Future of Nonce in Blockchain: What Comes After Proof-of-Work?

The nonce is one of the quiet heroes of blockchain. You don’t hear much about it, but without it, Bitcoin wouldn’t exist. It’s the number miners tweak over and over until the hash of a block matches the network’s target. It’s what makes tampering with transactions nearly impossible. But as the world pushes for cleaner, faster, and cheaper blockchains, the nonce is under pressure. Is it fading out? Or is it just adapting?

What Exactly Is a Nonce?

A nonce stands for "number used once." It’s a random number added to a block’s header during mining. In Bitcoin, every block contains data like the previous block’s hash, transaction records, a timestamp, and the nonce. Miners change the nonce repeatedly - millions of times per second - until the resulting hash starts with enough zeros to meet the network’s difficulty target.

This isn’t magic. It’s brute force. The hash function (SHA-256 in Bitcoin’s case) always gives the same output for the same input. But even a tiny change - like flipping one bit in the nonce - creates a completely different hash. That’s what makes it secure. You can’t predict the right nonce. You have to guess. And the more guesses you make, the higher your chance of winning the block reward.

That’s why mining rigs exist. They’re built to try trillions of nonces per second. In 2023, a successful Bitcoin miner got 6.25 BTC per block. Now, it’s 3.125 BTC after the 2024 halving. But the energy used? That’s the real cost.

Why the Nonce Matters for Security

The nonce isn’t just a number. It’s the backbone of trust in proof-of-work blockchains. By requiring massive computational work to find it, the system ensures that altering a single transaction would mean redoing all the work on that block - and every block after it. That’s why hackers don’t try to change old blocks. It’s cheaper to attack elsewhere.

Without the nonce, there’s no proof-of-work. And without proof-of-work, there’s no easy way to prevent double-spending. The nonce forces attackers to spend real money - in electricity and hardware - to try and cheat. That’s what makes Bitcoin resilient. Even today, no one has successfully altered the Bitcoin blockchain, not because it’s unbreakable, but because it’s too expensive to try.

Security experts at Nadcab Labs and itez agree: the nonce is what turns a distributed ledger into a tamper-proof system. It’s the reason you can send Bitcoin to someone you’ve never met and trust it will arrive.

The Energy Problem

But here’s the catch: all that guessing takes power. In 2025, Bitcoin mining still uses more electricity than most countries. Australia alone uses about 25 terawatt-hours per year. Bitcoin? Around 120. That’s not sustainable. Governments are noticing. The EU is tightening rules. California is banning mining operations tied to fossil fuels. Even in Perth, where solar is abundant, regulators are asking: "Is this worth it?"

Miners used to run rigs in basements. Now, they’re in warehouses near hydroelectric dams in Canada or geothermal plants in Iceland. The race isn’t just for faster chips - it’s for cheaper, cleaner power. But even the most efficient ASIC miners still burn through megawatts. And the nonce? It doesn’t care how green your power source is. It still needs to be guessed.

