Mobius Finance Airdrop – Your Quick Guide

When you hear about Mobius Finance airdrop, a free token giveaway tied to the Mobius Finance DeFi platform. Also known as MOBI airdrop, it aims to reward early supporters and boost community participation.

In practice, an airdrop, a distribution event where a project sends tokens to qualifying wallets free of charge is a common growth tactic in crypto. DeFi, decentralized finance services that run on blockchain smart contracts projects often use airdrops to attract liquidity providers, voters, or users of their platform. Understanding how an airdrop works helps you avoid scams, meet eligibility, and stay compliant with tax rules.

Key Elements of the Mobius Finance Airdrop

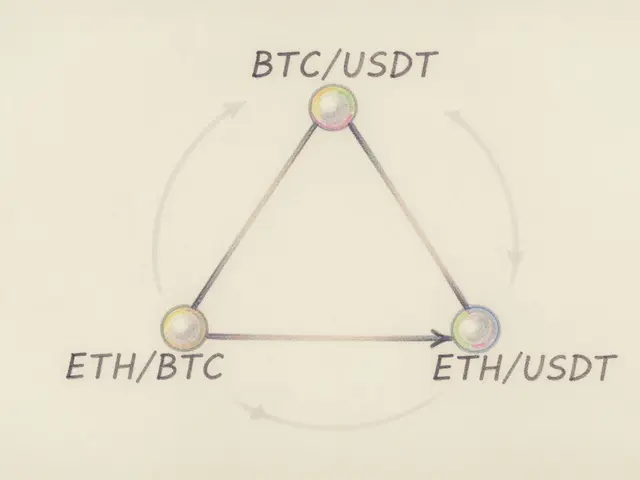

The Mobius Finance airdrop encompasses three core steps: (1) registration on the official portal, (2) wallet verification, and (3) token claim after a snapshot date. The snapshot records each eligible address’s balance at a specific block, ensuring a fair distribution based on holdings or activity. Eligibility usually hinges on holding a minimum amount of MOBI token, staking on the platform, or completing a short KYC process. The airdrop amount is calculated by a simple formula – for example, 100 MOBI per qualifying stake unit – making the reward transparent and easy to verify.

To participate safely, you need a compatible wallet that supports the Binance Smart Chain, where Mobius Finance lives. MetaMask, Trust Wallet, and Binance Chain Wallet are popular choices. Once you connect your wallet, the system checks the snapshot data, and if you meet the criteria, you receive the tokens directly into your address. No manual token transfer is required, which reduces the risk of phishing attacks.

One important semantic link is that the Mobius Finance airdrop requires wallet registration – without a proper address you cannot claim. This connection mirrors the broader rule that any crypto airdrop demands a valid blockchain address. Another link is that airdrop eligibility often influences token price dynamics; large claim windows can create short‑term sell pressure, while tightly scoped criteria can boost token scarcity and value.

Tax considerations are a separate but essential piece of the puzzle. In many jurisdictions, airdropped tokens are treated as ordinary income at the fair market value on the day they become controllable. This means you must report the value on your tax return, even if you never sell the tokens. Using a crypto tax tracker can simplify calculations, especially if you receive multiple airdrops in a year. Ignoring tax obligations can lead to penalties, so treat the airdrop like any other taxable event.

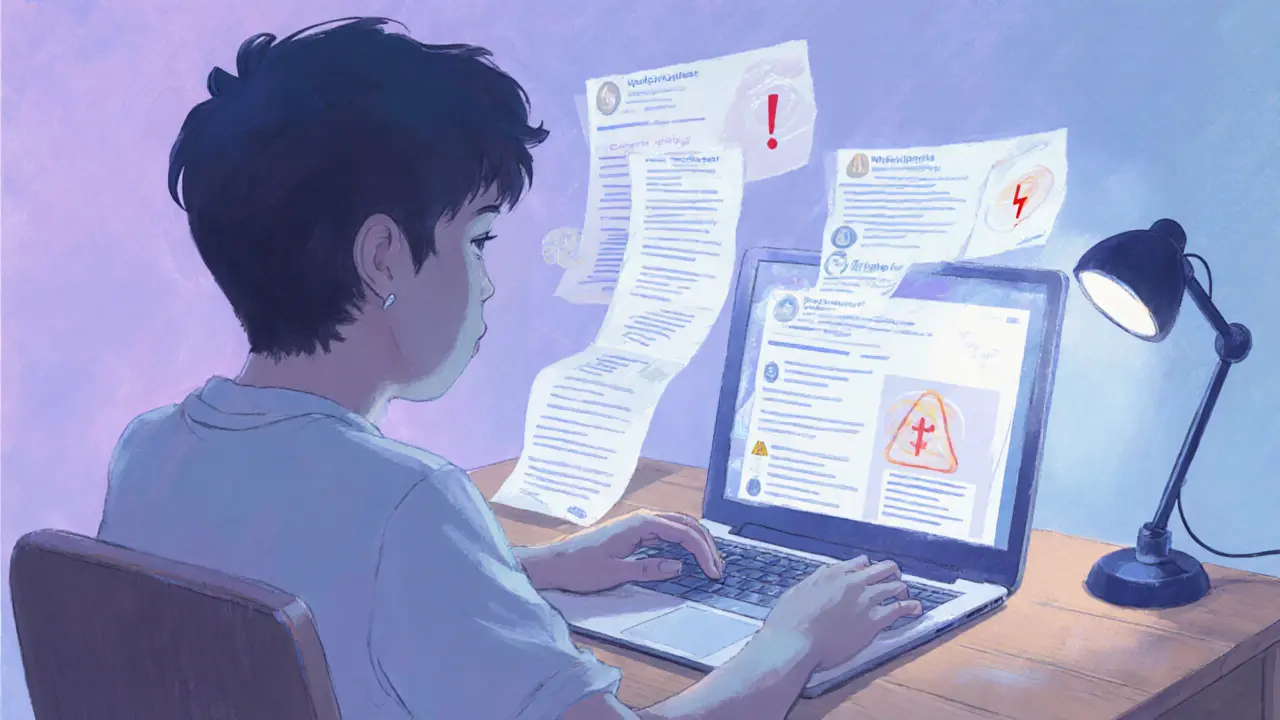

Unfortunately, airdrop scams are rampant. Common red flags include unsolicited messages asking for private keys, requests for native chain tokens as “fees,” or fake landing pages that mimic the official Mobius Finance site. Always double‑check the URL, verify the contract address on a block explorer, and never share your seed phrase. Legitimate airdrops never ask for secret information.

By now you should see how the Mobius Finance airdrop ties together registration, wallet tech, DeFi incentives, and tax rules. Below you’ll find a curated list of articles that walk you through each piece in detail – from step‑by‑step claim guides to deep dives on airdrop tax reporting and scam detection. Dive into the posts to get actionable advice and stay ahead of the curve.

Discover why there's no official Mobius Finance airdrop, learn MOT token distribution, current price, how to buy safely, and avoid scams.

Jonathan Jennings Aug 4, 2025