Crypto Airdrop Details

When you hear the term crypto airdrop, a free token giveaway usually tied to a blockchain project’s promotion or community building effort, you probably picture a flashy announcement and a quick claim button. In reality, a crypto airdrop is a structured distribution of tokens that can affect your portfolio, tax bill, and even your reputation on platforms like CoinMarketCap. Also known as a token giveaway, it blends marketing, network effects, and sometimes regulatory hurdles. Understanding how it works saves you from missing out or falling for a scam.

One core piece of any airdrop is the token distribution, the method by which the free tokens are allocated to eligible wallets. Projects may use snapshot blocks, activity‑based criteria, or manual claim forms. The distribution model influences how many tokens you receive, the timing of the payout, and the level of verification required. For example, a snapshot airdrop rewards users who held a certain coin on a specific date, while a task‑based airdrop asks you to join a Telegram group or retweet a post. Knowing the distribution type helps you gauge effort versus reward.

Tax treatment is another must‑know area. In many jurisdictions, a crypto airdrop counts as ordinary income at the fair market value on the day you gain control. That means you have to report it on your tax return, keep records of the token’s price, and possibly pay capital gains tax later when you sell. Some countries even require you to file a separate schedule for crypto events. Ignoring the airdrop tax, the reporting obligations that arise from receiving free tokens can trigger penalties, especially as tax authorities tighten their focus on digital assets.

What to watch when chasing a crypto airdrop

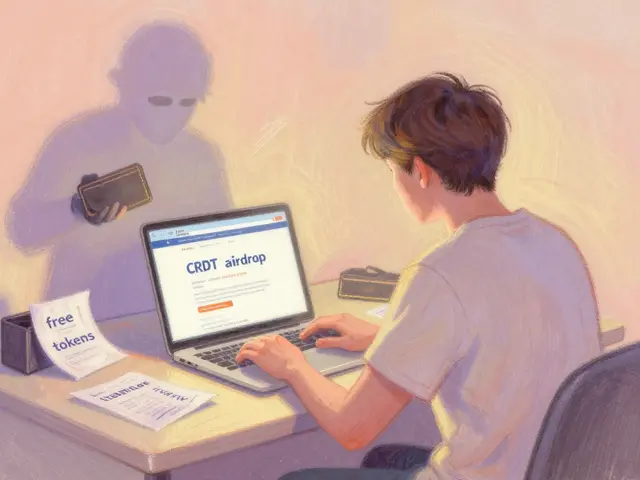

Credibility often hinges on where the airdrop is listed. A project that shows up on CoinMarketCap, the leading market data aggregator for crypto assets enjoys a layer of validation that many DIY scams lack. However, a listing alone isn’t a guarantee; scammers frequently spoof CoinMarketCap pages or create fake URLs. Always double‑check the URL, verify the project’s social channels, and look for community sentiment before you input a private key or sign a transaction.

Scam detection is a skill you can develop. Red flags include requests for private keys, unusually high promises (“$10,000 worth of tokens for a single tweet”), and pressure to act within minutes. Legitimate airdrops typically use read‑only wallet connections (e.g., MetaMask) and never ask for secret information. When in doubt, search the project’s name plus “scam” on forums or Reddit; the community often surfaces warning signs quickly.

Beyond the basics, consider the timing of the airdrop. Some projects launch a token first, then announce an airdrop later to boost liquidity. Others combine the airdrop with a token launch, creating a burst of activity that can affect price volatility. Aligning your claim strategy with market cycles can improve the chance of a profitable exit, especially if you plan to trade the tokens on exchanges like Binance or WOO X.

Finally, keep an eye on the token’s utility. A token that powers a functional platform—like a DePIN communication network or a NFT marketplace—offers more long‑term value than a pure hype coin. When the token has real use cases, you’re more likely to see sustainable demand, which can turn a simple giveaway into a meaningful asset.

All these angles—distribution method, tax impact, listing credibility, scam awareness, timing, and utility—form the backbone of a smart airdrop strategy. Below you’ll find a curated set of DexSharp articles that dive deeper into each of these topics, from step‑by‑step claim guides to detailed tax reporting checklists. Use them as a toolbox to navigate the ever‑changing landscape of crypto airdrops with confidence.

Break down Bull BTC Club vs BTC Bull Token, clarify the rumored CoinMarketCap airdrop, and learn how to claim real rewards safely.

Jonathan Jennings Oct 13, 2025