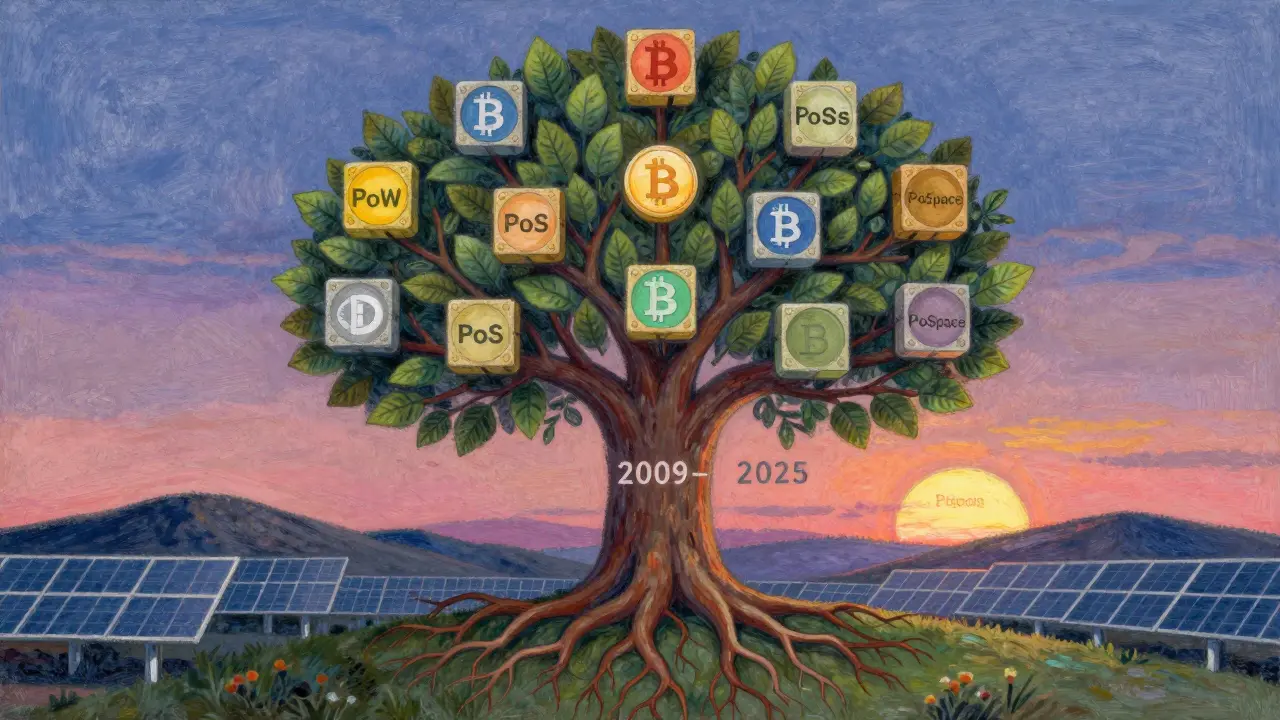

Proof-of-Stake Is Taking Over

Enter proof-of-stake. Ethereum switched in 2022. Cardano, Solana, and Polkadot never used nonce-based mining. Instead of guessing numbers, validators are chosen based on how much crypto they "stake" - or lock up - as collateral. No mining. No nonce. No massive power draw.

It’s faster. Cheaper. Greener. Ethereum’s energy use dropped by 99.95% overnight. Transaction fees fell. New users flooded in. And the network stayed secure. Why? Because if a validator tries to cheat, they lose their staked coins. The punishment is immediate and financial - not computational.

As of 2025, over 70% of the total market value in blockchain networks runs on proof-of-stake or similar mechanisms. Bitcoin’s dominance is no longer about technology - it’s about brand. People still trust it. But new projects? They’re skipping the nonce entirely.

Is the Nonce Dead?

No. But its role is shrinking. The future of the nonce isn’t about bigger mining farms. It’s about niche use cases.

Some blockchains are experimenting with hybrid models. For example, a chain might use proof-of-stake for everyday transactions but still require a nonce-based proof-of-work for critical system updates - like changing the protocol rules. That way, the network stays secure without burning power daily.

Others are exploring "nonce-light" systems. Instead of mining a full block, nodes solve a lightweight cryptographic puzzle - maybe a smaller hash or a memory-hard function - just enough to delay bad actors without draining energy. These aren’t Bitcoin-style nonces. They’re scaled-down versions, designed for efficiency.

Even in Bitcoin, there’s talk of off-chain solutions. The Lightning Network handles most small payments without touching the main chain. That means fewer blocks need mining. Fewer nonces need to be guessed. The nonce isn’t disappearing - it’s being used less often.

What’s Next for Nonce Technology?

There’s no official roadmap for the nonce. No whitepaper promising a "Nonce 2.0." But researchers are quietly working on alternatives:

- Proof-of-Space-Time: Uses unused hard drive space instead of CPU power. Less energy, but slower.

- Proof-of-History: Used by Solana - timestamps transactions in sequence, eliminating the need for mining entirely.

- Proof-of-Useful-Work: What if mining solved real-world problems? Like protein folding or climate modeling? Some projects are testing this, but scalability is a hurdle.

None of these replace the nonce outright. But they show the direction: security without waste.

The real question isn’t whether the nonce will vanish. It’s whether it will become a relic - like the floppy disk - only used in legacy systems or by die-hard believers.

Who Still Needs the Nonce?

Bitcoin miners, of course. They’ve invested billions in hardware. They won’t quit overnight. But even they know the writing’s on the wall. Many are shifting to Bitcoin Layer 2 solutions or diversifying into other blockchains that still use proof-of-work - like Litecoin or Bitcoin Cash.

Some governments and institutions still prefer proof-of-work. Why? Because it’s transparent. Anyone can verify the work. No central authority picks validators. It’s decentralized by design. For countries wary of centralized control, the nonce still has value.

And then there’s the psychological factor. People trust what they understand. Proof-of-work feels tangible. You see the machines humming. You know someone’s working for the reward. Proof-of-stake? It’s invisible. You just lock up coins and wait. That’s harder to explain.

The Bottom Line

The nonce isn’t going to vanish tomorrow. But its golden age is over. It served blockchain well for 15 years. It secured the first decentralized digital currency. It proved that trust could be built without banks.

But the future belongs to systems that don’t need to burn the planet to stay secure. The nonce’s role is narrowing. It’s becoming a backup, a fallback, a legacy tool - not the default.

If you’re building a new blockchain, you won’t start with a nonce. You’ll start with staking, delegation, or some other mechanism that doesn’t demand a power plant. If you’re holding Bitcoin, you’re holding the last major system still relying on it. That’s not a weakness - it’s a choice.

The nonce helped create the blockchain revolution. Now, the revolution is moving on.

What is the main purpose of a nonce in blockchain?

The nonce is a random number miners adjust to find a valid hash for a block. It’s the core of proof-of-work, forcing computational effort to add new blocks and preventing fraud by making tampering too expensive.

Is the nonce still used in modern blockchains?

Yes, but only in proof-of-work chains like Bitcoin and Litecoin. Most new blockchains - including Ethereum, Solana, and Cardano - use proof-of-stake or other consensus methods that don’t require a nonce.

