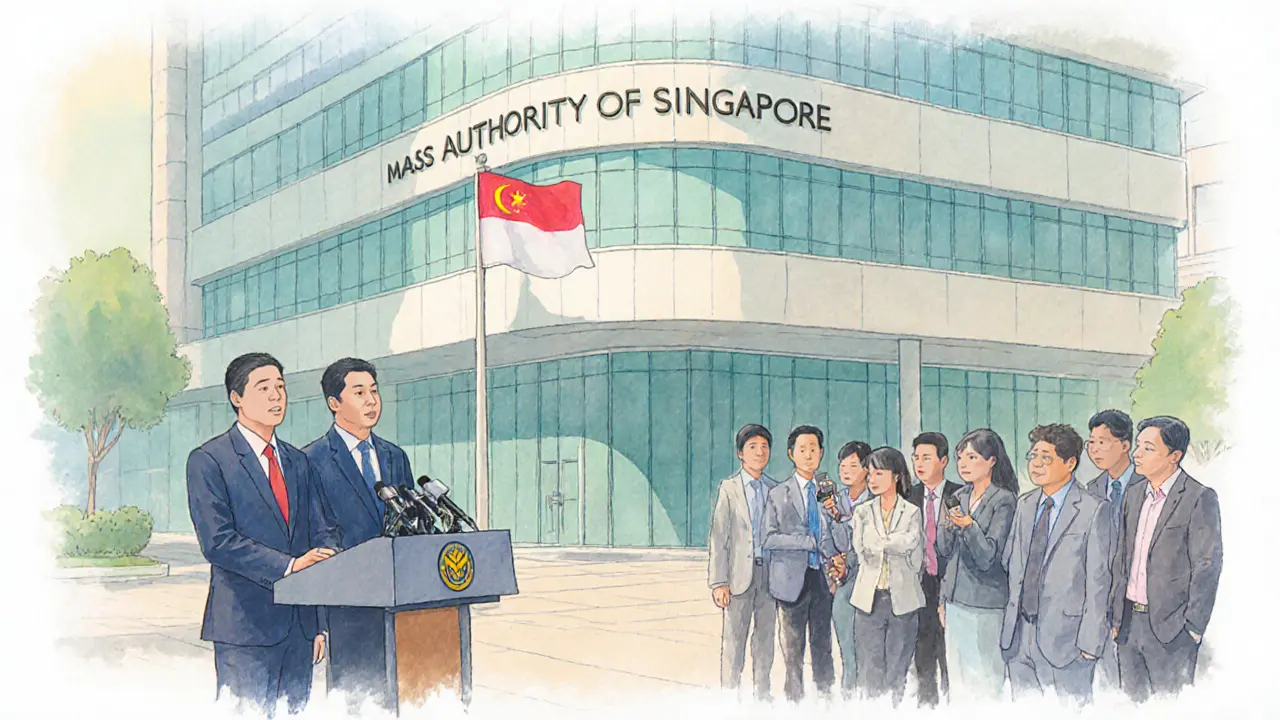

MAS travel rule: what you need to know

When dealing with MAS travel rule, a Singapore‑mandated framework that forces virtual‑asset service providers to collect and share sender and receiver details for transactions above a set threshold. Also known as the Singapore Travel Rule, it extends the traditional FATF travel rule to digital assets, aiming to curb money‑laundering and terrorist financing. The rule ties directly into AML requirements and relies on robust KYC processes to verify user identities before any data is shared.

How compliance works for crypto service providers

Under the MAS travel rule, any VASP (Virtual Asset Service Provider) that processes transactions over the prescribed amount must capture the sender’s full name, address, and account number, as well as the recipient’s corresponding details. This data must be transmitted securely to the counter‑party’s VASP using approved standards such as TRISA or the InterVASP protocol. The rule encompasses AML reporting, meaning that compliance teams must flag suspicious patterns and file reports with the Monetary Authority of Singapore. Because the FATF travel rule sets the global baseline, MAS adopts its definitions of “covered transaction” and “information to be shared,” creating a direct influence link: FATF → MAS travel rule → local enforcement. Crypto exchanges, custodians, and wallet providers therefore need to integrate KYC verification at onboarding, maintain up‑to‑date customer databases, and build automated pipelines for data exchange. Failure to do so can trigger fines, revocation of licenses, or even criminal prosecution. Many firms are already adopting off‑the‑shelf compliance suites that handle data formatting, encryption, and audit trails, reducing the operational burden while staying within the regulatory sandbox.

For everyday traders, the MAS travel rule translates into a few concrete steps: complete identity verification before moving large sums, expect extra prompts when sending funds to another exchange, and keep records of transaction receipts for future audits. While the rule adds a layer of paperwork, it also boosts confidence in the market by limiting illicit flows and protecting users from fraud. Understanding the MAS travel rule helps you stay compliant, avoid unexpected delays, and make the most of Singapore’s forward‑looking crypto ecosystem. Below you’ll find a curated set of articles that dive deeper into related topics – from airdrop tax implications to exchange risk assessments – giving you a full picture of how the travel rule fits into the broader landscape of crypto regulation.

MAS tightens Singapore's crypto rules, limiting new DTSP licences, enforcing AML/CFT standards, Travel Rule, and hefty penalties after a June 30, 2025 deadline.

Jonathan Jennings Oct 13, 2025