Upbit Regulation: What You Need to Know About South Korea's Crypto Exchange Rules

When you trade on Upbit, South Korea’s largest cryptocurrency exchange, owned by Daewoo Corporation and regulated by the Financial Services Commission. It's known for high volume, but also for being one of the most tightly controlled platforms in the world. Unlike exchanges in the U.S. or Europe, Upbit doesn’t just follow rules — it’s built inside them. The Korean government doesn’t just monitor crypto; it dictates how it works.

Upbit regulation means KYC, mandatory identity verification required by law for every user isn’t optional — it’s locked in at signup. No passport, no account. No anonymous trading. Even small purchases require full government ID. This isn’t just about anti-money laundering — it’s about control. The Financial Services Commission, South Korea’s main financial watchdog that enforces crypto rules can freeze accounts, block withdrawals, or shut down trading pairs overnight. In 2021, they banned all anonymous trading and forced exchanges to report every transaction above $1,000. Upbit complied immediately. No debate.

That’s why Upbit doesn’t list every coin you’ve heard of. If a token doesn’t meet Korea’s strict compliance standards — even if it’s on Binance or Coinbase — it won’t be on Upbit. The government doesn’t trust DeFi, doesn’t allow leveraged trading on retail accounts, and blocks foreign exchanges from targeting Korean users. That’s why you’ll see only 150+ coins on Upbit, while other exchanges list thousands. It’s not a limitation — it’s a legal requirement.

And if you’re outside Korea? You can’t legally use Upbit unless you’re a resident. The platform blocks VPNs, checks IP addresses, and requires Korean bank accounts. Even if you find a way in, your funds aren’t protected under international law. If the government changes its mind, your money could be locked for months. That’s the price of using a platform that answers to Seoul, not Silicon Valley.

What you’ll find below are real posts that break down how Upbit regulation shapes everything — from how you verify your identity to why certain tokens vanish overnight. These aren’t guesses. They’re based on how the rules actually play out in practice, what traders have lost, and what still works under the system. You won’t find fluff here. Just what happens when a country decides crypto needs to be tamed.

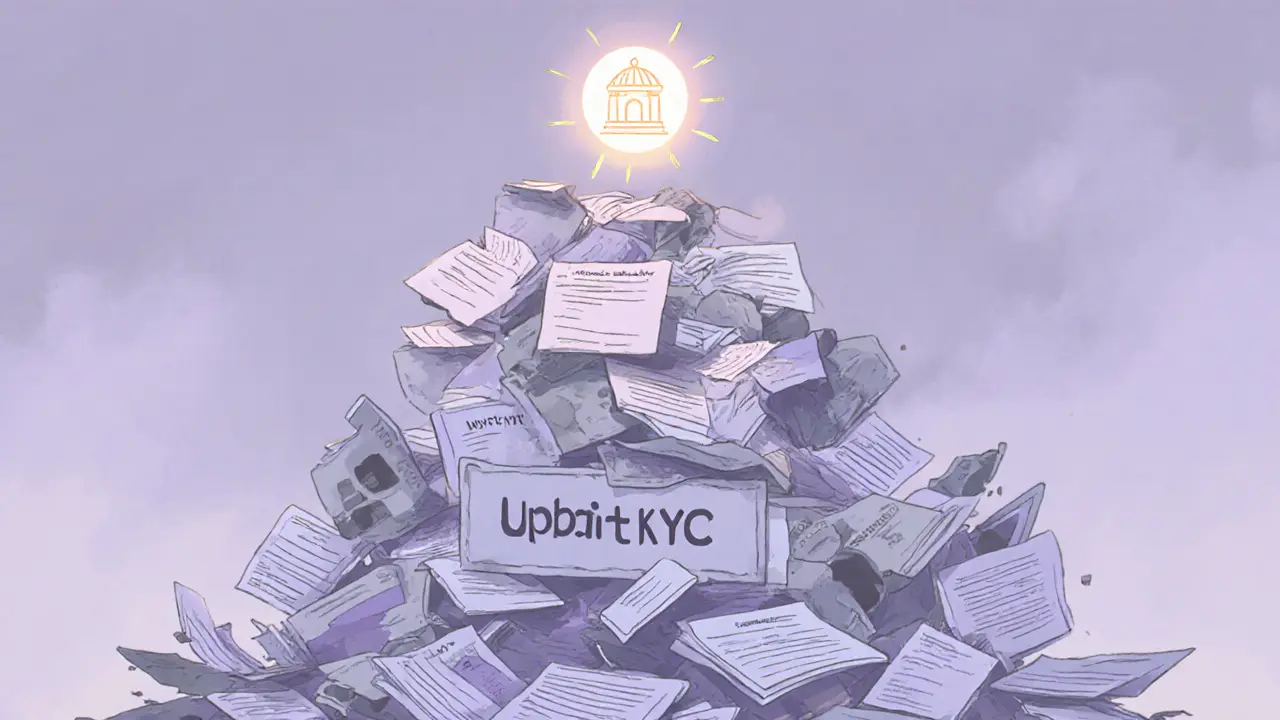

Upbit faced over 500,000 KYC violations, exposing systemic failures in South Korea’s largest crypto exchange. This case reshaped crypto regulation in Asia and set new global standards for compliance.

Jonathan Jennings Nov 26, 2025