ByteDex Crypto Exchange Review - In‑Depth Look at the Hybrid Platform

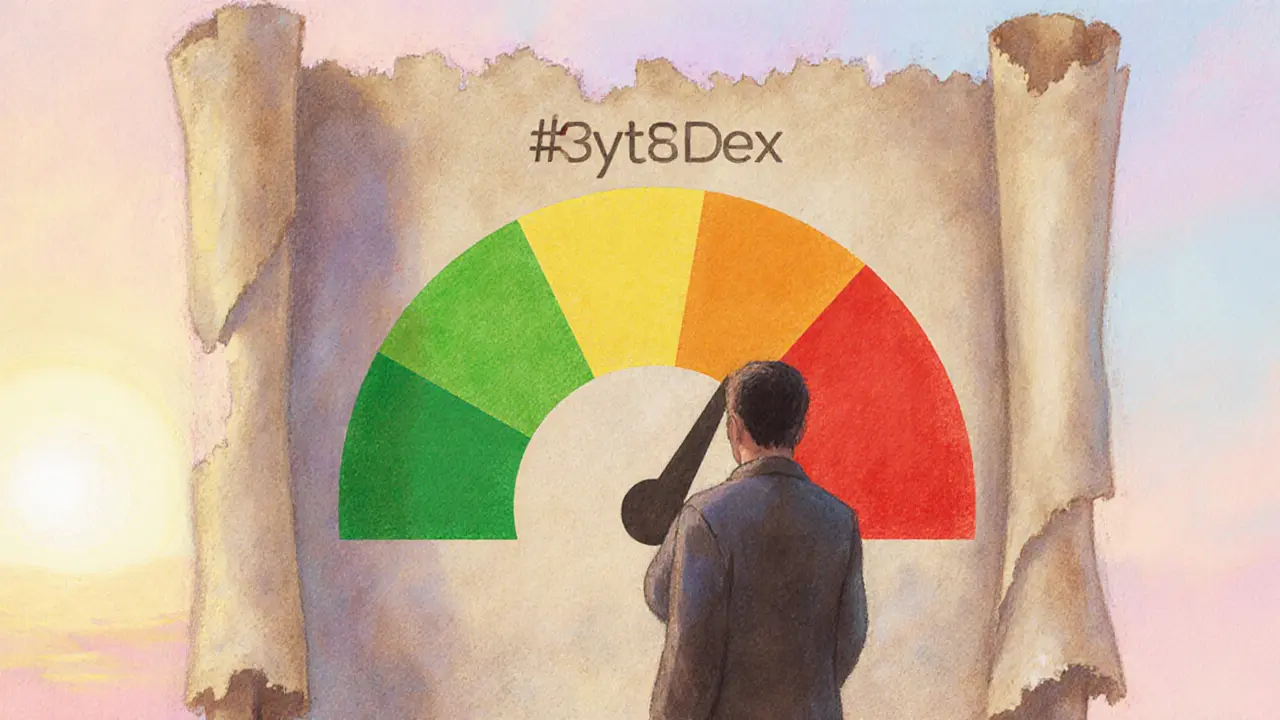

ByteDex Exchange Risk Assessment Tool

Transparency Score

How clear is the exchange about its operations, fees, and policies?

Low transparency (3/10)Security Rating

What security measures are in place to protect your assets?

Limited security validation (2/10)Imagine a crypto exchange that promises the speed of a centralized hub and the safety of a decentralized network, yet leaves you hunting for basic details like fees or regulatory status. That’s the story of ByteDex review. Below we break down what the platform actually offers, where it shines, and what still feels vague.

Key Takeaways

- ByteDex calls itself a hybrid exchange, blending CEX liquidity with DEX security.

- Its native token, BEXT, has a max supply of 311.95million and trades around $0.016USD.

- The platform runs on a proprietary blockchain that claims faster settlement but lacks public audit data.

- Mobile app "Byte Exchange" is built by Turkish firm Bytedx Teknoloji A.ş. and has just over 1,000 downloads.

- Transparency gaps-no clear fee schedule, KYC policy, or regulatory license-make risk assessment difficult.

What Is ByteDex?

ByteDex (sometimes stylized ByteDx) is a ByteDex a hybrid cryptocurrency exchange that combines centralized order‑book liquidity with decentralized custody of assets. The service operates on its own blockchain infrastructure and introduces a native utility token called BEXT.

