July 2025 Archive – DexSharp Crypto, DeFi & Market Insights

When you dive into the July 2025 archive, a curated set of DexSharp articles that tracked the hottest moves in crypto, DeFi, blockchain and global stock markets during July 2025, you get a clear picture of what mattered that month. Also known as July ’25 roundup, it brings together fresh data, real‑time news, and actionable tips. The collection covers cryptocurrency, digital assets like Bitcoin, Ethereum, and emerging altcoins, DeFi, decentralized finance protocols that let you lend, borrow, and earn without banks, blockchain, the distributed ledger technology that powers crypto and many enterprise solutions, and the stock market, global equity exchanges where traditional assets trade alongside crypto‑linked products. July 2025 archive encompasses crypto price spikes, DeFi protocol upgrades, blockchain network upgrades, and major market swings, creating a single source you can scan for all the signals you need.

What’s Inside the July 2025 Collection

July was a month of rapid change. Bitcoin broke the $35,000 barrier, while Ethereum’s merge‑related upgrades pushed gas fees down and spurred a wave of layer‑2 projects. Those price moves fed directly into DeFi activity – yield farms on platforms like Aave and Curve saw inflows double, and new liquidity mining campaigns emerged to reward early participants. At the same time, blockchain networks scrambled to roll out scalability patches; Solana’s proof‑of‑history refinement cut transaction latency by 20%, and Polkadot’s parachain slots opened to a fresh batch of DeFi innovators. Stock markets reacted to these crypto trends, with tech‑heavy indices showing a modest uptick as investors hedged with crypto‑linked ETFs. The archive captures how cryptocurrency trends influence DeFi strategies, how DeFi projects require solid blockchain foundations, and how stock market updates affect overall crypto sentiment.

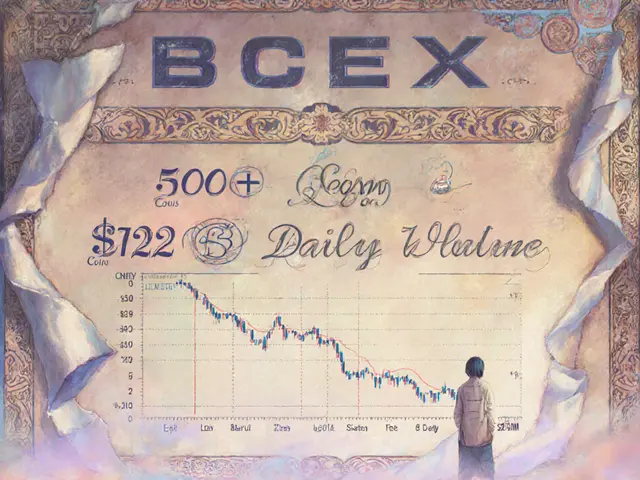

Beyond market charts, the July files dive into practical tools. We verified three new airdrops – each backed by reputable projects and vetted for scam‑free delivery. Our exchange comparison guide broke down fees, liquidity, and security across six major DEXs, giving you a quick way to pick the right platform for a trade. For traders wanting deeper insight, the DEX strategy piece explained how to set limit orders using automated bots, how to manage slippage, and why combining on‑chain data with off‑chain news improves timing. The combination of real‑time alerts, step‑by‑step guides, and strategic overviews makes the archive a go‑to resource for anyone looking to stay ahead in July’s fast‑moving landscape.

All of this material is organized for quick reference. Whether you’re a seasoned trader scanning for the next big move, a DeFi developer hunting the latest protocol upgrade, or a casual investor wanting a clear snapshot of how crypto and stocks intersected in July, the archive has a piece that fits. Scroll down to explore each article, pick the insights that match your goals, and use the data‑driven analysis to make smarter moves this month and beyond.

A detailed WOO X review covering fees, liquidity, security, trading tools, and how it compares to other exchanges for high‑volume crypto traders.

Jonathan Jennings Jul 27, 2025

Explore how blockchain voting creates transparent, auditable elections while protecting voter privacy, backed by real pilots, benefits, challenges, and future steps.

Jonathan Jennings Jul 16, 2025