then sends a standardized XML file to its domestic tax authority, which forwards it to the account holder’s home country.

CRS 2.0: Crypto Assets Join the Fold

Starting Jan12026, the OECD will roll out CRS 2.0 - an amendment that explicitly brings crypto‑related products under the CRS umbrella. The amendment widens the definition of “Financial Asset” to include:

- Specified Electronic Money Products.

- Central Bank Digital Currencies (CBDCs).

- Derivatives that reference crypto‑assets held in custodial accounts.

- Investment entities that allocate funds to crypto‑assets.

Crypto‑assets are now defined as any digital representation of value secured on a distributed ledger, covering stablecoins, tokenised derivatives, and even certain non‑fungible tokens (NFTs). In practice, the RFI must report the total market value of each crypto holding at year‑end, similar to a traditional securities position.

Introducing the Crypto‑Asset Reporting Framework (CARF)

CARF is the sister framework that focuses on the transaction side of crypto. Where CRS looks at “what you own”, CARF looks at “what you did”. It requires reporting of each taxable event - sales, swaps, staking rewards, and even transfers between wallets that cross borders.

CARF and CRS are designed to be complementary, avoiding duplicate data. For example, a user who holds a stablecoin will have that balance reported via CRS, while each purchase and sale of that stablecoin will be captured in the CARF feed.

Who Must Report? - The Expanded RFI Landscape

Under the combined regime, the following entities are on the hook:

- Financial Institutions - banks, broker‑dealers, and payment service providers that maintain custodial crypto wallets for customers.

- Investment Entities - funds, trusts, and venture capital vehicles that invest directly in crypto‑assets.

- Crypto Exchanges - platforms where users trade digital assets, provided they hold customer accounts.

- Custodial Wallet Providers - services that store private keys on behalf of users.

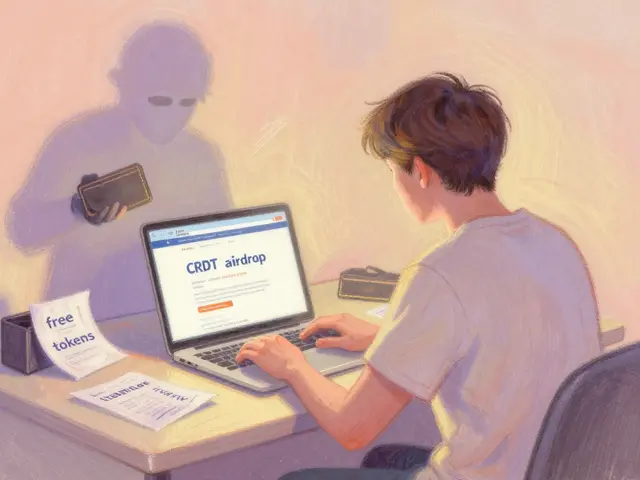

Non‑custodial wallets (where the user alone holds the private key) are generally exempt because there is no reporting entity. However, if a non‑custodial wallet is integrated into a broader service that qualifies as an RFI, reporting may still be required.

Step‑by‑Step Compliance Roadmap

- Map your crypto exposure. List every product you offer - from Bitcoin custodial accounts to tokenised real‑estate NFTs.

- Determine residency of each account holder. Use the OECD’s “indicators of tax residency” checklist to flag foreign customers.

- Upgrade data collection systems. Add fields for crypto‑asset type, contract address, and market‑value at year‑end.

- Implement CARF transaction logging. Capture date, amount, counter‑party jurisdiction, and classification (sale, swap, reward).

- Run a dual‑reporting test. Generate a mock CRS XML file and a separate CARF CSV; validate against both OECD schemas.

- Submit by the local deadline. Most jurisdictions require annual filing by the end of March following the reporting year.

Many firms are partnering with RegTech vendors that offer pre‑built CRS‑CARF modules - a cost‑effective shortcut compared to building the pipeline from scratch.

Global Rollout Timeline

The rollout is not uniform. Here are the key dates for major jurisdictions:

| Jurisdiction | CRS 2.0 Effective | CARF Effective |

|---|---|---|

| European Union (via DAC8) | Jan12026 | Jan12026 |

| Guernsey | Jan12026 | Jan12026 |

| United Kingdom | Jan12026 | Jan12026 |

| Australia | Jan12026 (scheduled) | Jan12026 (scheduled) |

| United States (CARF adoption under separate AML rules) | Not required (FATCA remains) | 2027 (planned) |

Notice the EU adopts the framework through DAC8, an amendment to the 2011 directive on administrative cooperation. The United States has not adopted CRS, but its FATCA regime will eventually intersect with CARF via AML/CTF legislation.

