Amaterasu Finance Crypto Exchange Review: Is This DEX Still Operational?

Crypto Exchange Trust Checker

Enter a crypto exchange name to check its operational status based on real metrics from CoinGecko and Holder.io.

Verification Results

Amaterasu Finance Crypto Exchange Review: Is This DEX Still Operational?

If you're looking for a new decentralized exchange to trade crypto, you might have come across Amaterasu Finance. But here’s the reality: as of October 2025, this platform isn’t just inactive-it’s effectively dead.

Amaterasu Finance launched in 2022 during the peak of DeFi hype, promising a non-custodial trading experience like Uniswap or PancakeSwap. But unlike those platforms, which handle billions in daily volume, Amaterasu Finance hasn’t recorded a single trade in the last 30 days. That’s not a glitch. That’s a shutdown.

Holder.io, a reliable data aggregator for crypto exchanges, confirms zero trading activity since late August 2025. CoinGecko, another trusted source, lists only one token and two trading pairs-yet even those appear to be ghosts. The platform’s trust score of 2 out of 10 screams red flags: no proof of reserves, no transparency, no user base.

What Even Is Amaterasu Finance?

Amaterasu Finance is classified as a decentralized exchange (DEX), meaning it’s supposed to let you trade crypto directly from your wallet without handing over control of your funds. That’s a good thing-in theory.

But here’s where it falls apart. Most DEXs run on popular blockchains like Ethereum or Binance Smart Chain. Amaterasu Finance appears locked to the Aurora network, based on its only active trading pair: IZA/AURORA. That alone limits its audience to a tiny slice of DeFi users.

There’s no public documentation on its smart contracts. No audit reports. No team members listed. No GitHub activity. No social media updates since 2023. It’s like a store with the lights off, the doors locked, and no sign saying why.

Trading Pairs? Almost None

Let’s talk about what you can actually trade. Holder.io says there are four tokens listed. CoinGecko says one. Either way, that’s nowhere near enough.

Compare that to Coinbase, which supports over 250 cryptocurrencies. Even smaller DEXs like SushiSwap offer 50+ trading pairs. Amaterasu Finance? You’re stuck with maybe one or two. If you’re holding anything besides IZA or AURORA, you can’t trade it here. Not even Bitcoin or Ethereum.

And even if you did hold IZA, you couldn’t trade it-because no one else is. Liquidity is zero. Slippage would be insane. Your transaction might not even go through.

Why the Trust Score Is So Low

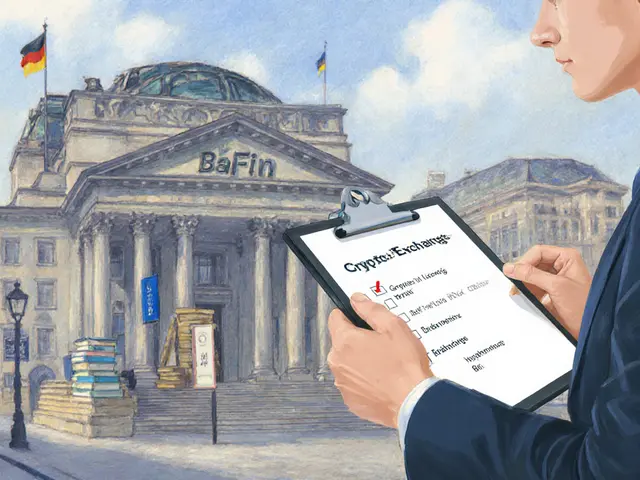

CoinGecko’s trust score isn’t arbitrary. It’s based on real metrics: proof of reserves, security history, regulatory compliance, and whether the exchange shows signs of wash trading or fake volume.

Amaterasu Finance scores a 2. That’s lower than most failed projects. For context: Binance scores 9, Coinbase 8, and even lesser-known DEXs like Curve or Trader Joe score above 6. A score of 2 means the platform fails on at least three core criteria.

There’s no evidence they ever held reserves. No audits. No KYC. No customer support channels. No public team. No roadmap. No updates. In a space where trust is everything, this exchange has none.

No Users. No Reviews. No Activity.

You won’t find a single Reddit thread about Amaterasu Finance. No YouTube reviews. No Twitter chatter. No complaints on Trustpilot. Nothing.

That’s not because it’s secretly great. It’s because nobody used it. Not enough to leave feedback. Not enough to cause problems. Not enough to even get noticed.

