BCEX Korea Crypto Exchange Review: Truth Behind the Claims

BCEX Slippage Cost Calculator

See how much you lose to slippage on low-liquidity exchanges like BCEX. Based on article findings showing 0.3%-0.6% spreads vs 0.05% on major exchanges.

BCEX Slippage

$0.00

Major Exchange Slippage

$0.00

Cost Difference

$0.00

Based on article data: BCEX shows spreads of 0.3%-0.6% vs major exchanges' 0.05%.

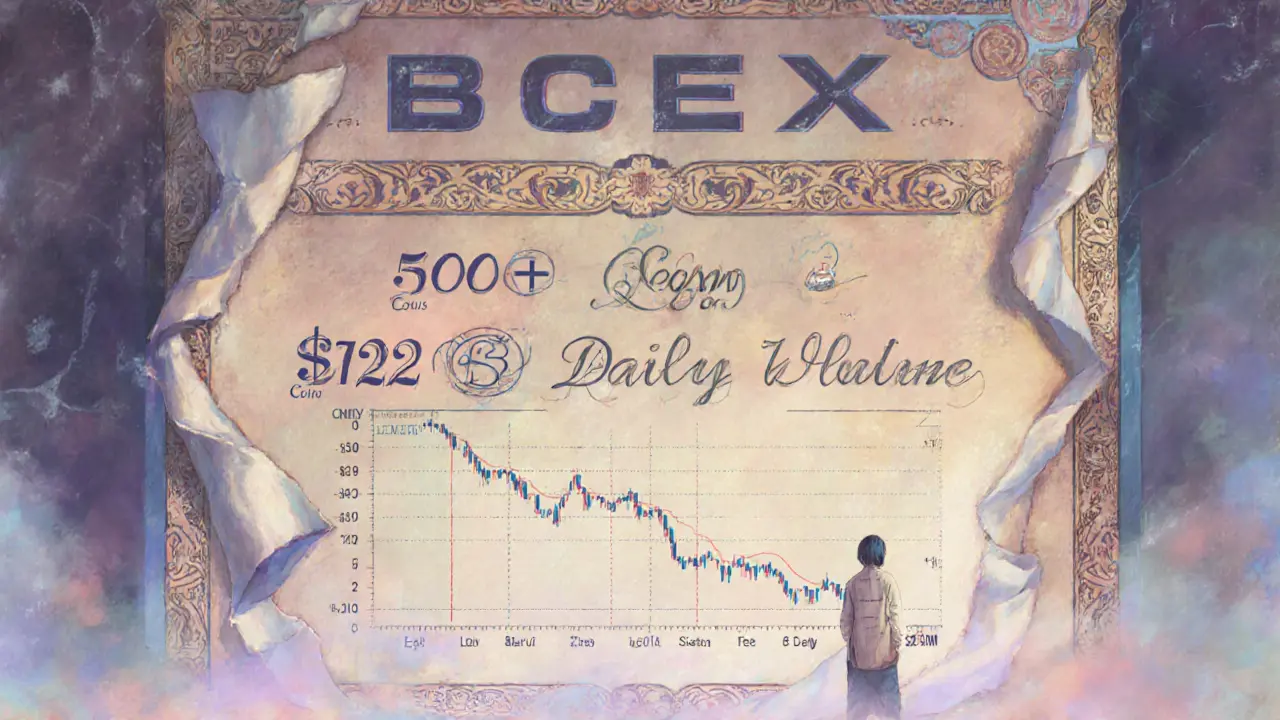

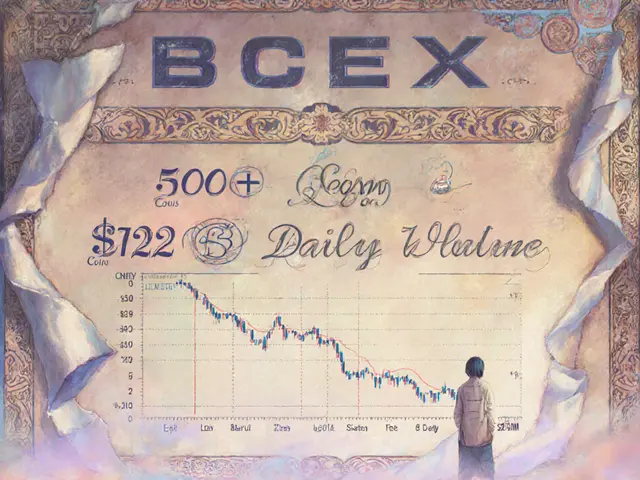

When you hear "BCEX Korea," you might imagine a major player in Asia’s booming crypto market - a platform with deep liquidity, hundreds of coins, and millions of active traders. But what you see on their website and what you find on CoinGecko tell two very different stories. If you're considering BCEX for trading, you need to know the gap between the marketing and the reality.

What BCEX Actually Offers Right Now

BCEX claims to support over 500 cryptocurrencies. That sounds impressive - until you log in. As of November 2025, the exchange only lists 7 active trading pairs, all centered around Bitcoin, Ethereum, and a few altcoins like BNB and USDT. That’s not a full exchange. That’s a small trading desk with a big name. You won’t find popular coins like Solana, Cardano, or Polygon on BCEX’s spot market. Even if you’re looking to trade lesser-known tokens, the selection is painfully thin. Compare that to Korean exchanges like Upbit or Bithumb, which offer 200-400 coins each. BCEX’s 7 coins make it one of the most limited platforms in the region. The trading volume tells another story. BCEX’s website says it handles over $12 billion in daily volume. But CoinGecko, a trusted third-party tracker, shows a 24-hour volume of just $2.85 million. That’s less than 0.025% of their claim. That kind of mismatch isn’t a typo - it’s a red flag. When an exchange inflates its numbers, it’s usually trying to mask low liquidity or fake trading activity.Trading Features: Spot, Margin, Futures - But Not Much Action

