Crypto Exchange Fees – Your Quick Guide

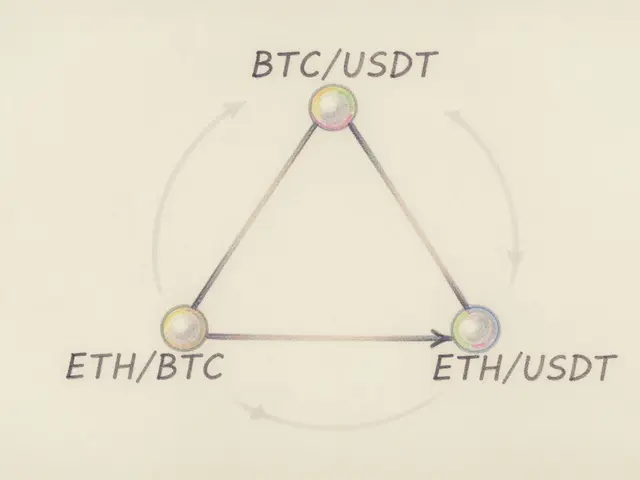

When talking about crypto exchange fees, the charges a platform applies when you buy, sell, or move digital assets. Also known as trading fees, they can make or break a profit, especially on tight margins. Understanding them starts with three basic pieces: the maker‑taker model, a pricing structure that rewards liquidity providers (makers) and charges those who take liquidity (takers), the withdrawal fees, the cost of moving coins off the exchange to an external wallet, and the trading volume discounts, lower percentages applied when you hit higher 30‑day trading thresholds. These elements shape the total cost of any trade you make.

Key fee components to watch

First, the maker‑taker model sets the baseline. Makers place limit orders that sit on the order book, earning a small rebate—often 0.02% to 0.05%—while takers hit existing orders, paying a premium that can range from 0.10% to 0.30%. This structure creates a direct link between market liquidity and your fee bill: the more you add depth, the less you pay. Second, withdrawal fees vary widely across assets and chains. Bitcoin withdrawals might cost $5‑$15, whereas a stablecoin on a fast network could be under $0.10. Ignoring these can eat into profits, especially when you move funds frequently.

Third, volume discounts reward active traders. Most exchanges tier their fees—hitting $10,000 of 30‑day volume might drop your taker fee from 0.25% to 0.20%, while $1 million could bring it under 0.10%. The crypto exchange fees you see on the price sheet are just a starting point; your actual cost depends on how much you trade and whether you’re a maker or taker. Some platforms also offer VIP programs that cut fees further if you hold native tokens or meet staking requirements.

Beyond these core items, hidden costs can surprise you. Some exchanges charge “inactivity fees” if you don’t trade for a certain period, while others levy “maintenance fees” on margin positions. Fee structures also differ between spot and derivatives markets—futures contracts often have lower maker‑taker spreads but include funding rates that can be positive or negative. Knowing the full fee landscape means you can compare platforms like WOO X, VALR, or GoSwap on equal footing.

Finally, the choice between centralized exchanges (CEX) and decentralized exchanges (DEX) adds another layer. Centralized venues usually offer tighter spreads and predictable fee schedules, whereas DEXs like Uniswap charge a flat 0.30% plus gas fees, which can spike during network congestion. Some DEX aggregators bundle several liquidity sources to lower the effective cost, but they may also introduce extra slippage. Deciding which model fits your strategy depends on how you weigh security, speed, and cost.

All these pieces—maker‑taker spreads, withdrawal costs, volume discounts, hidden fees, and the CEX vs. DEX decision—form a network of factors that determine the true price you pay to move money. Below you’ll find a curated list of articles that break each element down, compare real‑world platforms, and give you actionable tips to keep fees low while staying efficient in the market.

A detailed Deliondex crypto exchange review covering fees, security, liquidity, user experience, and how it compares with Binance, Coinbase, and Kraken.

Jonathan Jennings Jan 8, 2025