Even the most obscure exchanges have at least a handful of users who post about bugs, delays, or scams. Amaterasu Finance? Silence. The kind of silence that follows when a project is abandoned.

How It Compares to Real Alternatives

Here’s what a working DEX looks like in 2025:

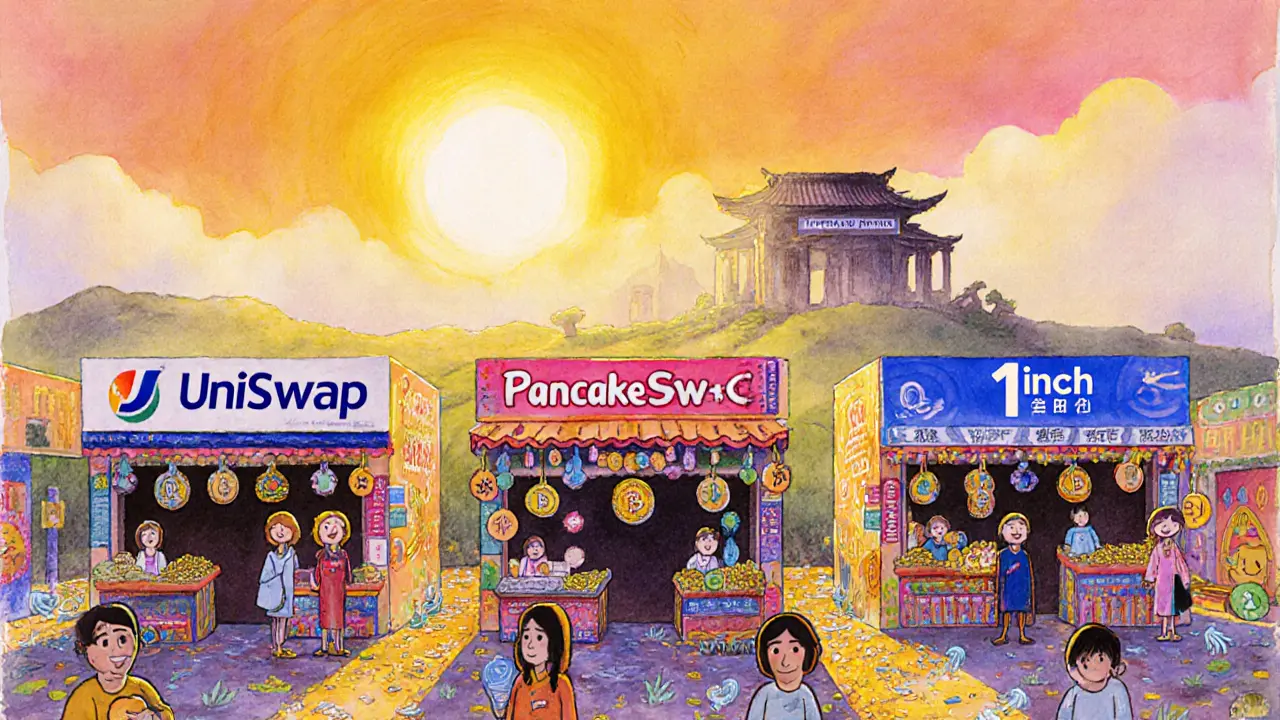

- Uniswap (Ethereum): $1.8B daily volume, 10,000+ tokens, open-source code, audited contracts.

- PancakeSwap (BSC): $450M daily volume, 500+ tokens, staking, yield farming, active community.

- SushiSwap: $120M daily volume, 200+ tokens, governance token, regular updates.

- 1inch: Aggregates liquidity across 15+ DEXs, best prices, low slippage.

Amaterasu Finance doesn’t just lose to these-it doesn’t even show up on the radar. It’s not a competitor. It’s a footnote.

Is There Any Way to Use It?

Technically, you could connect your MetaMask wallet to the Amaterasu Finance interface. But what happens next?

You’ll see empty liquidity pools. Your trade will fail. Your gas fees will be wasted. You won’t get any support if something goes wrong. There’s no help center. No email. No Telegram group. No Discord.

It’s like trying to buy groceries from a store that’s been closed for six months. The sign still hangs. The lights might still be on. But there’s no one inside.

And if you send crypto there by accident? Good luck getting it back. Non-custodial doesn’t mean safe if the platform is dead.

What This Means for You

If you’re thinking of trying Amaterasu Finance: don’t. Not even to test it.