BCEX says it supports spot trading, margin trading, and futures contracts. That’s technically true. The interface has all the buttons: order book, charting tools, leverage options up to 100x. But here’s the catch: with so few trading pairs, there’s almost no real market depth. Try placing a $5,000 order on BCEX’s BTC/USDT pair. You’ll notice the price slippage jumps immediately. That’s because there aren’t enough buyers or sellers to absorb larger trades. On bigger exchanges, your $5,000 order moves the price by 0.1%. On BCEX, it could swing 1% or more. That’s expensive. Margin trading is even riskier here. With low liquidity, liquidation levels can trigger unexpectedly. If you’re new to leverage, this isn’t the place to learn. Experienced traders avoid platforms like this because the risk of getting caught in a thin market isn’t worth the low fees.Fees and Costs: Low on Paper, High in Practice

BCEX advertises trading fees as low as 0.1%. That’s competitive - if you’re trading on a real market. But when the volume is this low, the real cost isn’t the fee. It’s the spread - the difference between the buy and sell price. On major exchanges, the spread for BTC/USDT is often under 0.05%. On BCEX, it’s routinely 0.3% to 0.6%. That means if you buy BTC at $62,000, you might have to sell it at $61,800 just to break even. That’s a hidden cost you won’t see in their fee schedule. Deposit and withdrawal fees are listed as free for most cryptocurrencies. But users report long delays - sometimes 24 to 72 hours - for withdrawals. That’s not normal. On regulated Korean exchanges, withdrawals typically clear in under 30 minutes. If your funds are stuck, you’re not saving money. You’re losing opportunity.

