DefiTuna (TUNA) Explained: Solana DeFi Token Overview

DefiTuna (TUNA) Yield Calculator

Potential Returns Analysis

Without Leverage:

Monthly Return:

With 3x Leverage:

Monthly Return:

Key Takeaways

- DefiTuna is a Solana‑based DeFi platform that uses a Concentrated Liquidity Market Maker (CLMM) to boost capital efficiency.

- The native token TUNA powers governance, staking, and fee revenue sharing.

- Trading volume hit $3.8billion in the first two months, showing rapid user adoption.

- Yield comes from two sides: leveraged liquidity provision and high‑yield lending.

- Risks include smart‑contract bugs, impermanent loss on leveraged pools, and regulatory uncertainty.

What is DefiTuna?

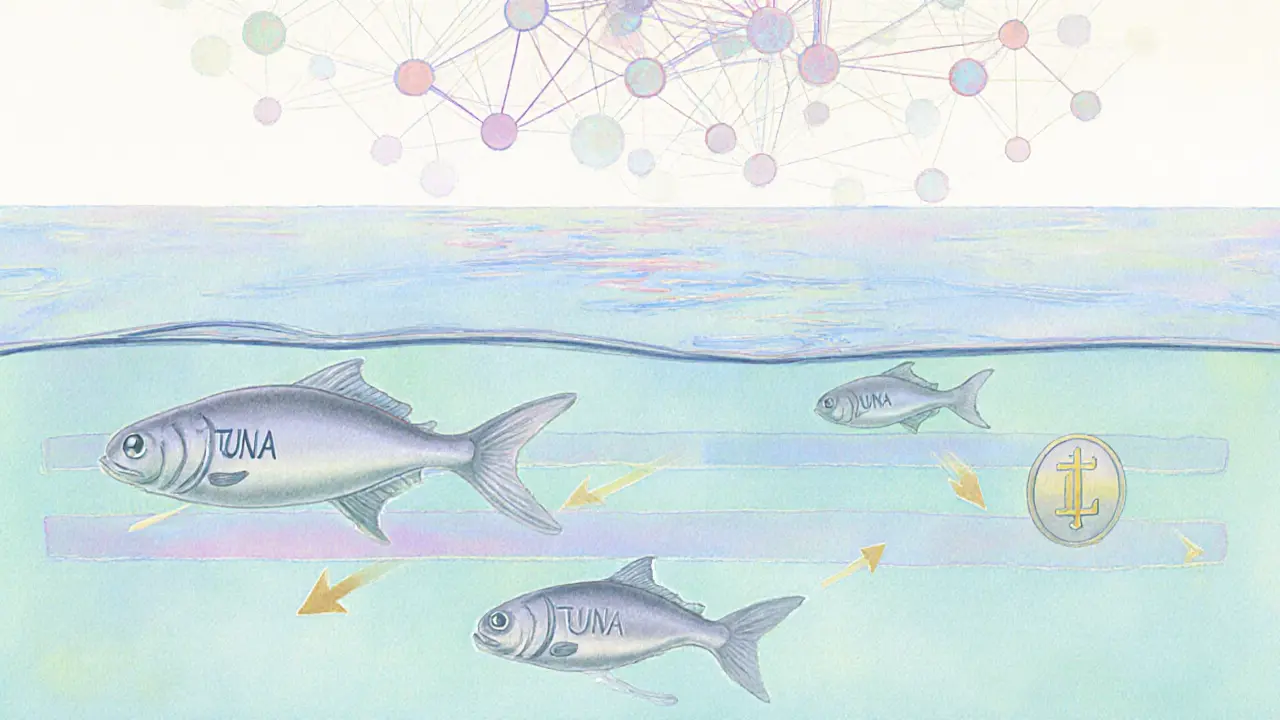

DefiTuna is a decentralized finance platform built on the Solana blockchain. It offers a suite of lending, borrowing, and liquidity‑provision services that run entirely on smart contracts. The project launched in early 2025, positioning itself as a capital‑efficient alternative to Ethereum‑based AMMs. By tapping Solana’s sub‑second finality and near‑zero fees, DefiTuna can execute complex trades without the gas price spikes that often cripple other DeFi protocols.