This isn’t a risky investment. This is a graveyard. The lack of trading activity isn’t a temporary dip-it’s a death certificate. The low trust score isn’t a warning. It’s a verdict.

There’s no recovery path here. No team is coming back. No new token launch will revive it. No community effort can fix a project with zero documentation and zero engagement.

Save your time. Save your gas fees. Save your crypto.

What to Do Instead

If you want a real decentralized exchange, here are three safe, active options:

- Uniswap - Best for Ethereum-based tokens. Reliable, well-audited, high liquidity.

- PancakeSwap - Best for BSC tokens. Low fees, staking, and active development.

- 1inch - Best for finding the best price across multiple DEXs. Aggregator model reduces slippage.

All three have active communities, public codebases, regular updates, and real trading volume. None of them are ghosts.

And if you’re new to DeFi? Start with one of these. Learn how wallets, gas fees, and liquidity pools work. Then explore newer projects with transparent teams and real activity.

Amaterasu Finance isn’t a hidden gem. It’s a cautionary tale.

Is Amaterasu Finance still working in 2025?

No. As of September 2025, Holder.io confirmed zero trading activity on Amaterasu Finance for the past 30 days. CoinGecko lists it with a trust score of 2, the lowest possible without being flagged as fraudulent. The platform appears to be completely inactive with no updates, no support, and no users.

Can I withdraw my crypto from Amaterasu Finance?

Technically, yes-if your crypto is still in your wallet and you never sent it to the exchange. But if you deposited funds into Amaterasu Finance’s liquidity pools or trading interface, you likely can’t access them. With no active developers, no support team, and no functioning smart contracts, there’s no way to retrieve assets stuck on the platform.

Why does CoinGecko give Amaterasu Finance such a low trust score?

CoinGecko’s trust score evaluates security, transparency, liquidity, and compliance. Amaterasu Finance scores 2 because it has no proof of reserves, no audits, no team information, no customer support, and no trading activity. These are mandatory criteria for even a basic score above 5. A score of 2 means the exchange fails on nearly all safety indicators.

Are there any legitimate alternatives to Amaterasu Finance?

Yes. Uniswap, PancakeSwap, and 1inch are all active, well-audited, and widely used. They offer hundreds of trading pairs, real liquidity, community support, and regular updates. Unlike Amaterasu Finance, these platforms have proven track records and transparent operations.

Should I avoid all new crypto exchanges?

Not all-but you should be extremely cautious. Look for exchanges with at least 30 days of consistent trading volume, public team members, audited smart contracts, and active social media. If a platform has no user reviews, no updates, and no liquidity, treat it like a scam-even if it looks professional. Dead projects are more common than you think.

This is the exact kind of graveyard project that eats newbies alive. I saw someone dump 5 ETH into Amaterasu last month thinking it was 'undervalued.' They’re still waiting for their tokens to move.

LMAO someone actually wrote a 2000-word obituary for this thing? I thought it died in 2023 and we all moved on.

You think this is just dead? Nah this was a honeypot from day one. The Aurora chain was chosen because it’s easy to fake liquidity and vanish. I’ve seen this script before. They took the dev wallet private keys and ran. No audits? No team? That’s not incompetence. That’s a contract designed to trap you.

What strikes me is not just the silence but the eerie precision of its decay. A DEX doesn’t just fade-it collapses under the weight of its own invisibility. No updates, no community, no even a farewell tweet. It’s like a ship that sailed into fog and never sent a distress signal. We forget that in crypto, absence is louder than noise. This wasn’t a failure. It was a ghost story written in smart contracts.

US based DeFi projects have real infrastructure. This Aurora nonsense is a third world crypto experiment. If you cant build on Ethereum or Solana you dont belong in the space. This is why Americans lose trust in crypto. Foreign junk projects like this.

I actually tried connecting my wallet to it back in January just to see if it was a glitch. The UI loaded but every pool showed zero liquidity. I thought my MetaMask was broken. Turned out the whole thing was just a static HTML page with a fake RPC endpoint. I wasted 0.02 ETH on gas trying to swap IZA. Never again. The devs didn’t even bother to take the site down. Just left it hanging like a dead neon sign.

I remember when Aurora was hype. Everyone thought it was the next Solana. Then Amaterasu showed up like a knockoff brand with a cool name. People got excited because it sounded Japanese and futuristic. But the team never even localized their docs. No Japanese community. No Asian devs. Just a name borrowed from a Shinto goddess and zero substance. It’s cultural appropriation with crypto tokens.