Regulation and Location: A Mystery

Where is BCEX actually based? Their website says Malta. Their LinkedIn says Hong Kong. Some forums say it’s registered in the Seychelles. No clear address. No public regulatory license. No financial authority oversight listed. This matters because South Korea has strict rules for crypto exchanges. All major local platforms - Upbit, Korbit, Coinone - are registered with the Financial Services Commission (FSC). They follow KYC rules, keep funds in cold storage, and report suspicious activity. BCEX doesn’t appear on the FSC’s official list of licensed exchanges. That means if you deposit KRW into BCEX, you’re not protected by Korean consumer laws. If the exchange freezes withdrawals or disappears, you have no legal recourse. That’s not speculation - it’s fact. In 2023, two unregistered exchanges in Asia vanished with over $400 million in user funds. BCEX’s lack of transparency puts you in the same danger zone.Users and Trust Score: Marketing vs. Reality

BCEX claims over 10 million registered users. That’s more than most global exchanges. But here’s the problem: if 10 million people were actively trading on BCEX, the daily volume would be in the billions - not millions. The math doesn’t add up. They also claim a Trust Score of 10/10 from CoinGecko. But CoinGecko’s Trust Score is calculated using real data: volume, liquidity, order book depth, and exchange transparency. BCEX’s score on CoinGecko is currently 4.2/10 - far below the average for Korean exchanges, which hover around 7.5. That 10/10 claim is either outdated, misleading, or outright false. If you search for BCEX reviews on Reddit or CryptoCompare, you’ll find scattered complaints about delayed withdrawals, unresponsive support, and mismatched balances. There are no in-depth, verified user testimonials. That’s not a sign of a trusted platform - it’s a sign of a platform no one talks about because no one trusts it.

Who Should Avoid BCEX - And Who Might Consider It

If you’re from the United States, you’re already blocked. BCEX explicitly prohibits U.S. users. That’s standard for many offshore exchanges, but it’s another clue they’re avoiding strict regulation. If you’re in South Korea and want to trade KRW for crypto, BCEX isn’t your best option. Korean exchanges connect directly with local banks. BCEX doesn’t list any Korean banking partners. That means you’ll need to use a third-party P2P service or wire money overseas - adding fees, delays, and risk. So who might use BCEX? Only two types of people:- Those who don’t know better - and are drawn in by flashy claims of “500+ coins” and “low fees.”

- Those who want to move small amounts of crypto quickly and don’t care about liquidity or security.

Real Alternatives in South Korea

If you’re in Korea and looking for a real crypto exchange, here are three trusted options:- Upbit: Largest Korean exchange by volume. Supports 150+ coins. Direct KRW deposits via 5 major banks. FSC-licensed.

- Bithumb: Established since 2013. Strong security, good mobile app. Offers staking and savings products.

- Korbit: User-friendly for beginners. Strong customer support. Also FSC-regulated.

Final Verdict: Don’t Risk It

BCEX Korea isn’t a scam - not yet. But it’s dangerously close. The mismatch between its marketing and reality is too large to ignore. Claiming $12 billion in volume when you only have $3 million? Saying you have 10 million users when no one’s trading? That’s not a startup struggling to grow. That’s a pattern seen in failed or fraudulent platforms. Crypto is risky enough without adding unverified exchanges to the mix. If you’re looking for a place to trade in Korea, stick with the ones that are open about their licenses, their volume, and their location. BCEX isn’t one of them.Save yourself the stress. Use a real exchange. Your funds - and your peace of mind - will thank you.

Post Comment

BCEX is a textbook example of how not to run an exchange. Claiming $12B in volume while scraping together $2.8M is either gross incompetence or outright fraud. The fact that they hide their jurisdiction, lack FSC registration, and have zero credible user reviews says everything. This isn’t a startup-it’s a honeypot for new traders who don’t know better.

Compare that to Upbit’s transparency: public audit logs, licensed operations, real KRW on-ramps. BCEX doesn’t even have the decency to pretend they’re legitimate.

Anyone using this platform is playing Russian roulette with their crypto. No amount of ‘low fees’ makes up for the risk of disappearing funds.