Practical Tips & Common Pitfalls

- Don’t treat crypto as a “one‑off” add‑on. The data model needs to handle high‑frequency trades and fractional balances.

- Watch the valuation date. CRS requires market value at the end‑of‑year snapshot - use a reputable price source (e.g., CoinGecko or Bloomberg).

- Beware of double‑counting. If a transaction is already reported under CARF, avoid repeating the same amount in the CRS holdings line.

- Stay on top of jurisdiction‑specific definitions. Some countries treat stablecoins as “electronic money” while others see them as “cryptocurrency”.

- Plan for audit trails. Tax authorities will soon request the underlying transaction logs that fed CARF data.

Looking Ahead - What’s Next After 2026?

Analysts expect two major trends:

- Broader asset coverage. Future amendments may pull in tokenised securities, carbon‑credit NFTs, and even virtual‑world land parcels.

- Real‑time sharing. While CRS is annual, pilot programs in the EU aim to deliver quarterly exchanges to improve compliance monitoring.

For now, the priority is to get the 2026 reporting cycle right. Early adopters will enjoy smoother audits and a competitive edge in the regulated crypto market.

Frequently Asked Questions

Will my non‑custodial wallet be reported under CRS?

No, unless the wallet service is provided through a reporting financial institution. Pure self‑custody does not create a reporting trigger because there is no third‑party entity to collect and transmit the data.

How do I value NFTs for CRS reporting?

Use the market price on the reporting date from a recognised marketplace (e.g., OpenSea) or an independent appraisal if the NFT is not actively traded. The value must be expressed in the reporting entity’s functional currency.

Do stablecoins count as crypto‑assets?

Yes. Under CRS 2.0, stablecoins are classified as "Specified Electronic Money Products" and are subject to the same holding‑reporting rules as other crypto‑assets.

What penalties exist for non‑compliance?

Penalties vary by jurisdiction but can include hefty fines (up to 10% of annual revenue), revocation of licence, and criminal prosecution for willful evasion.

Is there a unified software solution for CRS and CARF?

Several RegTech providers now offer integrated modules that generate both the CRS XML and CARF CSV files from a single data warehouse. Look for platforms that support the OECD’s latest schema versions.

Reading through the CRS‑2.0 rollout feels like stepping into a labyrinth of tax‑jurisdiction jargon, where every “financial asset” definition suddenly sprouts a crypto‑branch. The OECD’s shift forces custodial services to retrofit legacy reporting pipelines with blockchain address fields and market‑price APIs. If your compliance team still relies on Excel sheets, expect an existential crisis by Q1 2026. In short, brace for a data‑engineering sprint that rivals any DeFi launch.

It’s fascinating how the regulatory narrative frames decentralized finance as a mere accounting footnote, yet the underlying economics demand a paradigm shift. One could argue the real innovation lies not in the technology but in the global coordination of tax authorities.

Mapping every wallet address to its owner’s tax residency is the first concrete step toward compliance. Start by extracting the KYC data you already have and cross‑reference it with the latest OECD residency indicators. This proactive audit will save you from costly retroactive filings later.

Sure, but let’s be honest – most firms will wait until the regulator knocks before they even think about a KYC‑address matrix. Procrastination is a luxury they can’t afford.

From an ethical standpoint, the expansion of CRS to encompass crypto assets reinforces the principle that no financial activity should exist outside the sphere of public accountability. Regulatory arbitrage, especially in the crypto sphere, undermines the social contract and erodes trust in the financial system. Entities that ignore these obligations risk not only punitive fines but also reputational damage that can be irreversible. It is incumbent upon every institution, be it a bank or a custodial wallet provider, to embed robust compliance frameworks now, rather than retroactively scrambling under pressure.

Exactly. The moment you treat compliance as an afterthought is the moment you hand the regulators a golden ticket to your balance sheet. Immediate action isn’t just advisable; it’s mandatory.

Think of the upcoming reporting calendar as a training schedule – consistent, incremental effort beats a frantic last‑minute marathon. Allocate weekly sprints to update your data pipelines, and celebrate each milestone. You’ll find the process less daunting and more manageable.

That’s spot on. A disciplined, modular approach to integrating CRS‑CARF fields will also future‑proof your systems for the next wave of tokenized asset regulations.