The platform’s core hook is its Concentrated Liquidity Market Maker (CLMM) technology, which lets liquidity providers concentrate their capital into narrow price ranges, earning higher fees per dollar of capital compared to traditional constant‑product AMMs. This concentration, combined with optional leverage, opens the door to strategies that look like short, long, or delta‑neutral positions-all without leaving the DefiTuna UI.

How does the TUNA token work?

TUNA is the native utility token of the DefiTuna ecosystem. Holders can lock (stake) TUNA to earn a share of the protocol’s revenue, which comes from lending interest, trading fees, and liquidation penalties. Staked TUNA also grants voting rights on governance proposals, such as fee‑schedule tweaks or new pool launches.

Beyond governance, TUNA plays a practical role in the platform’s economics: it is used as collateral for leveraged liquidity positions and to pay for any on‑chain transaction fees that exceed the free Solana quota. Because the token is integral to both yield generation and protocol control, demand for TUNA spikes whenever new pools debut or APY rates climb.

Technical foundations: Solana and CLMM

Solana is a high‑throughput, proof‑of‑history blockchain that can process over 65,000 transactions per second with fees typically under $0.001. DefiTuna leverages these characteristics to deliver a frictionless user experience-trades settle instantly, and the cost of moving assets between pools is negligible.

The CLMM engine works by letting LPs allocate liquidity to a specific price interval instead of the whole curve. When market price stays inside that interval, the LP earns a larger slice of transaction fees. If the price moves out, the liquidity automatically shifts to the next active range, preserving capital efficiency. DefiTuna adds an optional leverage layer, allowing LPs to borrow additional capital against their staked TUNA, magnifying both potential returns and risk.

Getting started: wallet, token purchase, and first steps

Before you can interact with DefiTuna, you need a Solana‑compatible wallet-Phantom, Solflare, or Backpack are the most popular choices. Install the extension, fund it with a modest amount of SOL (the native Solana token) to cover any residual fees, and then connect the wallet to DefiTuna’s web UI via the “Connect Wallet” button.

Next, acquire TUNA. The token lists on centralized exchanges like Bitget and on decentralized Solana DEXs such as Raydium. After swapping SOL or USDC for TUNA, transfer the tokens to your connected wallet. The platform’s dashboard will display your balance, available staking slots, and current APY rates.

From there, you can choose one of three entry points:

- Lending: Deposit supported assets (USDC, SOL, or TUNA) into the lending pool and earn a dynamic interest rate that reflects pool utilization.

- Liquidity provision: Create a CLMM position, set your price range, and decide whether to add leverage (up to 3× on most pools).

- Staking: Lock TUNA for a set period (typically 30‑90 days) to capture a portion of protocol revenue and gain voting power.

Yield opportunities: how the numbers add up

DefiTuna reports live APY figures on its interface; as of October2025, basic USDC lending hovers around 7‑9%, while leveraged CLMM positions can push effective yields into the high‑20s, depending on market volatility and pool depth. The magic comes from fee capture: a concentrated pool that trades heavily within a narrow band can earn 0.3‑0.5% of each swap, translating into outsized annual returns when compounded.

Because leveraged positions amplify both upside and downside, many users adopt a risk‑management routine: set stop‑loss triggers, monitor price‑range utilization, and periodically rebalance. DefiTuna’s UI includes built‑in alerts and a “rebalance” button that automatically shifts liquidity back into the optimal range.

Risks you should know about

Smart contracts are self‑executing code that runs without a central authority. While DefiTuna’s contracts have passed external audits and ongoing white‑hat testing, no code is 100% immune to bugs. A vulnerability could lead to fund loss or partial draining of pools.

Leveraged CLMM positions introduce impermanent loss that occurs when the price of assets in a liquidity pool diverges from the price at deposit.. The effect is magnified by leverage, so a sudden market swing can liquidate a position before you have a chance to react.

Regulatory uncertainty remains a backdrop for all DeFi projects. Depending on jurisdiction, token holders could face tax reporting obligations or future compliance mandates that affect token utility.

Performance snapshot and price outlook

Trading volume for DefiTuna reached $3.8billion within the first two months of operation. This rapid throughput places the platform among the top tier of Solana DeFi projects.

As of the latest market data (Oct12025), TUNA trades around $0.1188 with a 24‑hour volume of $938k, down 9.3% on the day. Forecasts from several analytics firms range from $0.12 to $0.13 in the short term, with long‑term averages around $0.10 by 2029. The price trajectory largely tracks overall Solana ecosystem health and the platform’s ability to retain high‑yield pools.

