Digital Token Service Provider License

When navigating the world of crypto regulation, Digital token service provider license, a government‑issued permit that authorizes firms to offer token‑related services such as issuance, custody, or exchange, also known as DTSP license, is the cornerstone for legal operation. It encompasses a set of AML/KYC obligations, capital‑adequacy thresholds, and reporting duties that help protect investors. Another key piece of the puzzle is the VASP license, Virtual Asset Service Provider authorization required in many jurisdictions, which often serves as a prerequisite or complementary credential. Crypto exchange licensing, the process by which exchanges obtain formal permission to operate directly influences the scope of a digital token service provider license, because exchanges must meet both sets of rules to stay open. Regulatory compliance, the ongoing effort to follow laws, rules, and standards ties all these entities together, ensuring that each license holder adheres to the same baseline of consumer protection. Finally, a financial services license, a broader permission that covers traditional banking activities and may overlap with token services can expand the range of services a firm offers, but it also adds extra reporting layers. Together these entities create a web of requirements that any serious crypto business must understand.

Understanding the Digital token service provider license starts with the application checklist. First, you need a detailed business plan that outlines token use cases, target markets, and risk‑mitigation strategies. Then, you must submit AML/KYC policies that meet the standards set by the local financial authority—these policies are often audited by the same body that issues the VASP license. Capital requirements vary by country, but most regulators expect a minimum reserve that can cover potential losses and customer reimbursements. Technical security is another pillar: you’ll need to demonstrate robust custodial solutions, multi‑signature wallets, and regular penetration testing. Once the core paperwork is in, regulators will look at your governance structure; a clear board of directors, transparent ownership disclosures, and an internal compliance officer are all signals of reliability. If you already hold a crypto exchange license, the review may be faster because the regulator can see that you’ve passed similar audits before. However, a financial services license can add complexity, as it brings additional reporting to bodies like the central bank or securities commission. Throughout the process, continuous regulatory compliance—filing quarterly reports, updating AML procedures, and responding to on‑site inspections—keeps your license from lapsing. In practice, many firms treat the DTSP license as a living document: they update it whenever they launch new token products, expand into new jurisdictions, or adjust fee structures.

Below you’ll find a curated list of articles that break down every facet of this landscape. We cover real‑world examples of token service providers who secured their VASP and exchange licenses, deep dives into country‑specific capital rules, step‑by‑step guides for filing AML/KYC paperwork, and analyses of how a financial services license can amplify your business reach. Whether you’re a startup looking for your first permit or an established exchange polishing its compliance program, the posts here give you actionable insights, practical checklists, and the latest regulatory updates. Dive in to see how each piece fits together and to get the tools you need to stay ahead of the curve.

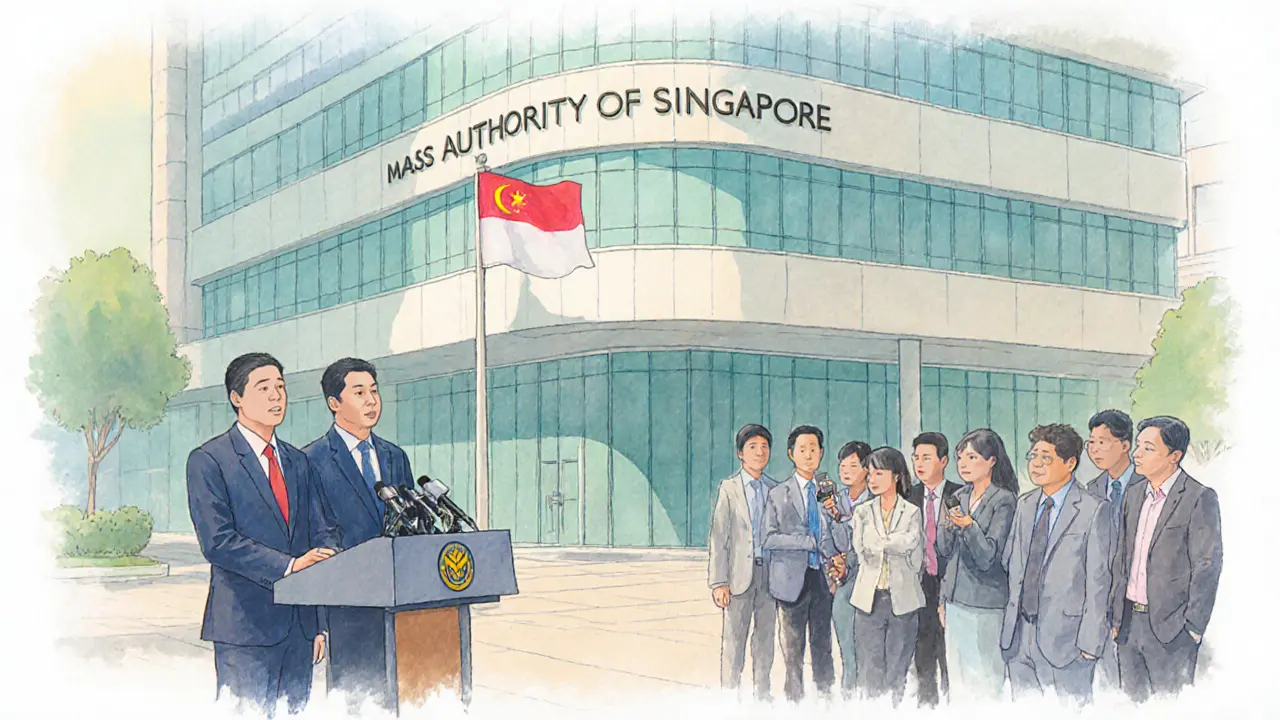

MAS tightens Singapore's crypto rules, limiting new DTSP licences, enforcing AML/CFT standards, Travel Rule, and hefty penalties after a June 30, 2025 deadline.

Jonathan Jennings Oct 13, 2025