Crypto Airdrop Guide: How to Find, Claim, and Stay Safe

When working with Crypto Airdrop Guide, a step‑by‑step resource that shows how to locate, qualify for, and claim free token drops safely. Also known as airdrop guide, it helps users navigate the fast‑moving world of free token promotions. The space is riddled with Airdrop Scams, fraudulent offers that mimic legitimate token drops to steal funds or personal data and with complex Airdrop Tax, reporting rules that turn a free token into a taxable event in many jurisdictions. Understanding these pitfalls is a core part of any solid guide. By breaking down eligibility, wallet setup, and claim procedures, a crypto airdrop guide — which we’ll refer to as the crypto airdrop guide — offers a clear path from discovery to safe receipt.

What You’ll Learn

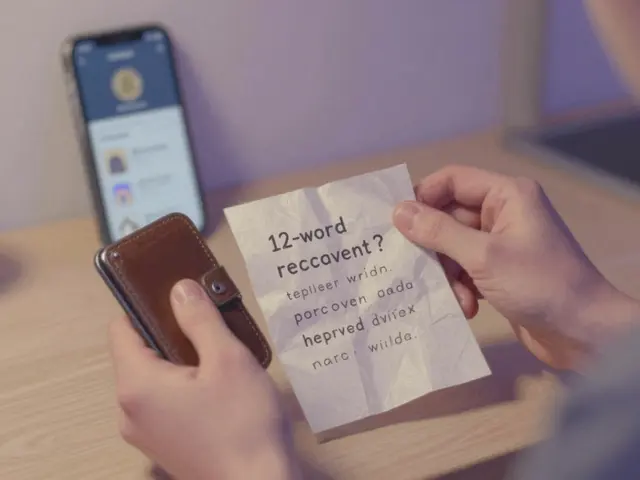

Eligibility criteria are the first gate. Projects usually require you to hold a certain token, join a Telegram, or complete a KYC step. The guide outlines how to verify each requirement without exposing private keys. Token distribution details, such as snapshot dates and vesting schedules, are also covered because they affect when you actually receive the tokens. This creates a semantic link: crypto airdrop guide → includes → eligibility checks and distribution timelines. Next, you need a compatible wallet. The guide explains why non‑custodial wallets are preferred, how to add custom token contracts, and how to double‑check contract addresses to avoid phishing contracts. Setting up a wallet is a prerequisite, forming another triple: crypto airdrop guide requires → secure wallet → reduces risk of loss. Once the wallet is ready, the claim process becomes a simple sequence of clicks, but the guide adds safety nets—like checking the official source, confirming the smart‑contract address on Etherscan or BscScan, and using a small test claim before moving larger amounts.

Staying safe after the claim is just as important. The guide teaches you how to track token listings, monitor price volatility, and understand the tax implications that arise when the airdropped token hits an exchange. It also flags typical red flags of scams, such as demands for private keys, unusually high promised returns, or requests to send a small ‘verification fee.’ By connecting the dots—airdrops influence portfolio growth, tax rules influence net profit, and scams threaten security—the guide equips you to make informed decisions. Below you’ll find a curated set of articles that dive deeper into specific airdrops, tax reporting tools, scam detection checklists, and real‑world examples of successful claims. Use this collection to sharpen your strategy, avoid common traps, and turn free token opportunities into genuine value.

All you need to know about the DeFiHorse (DFH) airdrop: eligibility, claim steps, tokenomics, security tips, and a comparison with other 2025 airdrops.

Jonathan Jennings Apr 1, 2025

A detailed guide to the CBSN airdrop for the CMC StakeHouse Game, covering eligibility, claim steps, tokenomics, safety tips, and FAQs.

Jonathan Jennings Mar 3, 2025