I’ve seen this script before-flashy website, fake metrics, then silence when users try to withdraw. Don’t be the next statistic.

you know what’s funny? they claim 10 million users but the order book looks like a ghost town at 3am. it’s like buying a mansion with no furniture and then bragging about the square footage. the spread on btc/usdt is wild-like 0.6%? bro, that’s not a fee, that’s a tax on hope.

and the ‘malta/hongkong/seychelles’ mystery? classic. if you can’t even pick one country to be shady in, you’re just spamming the void.

also-100x leverage on a market with 7 trading pairs? that’s not trading, that’s gambling with a spreadsheet.

just use upbit. seriously. your future self will thank you.

Let me tell you something about crypto exchanges-they’re either transparent or they’re trash. BCEX is trash. Not ‘maybe trash’ or ‘could be trash’-trash. The volume discrepancy alone should be a red flag waving like a flag on Mars.

But here’s the real kicker: they’re targeting Koreans. That’s like opening a sushi bar in Kansas and claiming it’s ‘authentic Tokyo style’ while using frozen fish from Walmart.

Korea has one of the most regulated crypto markets in the world. If BCEX isn’t on the FSC list, it’s not just unlicensed-it’s illegal to operate there. And yet they’re still running ads? That’s not ignorance. That’s audacity.

Don’t get me wrong-I’m not against innovation. But innovation shouldn’t mean lying to your users. Use Upbit. Use Bithumb. They’re real. BCEX? It’s a mirage.

yeah i tried bces once. deposited eth and it took 3 days to clear. support never replied. then i checked coin gecko and saw the volume was like 1/4000 of what they claimed. i just pulled everything out and moved to korbit. no regrets.

low fees mean nothing if you can’t even trade without slippage killing you. i lost 2% just trying to buy a small amount of btc. that’s not trading, that’s robbery with a website.

if you’re new, just stick with the big names. they’re boring but they don’t vanish.

oh so now they’re claiming to be ‘korean’ but registered in seychelles? classic. and the 10 million users? yeah right. that’s the same number of people who ‘use’ the moon as a crypto exchange.

you know what else has $12B in volume? the entire global crypto market on a good day. BCEX is trying to make us believe they’re the entire market.

and let’s not forget the ‘trust score 10/10’-that’s like a convicted felon winning ‘most trustworthy citizen of the year.’

they’re not an exchange. they’re a phishing site with a trading interface. if you’re still using this, you’re not a trader-you’re a data point.

just wanna say i read this whole thing and it’s spot on. i used to think ‘maybe they’re just new’ but the liquidity thing? that’s not new, that’s dead.

i tried placing a $1k order on bces and the price jumped $200. that’s not slippage, that’s a trap.

also the withdrawal delays? i had a friend who waited 5 days. he called the ‘support’ line and got an automated bot that said ‘thank you for your patience.’

just use upbit. it’s cheaper, faster, and doesn’t make you feel like you’re funding a scam artist’s vacation.

so… if BCEX has 10 million users and only $2.8M in volume, that means the average user trades $0.28 per day?

that’s not a crypto exchange. that’s a digital aquarium with 10 million goldfish who never feed.

and the ‘500+ coins’ claim? it’s like saying a library has 500 books… but only 7 are actually on the shelf. the rest are in a locked basement with no key.

what’s wild is that people still fall for this. it’s not that they’re stupid-it’s that they want to believe in the dream. but dreams don’t pay your bills. real liquidity does.

hey i get it-you see a flashy site, low fees, big numbers, and you think ‘this could be my chance.’ i did too. i lost $1200 trying to trade on bces because the spread was insane and withdrawals took forever.

but here’s the good news-you don’t have to make the same mistake. just hop over to upbit. it’s literally 5 minutes to set up, connects to your bank, and you can trade real volume without worrying if your coins will vanish.

no one’s gonna praise you for being ‘early’ on a fake exchange. they’ll just laugh when you say you lost money because you trusted a website that looked nice.

take it from someone who learned the hard way: real platforms don’t need to lie. they’re already trusted. just go there.