Why is proof-of-stake replacing proof-of-work?

Proof-of-stake uses far less energy, processes transactions faster, and reduces centralization risks from mining pools. Ethereum’s switch in 2022 cut its energy use by 99.95%, proving it’s viable at scale.

Can a nonce be hacked or manipulated?

Not directly. The nonce itself can’t be tampered with - it’s part of the block header, and any change alters the hash. To fake a block, an attacker would need to redo all the proof-of-work for that block and every block after it, which requires more than 51% of the network’s total mining power - nearly impossible on Bitcoin.

Will Bitcoin ever stop using nonces?

Unlikely in the near term. Bitcoin’s security model is built around proof-of-work and the nonce. Changing that would require a hard fork and near-universal agreement - something the community has resisted for over a decade. But its role may shrink as more transactions move to Layer 2 networks like Lightning.

Are there any new innovations for nonce technology?

There are no major upgrades to the nonce itself. But researchers are exploring alternatives like proof-of-space-time and proof-of-useful-work, which aim to retain security while reducing energy use. These aren’t improvements to the nonce - they’re replacements.

Proof-of-work is the only real security model. Anything else is just centralized banking with fancy labels. The nonce isn't dying-it's being hated by people who don't understand cryptography.

Nonce is like the engine in a classic car. Not efficient, but if it ain't broke, why replace it? Especially when the alternatives have their own hidden risks.

I appreciate how this post breaks down the technical side without oversimplifying. In India, we're watching this shift closely-many startups are skipping PoW entirely. It's smart economics.

Honestly? I don't miss the noise of ASICs. My phone can validate a PoS block in seconds. The nonce was cool in 2012. Now it's just loud.

The nonce is the last god of decentralized religion and people are worshipping its ashes like it's holy water. Wake up. We're building a future, not a museum.

I get why people love PoW. It feels real. But when your carbon footprint is bigger than a small country’s, maybe it’s time to rethink what 'real' means.

Nonce as a cryptographic primitive is functionally obsolete. The entropy layer it provided has been superseded by verifiable delay functions and threshold signatures in modern consensus protocols. The energy inefficiency is no longer justifiable at scale.

PoS is for people who can’t handle real math. If you’re not grinding hashes, you’re not securing the chain-you’re just trusting a few rich guys. Pathetic.

Let’s be real. Bitcoin’s nonce isn’t going anywhere because the miners are too invested. But the real threat isn’t PoS-it’s quantum computing. Once Shor’s algorithm hits, all hash-based systems crumble. PoW doesn’t save you from that. PoS might even be more adaptable. But no one wants to talk about this because it’s scary.

I’ve been mining since 2013. I’ve seen rigs go from GPUs to ASICs to dust. The nonce was the heartbeat. But I’m not bitter. The shift to PoS isn’t betrayal-it’s evolution. Just like the transition from dial-up to fiber. We didn’t mourn the modem. We celebrated the speed. This is the same. The blockchain’s soul isn’t in the hash-it’s in the trust.

They say PoS is greener but who’s really running those validators? Big institutions. Big banks. Big tech. The nonce at least let a guy with a garage and a power bill have a shot. Now it’s just the rich getting richer with their staked coins. That’s not decentralization. That’s capitalism with a blockchain sticker.

I love how this post doesn’t just trash PoW. It honors it. The nonce gave us something we didn’t know we needed-a way to build trust without a middleman. That’s huge. Even if it’s outdated, it deserves respect.

I’m from a country where electricity is a luxury. Watching Bitcoin miners burn power like it’s free… it breaks my heart. The nonce might be iconic, but it’s not ethical anymore. We need better.

The nonce was the first real solution to the Byzantine Generals Problem. That’s not nothing. But the fact that we’ve moved beyond it proves how far we’ve come. We’re not losing something-we’re gaining a smarter way.

i just dont get why people get so mad about this. its like being mad that we dont use typewriters anymore. the nonce did its job. now lets use the new tools. less noise more peace.

The transition from proof-of-work to proof-of-stake represents a paradigm shift in distributed consensus mechanisms. The nonce, while historically significant, introduces an asymptotic inefficiency that is incompatible with global scalability and environmental sustainability objectives.

PoS is just a scam. The rich get to pick who gets to validate. The nonce at least let anyone with a GPU try. And yeah the power use is bad but thats the price of freedom.

I don’t care if it’s green or not. If you’re not mining, you’re not part of the revolution. You’re just a tourist with a wallet. The nonce is the soul of Bitcoin. Kill it and you kill the dream.

The nonce is a trap. The whole PoW system is controlled by China and the US energy conglomerates. They want you to believe it’s decentralized. It’s not. They own the rigs. They own the power. They own the narrative. The nonce is just a shiny distraction.

I used to mine with my laptop. I remember the heat, the noise, the thrill of seeing a block confirm. I don’t miss it. But I miss the feeling that anyone could join. Now it’s all institutional. I feel left behind.

The nonce is not obsolete. It is merely being suppressed by centralized entities seeking to eliminate competition. The energy consumption argument is a pretext for control. The real threat to blockchain is not inefficiency-it is centralization disguised as innovation.