Don’t let the sheer volume of transactions intimidate you; automation is your ally. Leverage existing RegTech solutions that already support the OECD schemas, and you’ll transform a compliance nightmare into a streamlined workflow.

The introduction of CRS 2.0 and CARF marks a watershed moment in the global financial architecture, fundamentally altering how digital assets are perceived by tax authorities.

The shift compels every custodial service, exchange, and institutional investor to reevaluate their data collection practices.

First, a comprehensive inventory of all crypto‑related products-stablecoins, NFTs, tokenized securities-must be compiled.

Second, each asset’s market value at year‑end should be sourced from a reputable price oracle to satisfy CRS valuation requirements.

Third, transaction logs need to capture the date, amount, counter‑party jurisdiction, and the nature of the event, be it a sale, swap, or staking reward, to feed CARF.

Fourth, the residency of each account holder must be verified against the OECD indicator checklist, flagging any foreign tax‑resident.

Fifth, integration with existing AML/KYC systems ensures that the newly added fields do not become isolated data islands.

Sixth, robust audit trails should be instituted, enabling regulators to request underlying logs with minimal friction.

Seventh, organizations should pilot their reporting pipelines well before the March‑deadline to iron out schema validation errors.

Eighth, partnering with a RegTech vendor that offers pre‑built CRS‑CARF modules can dramatically reduce implementation timelines.

Ninth, continuous monitoring of jurisdiction‑specific amendments is essential, as countries like the UK and Australia may introduce nuanced definitions for stablecoins.

Tenth, internal training programs must educate compliance teams on the subtleties of crypto‑asset classification under the new framework.

Finally, embracing this regulatory evolution can become a competitive advantage, signaling to investors that the firm operates with transparency and foresight.

In summary, a methodical, step‑by‑step approach will turn what appears to be a daunting compliance overhaul into a manageable, future‑proofed process.

While the preceding checklist reads like a best‑practice manifesto, one must question whether the OECD’s one‑size‑fits‑all methodology truly captures the heterogeneity of crypto markets. Nations with divergent regulatory philosophies may soon deviate, rendering such exhaustive preparations redundant.

Bottom line: dive in early, keep the data tidy, and you’ll sleep better at night when the tax season rolls around.

Regulators will never catch the average retail trader.

🚀 The crypto compliance wave is coming – better surf it than drown.

From a systemic perspective, integrating CARF data with existing AML transaction monitoring can unlock new risk‑scoring models, offering regulators a more granular view of cross‑border flows and potentially deterring illicit activity before it materializes.

That’s a great insight – developing a unified analytics dashboard for CRS and CARF feeds will not only simplify reporting but also empower firms to detect anomalies in real time.

Compliance is a marathon not a sprint

Only the lazy wait for the deadline to hit; the smart build systems now and laugh at the fines.

The global CRS push is a thinly veiled attempt by foreign powers to siphon wealth from sovereign citizens, and it must be resisted with robust legal defenses.

Everyone’s got their own take but the data pipelines will speak louder than rhetoric eventually

In the grand tapestry of fiscal oversight, crypto threads are just new colors weaving into an age‑old pattern, reminding us that law, like art, must evolve to reflect the canvas of human ingenuity.

Let’s focus on constructing transparent processes that satisfy regulators while preserving the innovative spirit of the crypto community.

💡 Pro tip: store all transaction hashes with timestamps in an immutable ledger; it makes both CRS and CARF reporting a breeze.

Building a compliant infrastructure is akin to constructing a sturdy bridge – you need a solid foundation, reliable pillars, and regular maintenance to ensure it doesn’t collapse under pressure.

Start by auditing your current data sources to identify gaps where crypto‑specific fields are missing.

Next, map those gaps to the OECD’s schema requirements, noting where custom transformations are necessary.

Deploy automated extraction routines that pull wallet balances, transaction histories, and counter‑party details into a centralized repository.

Validate the assembled data against both CRS XML and CARF CSV validators, fixing any mismatches before they become compliance headaches.

Incorporate version control for your compliance scripts so you can roll back changes if a jurisdiction updates its reporting rules.

Finally, schedule quarterly reviews to align your processes with the evolving regulatory landscape, turning compliance into a continuous improvement cycle rather than a once‑a‑year scramble.

By following this roadmap, firms not only avoid fines but also demonstrate a commitment to transparency that can attract savvy investors.

Oh great, another checklist – because that’s exactly what the regulators love to see.