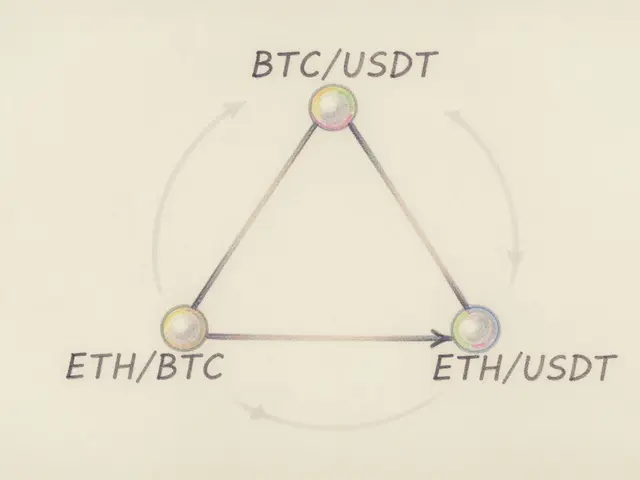

The Hybrid Architecture Explained

Traditional exchanges fall into two camps: centralized exchanges (CEX) like Binance that hold user funds in hot wallets, and decentralized exchanges (DEX) such as Uniswap where users trade directly from their wallets. ByteDex attempts to marry the two by letting traders execute orders through a central matching engine while still keeping the actual tokens in a user‑controlled, blockchain‑backed wallet.

In practice, the workflow looks like this:

- Trader deposits crypto into a ByteDex‑issued wallet address.

- The deposit is recorded on ByteDex’s proprietary blockchain, providing cryptographic proof of ownership.

- When a trade is placed, the order is matched on a centralized order book for speed and depth.

- After execution, the settled balance is written back to the user’s wallet on the blockchain, preserving decentralised custody.

This design promises the best of both worlds: low‑latency execution and reduced custodial risk. However, without third‑party audits, it’s hard to verify whether the custody model truly isolates user funds from the exchange’s operational vaults.

Token Economics: BEXT

The platform’s native token, BEXT a utility token that powers fee discounts, governance voting, and staking within the ByteDex ecosystem, has a hard cap of 311.95million tokens. Market data from Crypto.com lists BEXT at roughly $0.016USD, but 24‑hour volume figures are missing, and other price aggregators show “unavailable.” This volatility and lack of liquidity information raise concerns for anyone considering holding BEXT for long‑term benefits.

Key BEXT attributes:

- Maximum supply: 311,950,000 BEXT

- Current price (as of Oct2025): $0.016USD

- Use cases: fee rebates, staking rewards, governance proposals

- Distribution: No public tokenomics report; details on allocation to founders, advisors, or community are absent.

Platform Features & User Experience

ByteDex markets a clean, web‑based dashboard that works on both desktop and mobile browsers. It also offers a dedicated Android app called “Byte Exchange,” published by Bytedx Teknoloji A.ş. a Turkish technology company behind the mobile client. The app has just over 1,000 downloads and supports trading of Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

Feature highlights:

- Real‑time market data: Live price tickers for supported assets, though depth charts are limited.

- Smart‑contract support: Users can interact with on‑chain contracts directly from the interface.

- Secure wallet: Encrypted private key storage on the proprietary blockchain; no mention of cold‑storage ratios.

- Onboarding: The sign‑up flow requires email verification, but details on KYC/AML procedures are missing.

Security and Regulatory Landscape

Security claims rest on three buzzwords: “cryptographic security,” “blockchain implementation,” and “top‑tier encryption.” No third‑party penetration tests, security audits, or insurance coverage have been published. This omission makes it difficult to compare ByteDex’s safety to industry leaders that regularly disclose audit reports.

Regulatory compliance is equally opaque. The mobile app originates from Turkey, yet there’s no public licensing information for the United States, the European Union, or other major jurisdictions. For traders who need to meet local compliance, the lack of a clear legal framework could be a red flag.

Pros and Cons

| Pros | Cons |

|---|---|

| Hybrid model aims to combine liquidity and custody security. | Fee schedule and trading commissions are not publicly disclosed. |

| Proprietary blockchain promises faster settlement. | No independent security audit or bug‑bounty program. |

| Native BEXT token offers potential fee discounts. | BEXT market data is sparse; liquidity appears thin. |

| Mobile app available for Android users. | Regulatory status unclear; no known licensing in major markets. |

| Supports major coins (BTC, ETH, USDT) and smart contracts. | Community feedback limited; less than 1,000 app downloads suggests low adoption. |

How ByteDex Stacks Up Against the Big Players

| Exchange | Model | Typical Fees | Liquidity (US$bn) | Security Audits |

|---|---|---|---|---|

| ByteDex | Hybrid (CEX+DEX) | Not disclosed | - (no public data) | None published |

| Binance | CEX | 0.10% maker / 0.14% taker | ≈1.2 | Regular third‑party audits |

| Coinbase | CEX | 0.50% (≤$10k) | ≈0.8 | Annual SOC 2 TypeII, internal audits |

| Uniswap | DEX | 0.30% (protocol fee) | ≈0.6 | Open‑source; community‑driven audits |

From this snapshot, ByteDex’s biggest gaps are transparency around fees, liquidity, and security validation. Established exchanges openly publish these metrics, which guides trader confidence.

