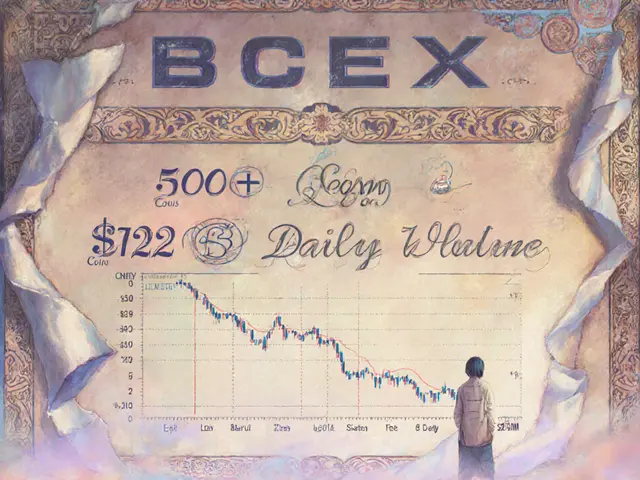

ByteDex Exchange – In‑Depth Overview

When working with ByteDex exchange, a newer crypto exchange that offers spot trading, futures contracts and a native token rewards program. Also known as ByteDex, it functions as a crypto exchange that prioritizes low fees, strong security and deep liquidity. In plain terms, ByteDex exchange encompasses both spot and derivatives markets, requires robust security protocols to protect user assets, and leverages high‑volume order books to keep slippage low. Those three pillars – fees, security and liquidity – shape the overall user experience and dictate how quickly traders can move in and out of positions.

Key Attributes and How They Impact Traders

One of the most talked‑about attributes is the fee model. ByteDex exchange offers tiered maker‑taker rates that start at 0.04% for makers and 0.06% for takers, dropping further for high‑volume users. This fee structure influences user choice because lower costs directly improve net returns, especially for day traders who execute dozens of trades a day. Security is another critical attribute: the platform uses multi‑factor authentication, cold‑storage for the majority of funds and regular penetration testing. These measures reduce the risk of hacks and give traders confidence to keep larger balances on the exchange. Liquidity, measured by daily trading volume and depth of order books, determines how easily large orders can be filled without moving the market. ByteDex’s partnership with market‑making firms ensures that even less‑popular token pairs have sufficient depth, which in turn supports smoother price discovery and tighter spreads.

Beyond the core trio, the exchange also supports token listings, a process that enables new projects to reach a broader audience. ByteDex exchange requires projects to pass a KYC/AML check, provide audited smart contracts and demonstrate community demand before a token can be listed. This gatekeeping improves overall market quality and protects users from fraudulent projects. The combination of transparent fee tiers, rigorous security protocols, solid liquidity provision and a responsible listing process makes ByteDex exchange a compelling option for both newcomers and seasoned traders. Below you’ll find a curated set of articles that dive deeper into each of these areas, from fee breakdowns to security audits and token‑listing case studies.

A detailed review of ByteDex, the hybrid crypto exchange. Covers its architecture, BEXT token, features, security, fees, and how it stacks up against major exchanges.

Jonathan Jennings Nov 12, 2024