South Korea crypto: Regulations, exchanges, and what traders really face

When it comes to South Korea crypto, the country’s approach to digital assets combines heavy oversight with surprising market activity. Also known as Korean cryptocurrency market, it’s one of the few places where retail trading is massive but legal gray zones are everywhere. Unlike the U.S. or EU, South Korea doesn’t ban crypto—it just makes it hard to use. You can buy Bitcoin, trade altcoins, and even stake tokens, but you can’t pay for coffee with Ethereum. The government keeps a tight grip on exchanges, requires full KYC, and monitors every transaction through real-name banking links.

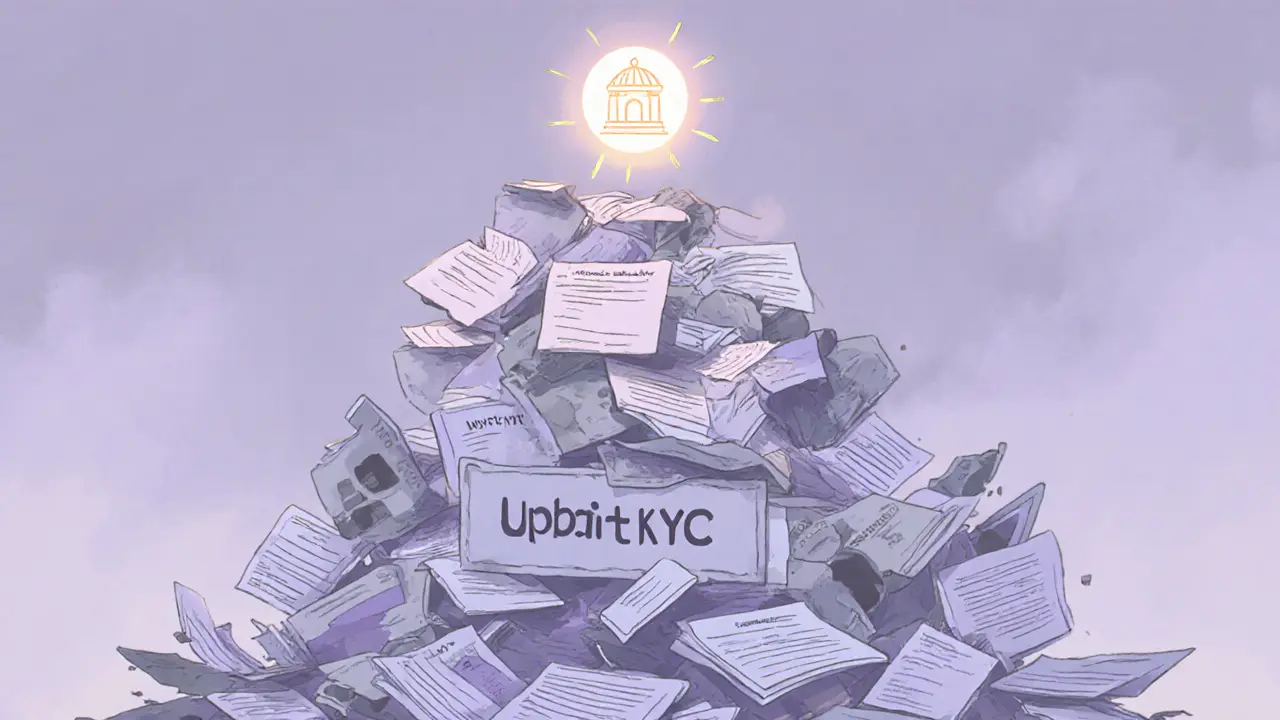

This isn’t just about rules—it’s about control. The BCEX Korea, a platform once promoted as a major Korean exchange with billions in volume. Also known as BCEX South Korea, it turned out to be a misleading operation with barely any real trading. That’s the pattern: hype followed by exposure. The Financial Services Commission (FSC) has shut down dozens of fake exchanges since 2020, but scams still pop up, often disguised as local platforms. Meanwhile, legit exchanges like Upbit and Bithumb operate under strict rules: no anonymous accounts, no leverage over 5x, and mandatory reporting to tax authorities. Traders don’t just need a wallet—they need a Korean ID, a local bank account, and patience for endless verification steps.

The real story isn’t in the headlines—it’s in the quiet corners of Korean crypto culture. People still trade. They use P2P platforms. They move funds through offshore wallets. They follow Telegram groups where tips on bypassing restrictions are shared. And they pay taxes, because the government now tracks on-chain activity with help from blockchain analytics firms. What you won’t find in official reports is how many Koreans hold crypto as a hedge against the won’s volatility or as a way to invest when stock markets feel rigged. It’s not rebellion—it’s adaptation.

Below, you’ll find real reviews of platforms that claim to serve the Korean market, breakdowns of how regulations actually impact daily trading, and warnings about the scams that prey on newcomers. No fluff. No promises. Just what’s happening on the ground.

Upbit faced over 500,000 KYC violations, exposing systemic failures in South Korea’s largest crypto exchange. This case reshaped crypto regulation in Asia and set new global standards for compliance.

Jonathan Jennings Nov 26, 2025