Final Verdict

If you’re a tech‑savvy trader who enjoys experimenting with new protocols and can tolerate uncertainty, ByteDex’s hybrid approach might be worth a test‑trade-especially if you’re curious about the BEXT token’s utility. For most users, however, the lack of clear fee information, regulatory licensing, and independent security audits makes the platform a higher‑risk choice compared to mainstream options.

In short, ByteDex promises an appealing blend of CEX speed and DEX safety, but the execution details remain hidden behind a thin information veil. Proceed with caution and only allocate funds you’re prepared to lose.

Frequently Asked Questions

Is ByteDex a regulated exchange?

No public licensing or regulatory filings have been disclosed for ByteDex in major jurisdictions such as the US, EU, or Australia. The platform appears to operate primarily under Turkish corporate structures, which may not satisfy local compliance requirements for many traders.

What are the trading fees on ByteDex?

ByteDex does not publish a detailed fee schedule on its website or within the mobile app. Users must contact support or rely on in‑app prompts, which adds an element of uncertainty compared to exchanges that list maker/taker rates openly.

How does the BEXT token provide fee discounts?

The platform claims that holding BEXT grants reduced trading fees and voting rights in governance proposals, but without a published fee matrix or staking model, the exact discount percentages remain ambiguous.

Can I withdraw my crypto to an external wallet?

Yes, the hybrid design lets users move assets out of the ByteDex wallet onto any external address. However, the withdrawal process may involve on‑chain confirmation times that depend on the proprietary blockchain’s current load.

Is there customer support available?

Support channels are limited to an email address listed in the app’s help section. No live chat, phone support, or dedicated ticketing system has been documented.

ByteDex touts a “hybrid” architecture that sounds like a buzzword cocktail 🍹, but the underlying protocol is about as transparent as a black‑box. The tokenomics sheet is missing, leaving traders to guess the fee schedule. In practice, you’re swapping on a centralized order‑book while trusting a proprietary blockchain for custody – a risky trade‑off. I’d say the hype outweighs the actual utility, especially for risk‑averse investors. 🤔

Reading through the review, it’s clear that the platform aims for speed without sacrificing security. The concept of a central matching engine paired with on‑chain custody is innovative, yet the lack of audit reports is a red flag. For anyone new to crypto, I’d recommend starting with a small amount to test the withdrawal flow. 😊

The hybrid model is interesting. Without a clear fee schedule it’s hard to assess cost efficiency. Users should watch for withdrawal delays.

Honestly, the whole thing feels like a glorified escrow service with no real guarantees. If you can’t see the audit, don’t trust the code.

From a regional perspective, the Turkish backing gives ByteDex an edge in emerging markets, but that doesn’t excuse the missing regulatory filings. The token’s thin liquidity makes price manipulation a genuine concern, especially given the opaque distribution. Moreover, the platform’s claim of “top‑tier encryption” is unsubstantiated without third‑party verification. Investors should demand transparency before committing capital. In short, the initiative is bold but the execution is unfinished.

Looks sleek on mobile and the UI feels familiar for anyone who’s used big‑name exchanges. I haven’t noticed any hidden fees yet but the app doesn’t publish them either. The onboarding process is straightforward, though the KYC details are vague. Overall, it feels like a decent sandbox for experimenting with hybrid tech.

ByteDex is a curious case of ambition colliding with opacity. It promises the best of both worlds-fast execution and user‑controlled custody-yet the lack of public audits turns that promise into a philosophical puzzle. When a platform hides its fee structure, you’re left pondering whether the hidden costs might erode any potential gains. Still, the concept sparks the imagination, hinting at a future where decentralization and performance coexist without compromise. For the adventurous, it’s a playground worth exploring, but with eyes wide open.

It’s a good thing they’re trying something new, but they’re missing the basics. Without clear fees, users can’t make informed decisions.

The hybrid approach could bridge the gap between liquidity and security, which is a noble goal. Yet, trust is built on transparency, and ByteDex currently lacks that. I’d advise traders to keep a small portion of their portfolio here while monitoring any future audits. If the team releases detailed security reports, the platform could become more appealing. Until then, cautious optimism is the safest stance.

From a risk management angle, the platform’s opacity feels like a silent alarm. The BEXT token’s thin order book could amplify slippage, especially during market stress. It’s a classic case of high‑risk reward that leans heavily toward the risk side.