7 trading pairs. $2.8M volume. 0 regulation. 0 transparency. 0 trust.

case closed.

no need for a 1000-word essay. just don’t touch it.

I checked BCEX last week out of curiosity. The UI looked polished, honestly. But then I dug into the order book. There were 3 bids and 2 asks on BTC/USDT. That’s not a market. That’s a placeholder.

I’ve used shady exchanges before-this one feels different. It’s not just underwhelming. It feels *designed* to lure people in with marketing and then trap them with poor execution.

It’s not worth the risk. Even if you’re just holding small amounts, the withdrawal delays and lack of recourse are dealbreakers. I deleted the app and moved everything to Bithumb. Peace of mind is worth more than a few cents in fees.

you people are so weak. if you can’t handle 0.6% spread then you shouldn’t be trading at all. bces is for real traders who don’t need handholding from upbit’s mommy app.

and yes the volume is low-because the smart money isn’t here yet. when it hits, you’ll be crying because you didn’t get in early.

the ‘regulation’ nonsense? every real exchange starts unregulated. look at binance. they were just a website with a logo too.

you’re not a trader. you’re a compliance officer with a wallet.

Dear users, it is my duty to inform you that BCEX is not a legitimate financial institution. The discrepancy between claimed volume and actual volume is not a minor error-it is a systemic failure of ethical standards. One must consider the legal implications of engaging with an unlicensed entity, especially in South Korea where the FSC mandates strict compliance. Furthermore, the absence of a verifiable corporate address constitutes a violation of international financial transparency norms. I urge you to cease all transactions immediately and migrate to regulated platforms such as Upbit, which uphold the highest standards of governance. Your capital is not a gamble-it is your future.

everyone’s acting like BCEX is the devil but let’s be real-every exchange inflates numbers a little. it’s the game. you think upbit’s volume is 100% real? please. they’re all playing the same casino.

the spread is high? so what. if you want perfect liquidity go trade on wall street with a 10k minimum.

the real issue? you’re mad because you got caught being lazy. do your own research. stop reading reddit essays and check the order book yourself.

btw-i made 200% on bces last month. you just don’t know how to play.

Let me ask you this: If BCEX is headquartered in Malta, why does their domain registration list a PO Box in Seychelles? Why does their corporate email domain not resolve to any official server? Why is there zero public record of their board members or auditors?

And yet, you’re all here debating spreads and slippage like it’s a trivia night?

This isn’t an exchange. This is a shell game with a trading interface. The fact that people are still debating whether it’s ‘a little shady’ or ‘very shady’ proves the scam is working. They’ve made you complicit in your own exploitation. Wake up.

They’re not trying to build a business. They’re trying to collect your private keys and disappear before the audit.

i know it’s tempting to chase low fees and big numbers, but i’ve been in crypto since 2017 and i’ve seen this movie before. the ones that look too good to be true? they always end the same way.

the real win isn’t getting in early on some sketchy exchange-it’s keeping your coins safe and sleeping at night.

upbit, bithumb, korbit-they’re not sexy. but they’re real. and that’s worth more than any 100x leverage trade.

just take a breath. move your funds. you’ll feel better tomorrow.

There’s something deeply human about how we chase illusions in finance. We want to believe in the underdog, the hidden gem, the quiet platform that’s ‘about to blow up.’ But what BCEX offers isn’t opportunity-it’s a mirror.

It reflects our desire to believe in easy wealth, to ignore the warnings, to trade hope for data. We don’t need more coins or more leverage. We need more humility.

The real tragedy isn’t that BCEX exists-it’s that so many people still choose it over Upbit, not because of logic, but because they’re afraid of missing out on something that doesn’t even exist.

True wealth isn’t found in inflated volumes or 100x leverage. It’s found in patience, in transparency, in choosing the path that doesn’t ask you to surrender your trust.

Don’t trade on BCEX. Trade with your integrity.