The real issue here is the normalization of dead DEXs. We treat them like abandoned websites rather than financial black holes. This isn’t just a project failure-it’s a systemic failure of due diligence. The entire DeFi ecosystem has become a graveyard of unaudited, unlabeled, unmonitored contracts. We’ve lost the discipline to vet before we connect our wallets. This is why rug pulls are now considered 'market dynamics'.

CoinGecko trust score of 2 is generous. Should be 0. No proof of reserves. No team. No code commits. No socials. No liquidity. Zero activity. This is not a DEX. This is a digital tombstone with a URL.

I appreciate this breakdown. I’ve been warning my friends not to touch anything with under 100K in liquidity and no audit. This is why I always say: if you can’t find a single Reddit thread or YouTube video about it, it’s probably a ghost. Don’t be the first to test a dead platform.

I used to trade on this. It was fine for a few weeks. Then one day the app just stopped working. I emailed them. No reply. Tried the Discord. Dead. Now I just use Uniswap. Much easier. Don’t risk it.

Funny how we romanticize the 'hidden gem' in crypto until it turns out to be a hollow shell with a pretty logo. Amaterasu wasn’t just abandoned-it was designed to be forgotten. The name, the branding, the Aurora chain lock-in-it all screams performative depth. A project that wanted to look profound without ever being real. We don’t need more gods. We need more transparency.

The data here is meticulous. Zero trades for 30 days. One token. No team. No audits. The silence is the most damning evidence. In a space where noise is currency, this project’s quiet speaks volumes. It didn’t fail-it evaporated.

I’m so glad someone documented this. 🙏 I had a friend who sent $800 to Amaterasu last year thinking it was the next big thing. He’s still trying to recover it. I told him to just write it off. The smart contract is basically a black hole now. No one’s coming back. No one even remembers it’s alive. 💔

You people are overreacting. It’s just a small DEX. Maybe the devs took a break. Maybe they’re rebuilding. Why assume the worst? I’ve seen projects come back from worse. Give it time. Not everything that’s quiet is dead.

Let’s be clear: this isn’t about Amaterasu. It’s about the entire DeFi culture that glorifies novelty over sustainability. We chase shiny new tokens like children chasing fireflies. We don’t ask who built it. We don’t ask why it’s silent. We just connect our wallets and hope. This is why the space is full of ghosts. We don’t mourn them. We just move on to the next one.

The fact that anyone still even talks about this is proof of how lazy the crypto community is. You don’t need a 2000-word essay to know a project is dead. You check the blockchain. You see zero transactions. You see no GitHub. You see no Twitter. Done. You don’t need a PhD in crypto to know when something’s a corpse.

i thought this was just a scam but i didnt know it was this bad. i lost like 300 usd on it last year and thought it was my bad. now i feel dumb.

Honestly, I’m surprised this got a review at all. It’s like writing a Yelp review for a restaurant that closed in 2019 and still has the sign up. The aesthetic was beautiful. The concept? Aesthetic capitalism at its finest. I miss the 2021 era when we all pretended we understood DeFi. Now we just pretend we didn’t lose money.

I’ve been researching DEXs for my thesis on blockchain abandonment, and Amaterasu is a textbook case. No team, no updates, no community engagement, no liquidity. The only thing that survived was the domain name. It’s now parked with ads for 'crypto recovery services.' The irony is delicious.

This is why I don’t trust American crypto projects. They promise innovation but deliver nothing. This Amaterasu thing? Classic. They took money from global users and vanished. The silence? That’s the sound of betrayal. And now you’re all acting like this is just a normal market correction? No. This is theft.

I told everyone this was a trap. Aurora chain? No audits? Zero activity? You think they didn’t know this was going to happen? They planned it. The whole thing was a pump-and-dump disguised as a DEX. And now you’re all acting shocked? Wake up. This isn’t an accident. It’s the business model.

To everyone who lost money on this: I’m sorry. This isn’t your fault. The system is broken. We’re taught to chase hype, not to dig into contracts or team backgrounds. This isn’t about Amaterasu. It’s about how we’re all being trained to trust interfaces, not integrity. Let’s not forget the lesson. Let’s build better.

The author is right. This isn’t a review. It’s a funeral notice. And we’re all standing around it pretending we didn’t know it was dying.