Amaterasu Finance: What It Is, How It Works, and What You Need to Know

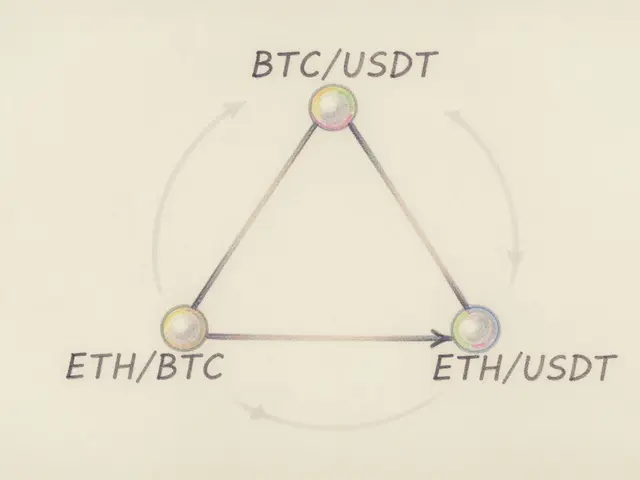

When you hear Amaterasu Finance, a decentralized finance protocol built to optimize yield farming and token rewards on blockchain networks. It’s not just another DeFi project—it’s a system designed to help users earn passive income by locking up crypto assets without relying on banks or middlemen. Think of it like a digital savings account that pays you in crypto, but instead of a bank, it runs on smart contracts you can verify yourself.

Amaterasu Finance relates closely to yield farming, the practice of lending or staking crypto to earn interest or rewards. It also connects to blockchain finance, the broader movement of moving financial services like lending, borrowing, and trading onto public ledgers. Unlike centralized platforms, Amaterasu Finance doesn’t hold your keys—you do. That means you control your funds, but you’re also responsible for managing risks like smart contract bugs or price swings.

It’s not for everyone. If you’re looking for a simple way to buy and hold Bitcoin, this isn’t it. But if you’re comfortable with wallets, gas fees, and understanding tokenomics, Amaterasu Finance offers real tools to grow your crypto holdings. It’s built for people who want to move beyond just trading and start earning from their holdings—without giving up control.

What you’ll find here are real breakdowns of how Amaterasu Finance operates, what rewards users actually get, where it’s deployed (Ethereum? Polygon? BSC?), and whether it’s still active or fading out. You’ll also see how it compares to similar protocols, what went wrong for some early adopters, and which features still hold up today. No fluff. No hype. Just what the data shows.

Amaterasu Finance is a dead crypto exchange with zero trading activity since August 2025. Learn why its trust score is 2/10, why no one uses it, and what real alternatives to choose instead.

Jonathan Jennings Oct 31, 2025