How does DefiTuna compare to other Solana DeFi protocols?

| Feature | DefiTuna | Raydium | Marinade |

|---|---|---|---|

| Core tech | CLMM with leverage | Standard AMM | Staking‑focused |

| Avg. APY (USDC lending) | 7‑9% | 5‑6% | N/A |

| Transaction fee (USD) | ~$0.001 | ~$0.0015 | ~$0.001 |

| Leverage options | Up to 3× | None | None |

| Governance token | TUNA | RAY | MNDE |

DefiTuna’s unique selling point is the combination of leveraged CLMM pools and a dedicated lending market. If you value capital efficiency and are comfortable with moderate risk, DefiTuna often out‑performs vanilla AMMs. For purely passive staking, protocols like Marinade remain simpler.

Future outlook and development roadmap

DefiTuna’s roadmap hints at three major upgrades for 2025‑2026:

- Cross‑chain bridges to bring assets from Ethereum and BNB Smart Chain onto the Solana CLMM engine.

- Advanced analytics dashboards that let LPs simulate impermanent loss under different market scenarios.

- Governance enhancements that lower the voting threshold for community proposals, fostering faster iteration.

Success will depend on Solana’s network stability, continued audit transparency, and the platform’s ability to attract institutional capital seeking high‑yield DeFi exposure. As the broader DeFi market expands-total value locked now sits in the tens of billions-DefiTuna is positioned to capture a slice of that growth, provided it maintains competitive APYs and mitigates the usual DeFi risks.

Bottom line

If you’re hunting for a Solana‑native token that blends high‑yield lending with leveraged liquidity, DefiTuna offers a compelling package. The platform’s CLMM engine drives extra fees, the TUNA token aligns incentives, and the low‑cost Solana backbone keeps transactions cheap. However, the upside comes with higher complexity-new users should start with small, unleveraged positions, absorb the educational material, and only scale up once they’re comfortable with impermanent loss and liquidation mechanics.

Frequently Asked Questions

What is the primary purpose of the TUNA token?

TUNA serves three main functions: governance voting, staking revenue share, and collateral for leveraged liquidity positions.

Do I need SOL to use DefiTuna?

Yes, a small amount of SOL is required to pay any residual network fees, but those fees are usually less than a cent.

How does leveraged liquidity work?

You lock TUNA as collateral, borrow additional capital from the protocol, and allocate the combined amount to a CLMM pool. The borrowed portion magnifies both fees earned and potential liquidation risk.

Is DefiTuna audited?

The smart‑contract suite has undergone external security audits, and the team works with white‑hat researchers for ongoing vulnerability testing.

Can I withdraw my funds at any time?

Yes. Lending and liquidity positions can be exited instantly, though leveraged positions may trigger liquidation if the price moves out of the chosen range.

How does DefiTuna compare to Raydium?

Raydium uses a standard AMM with no leverage, while DefiTuna’s CLMM pools focus on capital efficiency and offer up to 3× leverage, often delivering higher fees per dollar of liquidity.

What are the main risks of using DefiTuna?

Key risks include smart‑contract bugs, impermanent loss (especially with leveraged pools), liquidation during volatile markets, and potential regulatory changes affecting DeFi tokens.

🚀 DefiTuna’s APY looks shiny on paper, yet the underlying liquidity pools are just another layer of Solana’s fast‑lane yield farms. 😅 The tokenomics rely heavily on token swaps that can be gamed by high‑frequency bots, so the actual user‑side returns often dip below the advertised numbers. 📈 If you’re chasing the hype, you might miss the hidden impermanent loss.

DefiTuna offers a decent entry point for newcomers to Solana's DeFi ecosystem, especially with its integrated yield calculator. 😊 The leverage option can amplify gains, but it also magnifies liquidation risk, so users should calibrate exposure carefully. Maintaining a balanced portfolio and monitoring on‑chain metrics will help mitigate unexpected volatility.

DefiTuna is a Solana token with yield farming.

Another over‑promised token promising sky‑high APY, but the underlying smart contracts are barely audited. The leverage feature is a playground for reckless traders, and when the market dips, expect liquidations en masse.

The risk is amplified on Solana because transaction finality is fast, but that also means liquidations execute instantly, wiping out positions before you can react. Users should consider the systemic exposure of the protocol before deploying capital.