Philosophically, ByteDex invites us to reconsider custodial trust in the age of decentralization. Practically, the absence of third‑party audits makes that invitation feel theoretical rather than actionable. Users should weigh the novelty against the tangible safeguards currently missing. Until verification is public, skepticism remains a rational response.

For newcomers, the platform’s lack of a clear fee schedule can be daunting. Yet, the hybrid model could lower transaction latency, which is a plus for active traders. I’d suggest starting with a modest amount to evaluate the withdrawal experience. If the team rolls out transparent audit reports, confidence will grow. In the meantime, treat it as an experimental tool rather than a primary exchange.

Alright folks, let’s break this down! ByteDex promises the lightning‑fast match‑making of a CEX while keeping your coins in a self‑custody wallet-sounds like the crypto dream. The reality, however, is that the proprietary blockchain is a mystery box; no third‑party audits, no public docs. If you love tinkering and can stomach the risk, this could be your sandbox. But for the average trader, the missing fee schedule is a deal‑breaker. Bottom line: experiment with caution, and keep most of your assets on a vetted exchange.

ByteDex’s UI feels fresh and the mobile app is surprisingly smooth. I’ve tested a few trades and the execution speed is on point. The big question mark is still the security audit-nothing official yet. If they publish a report, I’d be more comfortable recommending it. For now, it’s a neat side‑project to dip your toes in.

When you first encounter the concept of a hybrid exchange, it sparks a cascade of possibilities that ripple through the entire crypto ecosystem, suggesting a future where the frictionless speed of centralized order books could seamlessly intertwine with the immutable custody guarantees of decentralized ledgers. Yet, as the review meticulously outlines, the veil of opacity surrounding ByteDex’s fee structure and regulatory compliance drifts like an uneasy fog over what could otherwise be a beacon of innovation. The native BEXT token, while touted as a utility key unlocking fee discounts and governance voting rights, dances on the periphery of liquidity, its market depth barely hinted at in fragmented data points that leave potential investors grasping at shadows. Moreover, the proprietary blockchain, a cornerstone of the platform’s promise for rapid settlement, remains shrouded in mystery without publicly available audit logs or third‑party security assessments, compelling us to ask whether the underlying cryptographic safeguards are merely theoretical constructs. In practice, the onboarding flow, although streamlined with email verification, omits crucial KYC nuances, raising alarms for those bound by stringent compliance regimes. The mobile application, a seemingly modest endeavor with just over a thousand downloads, reflects modest adoption, perhaps indicative of either a nascent user base or hesitancy born from the surrounding uncertainties. All these elements coalesce into a complex tapestry where ambition meets caution, urging traders to allocate only a sliver of their capital-money they can afford to lose-in this experimental arena. Should ByteDex eventually illuminate its operations with comprehensive audits, transparent fee disclosures, and clear regulatory licensing, it could pivot from an intriguing outlier to a formidable contender in the exchange landscape. Until that moment arrives, the prudent path remains one of measured curiosity, balancing the allure of pioneering technology against the steadfast need for security and clarity.

While the hybrid architecture is lauded as avant‑garde, the conspicuous absence of verifiable security audits renders the claim speculative at best. The platform’s opaque fee framework further erodes confidence, especially for institutional participants requiring granular cost analysis. In the aggregate, these deficiencies position ByteDex as a curiosity rather than a credible market infrastructure.

Yo, the UI feels fresh and the speed is solid. Just keep a tiny stash there until they show some real audit docs.

ByteDex’s hybrid model could be a game‑changer for traders seeking both depth and security 🌐. The lack of a published fee schedule, however, is a glaring omission that could deter serious investors. If the team releases comprehensive audit reports, confidence in the platform would rise dramatically. For now, it’s a great sandbox for tech‑savvy users willing to experiment with small amounts. Keep an eye on future transparency updates! 😊

Respectfully, the platform’s current lack of clear regulatory licensing is a significant hurdle for many users. The technical design is intriguing, but without proper oversight, it may not meet compliance standards in certain jurisdictions. Users should consider these factors before allocating substantial capital.

Looks like another “innovative” exchange. 🙄

From an ethical standpoint, promoting a platform that lacks transparency undermines the broader mission of fostering trust within the cryptocurrency community. It is incumbent upon developers and marketers alike to disclose fee structures, security audit outcomes, and regulatory compliance details before courting users. The absence of such disclosures not only jeopardizes individual investors but also erodes the foundational principles of open finance. Consequently, any endorsement of ByteDex without demanding these critical disclosures would be intellectually dishonest. I urge the community to hold this project to higher standards of accountability.

ByteDex’s promise of hybrid efficiency is alluring but the silent treatment on audits feels like a bait‑and‑switch. Aggressive marketing can’t mask the need for concrete security verification. Investors should remain vigilant and allocate only discretionary funds.