DefiTuna’s staking model aligns incentives by rewarding long‑term holders, which is a solid design choice. However, the token’s market depth is still thin, so large trades can cause slippage. Keep positions moderate and diversify across other Solana projects for stability.

When evaluating a token like TUNA, it’s essential to dissect both the on‑chain data and the off‑chain community sentiment. The real APY can diverge from the advertised rate due to impermanent loss, especially in volatile markets. Leveraged positions should only be used by experienced traders who can monitor collateral ratios continuously. Moreover, Solana’s recent network upgrades have reduced transaction costs, making micro‑leveraged strategies more feasible. Still, the underlying token supply dynamics and emission schedule play a crucial role in long‑term sustainability. Users should also watch for any governance proposals that could alter fee structures, as those can impact net yields dramatically. In summary, a cautious approach with incremental exposure is advisable.

The UI is clean, and the calculator makes it easy to visualize potential returns, but remember that the numbers are idealized. Always factor in network fees and potential slippage when planning your strategy.

From a philosophical standpoint, DeFi projects like DefiTuna embody the experimental spirit of decentralized finance, yet they also highlight the necessity for rigorous risk assessment. The balance between innovation and prudence is delicate.

Never trust a guaranteed APY.

It's encouraging to see more projects building on Solana's high‑throughput capabilities, expanding the ecosystem beyond just NFTs. However, ensuring adequate security audits remains paramount for user confidence.

While the ecosystem growth is positive, the rapid onboarding of inexperienced users can lead to costly mistakes, especially with leverage. Education resources should be highlighted alongside the platform.

DefiTuna’s tokenomics include a modest inflation rate, which helps sustain rewards but could dilute value over time if not managed properly.

Remember, consistent small gains compound over time better than chasing massive, short‑term spikes. Set realistic targets and stick to your risk parameters.

DefiTuna enters the Solana DeFi arena at a time when the ecosystem is craving sustainable yield opportunities, and its native token offers an intriguing blend of speed and low fees inherent to the network. The protocol’s core mechanism revolves around liquidity provision in a single‑sided pool, allowing users to earn a portion of transaction fees alongside the advertised APY. By integrating a 3x leverage option, the platform appeals to both conservative investors seeking modest returns and aggressive traders looking to amplify their exposure. However, leverage comes with heightened liquidation risk, particularly during periods of market turbulence, which can erode capital swiftly. The token’s supply schedule features a controlled inflation that distributes new tokens as rewards, but this also introduces dilution pressure if the growth of the user base stalls. On‑chain analytics reveal that volume has been steadily increasing, suggesting growing interest, yet the depth of the order books remains relatively shallow, indicating potential slippage for larger trades. Community governance plays a pivotal role, as proposals can adjust fee structures, reward rates, and even the leverage caps, thereby directly influencing user returns. It is crucial for participants to stay informed about upcoming votes and to engage in discussions to safeguard their interests. Moreover, the Solana network’s recent upgrades have reduced transaction confirmation times, making rapid repositioning feasible for those who monitor their collateral ratios closely. For newcomers, the integrated yield calculator serves as a valuable tool, but they should always overlay its output with conservative assumptions about market volatility. Diversification across multiple Solana projects can mitigate the systemic risk associated with concentrating assets in a single token. Educational resources provided by the platform, such as webinars and detailed documentation, can empower users to make informed decisions about leverage. In practice, setting stop‑loss thresholds and regularly rebalancing exposures can preserve capital during sudden drawdowns. Ultimately, while DefiTuna offers promising yield potential, success hinges on disciplined risk management, continuous learning, and active participation in governance. By approaching the platform with a balanced strategy, investors can harness the benefits of Solana’s high‑speed environment without succumbing to its inherent pitfalls.

In light of the prevailing market exuberance, one must scrutinize the purported sustainability of DefiTuna’s yield projections with a discerning eye, lest the allure of high returns eclipse prudent investment principles.

Give DefiTuna a shot, but keep your risk caps tight and watch the charts; steady gains beat wild swings any day.

DefiTuna’s platform is user‑friendly and the calculator helps visualize scenarios, yet remember that real‑world yields can be lower than projected. 📊 Maintaining a diversified portfolio is key to navigating volatility.

While the opportunity presented by DefiTuna is notable, it is essential to respect personal risk tolerance limits and avoid overextending capital on leveraged positions.