Iraqi CBDC: A Straightforward Overview

When talking about Iraqi CBDC, the digital version of the Iraqi dinar issued by the central bank. Also known as Iraq's digital currency, it aims to bring faster, cheaper payments to citizens and businesses. In plain terms, the Iraqi CBDC is a government‑backed token that lives on a computer network instead of paper notes. It encompasses everyday transactions, from buying groceries to paying taxes, while keeping a clear audit trail. The move follows a global trend where nations create Central Bank Digital Currency, a broader class of sovereign digital money that promises better financial stability. By digitizing the dinar, Iraq hopes to cut cash‑handling costs, fight money‑laundering, and give people in remote areas easier access to banking services.

Key Technologies and Regulators

The backbone of any modern CBDC is blockchain, a secure ledger that records each transaction in an immutable way. This technology requires robust consensus mechanisms to prevent double‑spending and ensure that every digital dinar is as trustworthy as a physical note. The Iraq Monetary Authority (IMA) is the regulatory body steering the project, setting rules for privacy, anti‑fraud measures, and integration with existing banks. Their work influences how quickly the Iraqi CBDC can roll out and how many services will link to it, from mobile wallets to point‑of‑sale terminals. The collaboration between IMA and tech firms also brings in real‑time settlement capabilities, meaning merchants get paid instantly instead of waiting days for bank clears.

Why should you care? Financial inclusion is the biggest driver behind the Iraqi CBDC. Over a third of Iraq’s population lacks a traditional bank account, and digital wallets can bridge that gap with just a smartphone. Faster payments also help small businesses stay afloat, especially in regions where cash shortages are common. Cross‑border remittances, a lifeline for many families, become cheaper and quicker when both sender and receiver use the same digital standard. In short, the Iraqi CBDC enables a more connected economy, improves transparency, and reduces the costs of moving money. Below you’ll find a hand‑picked collection of articles that dig deeper into the tech, the policy landscape, and real‑world use cases—so you can see exactly how this digital dinar could change everyday life.

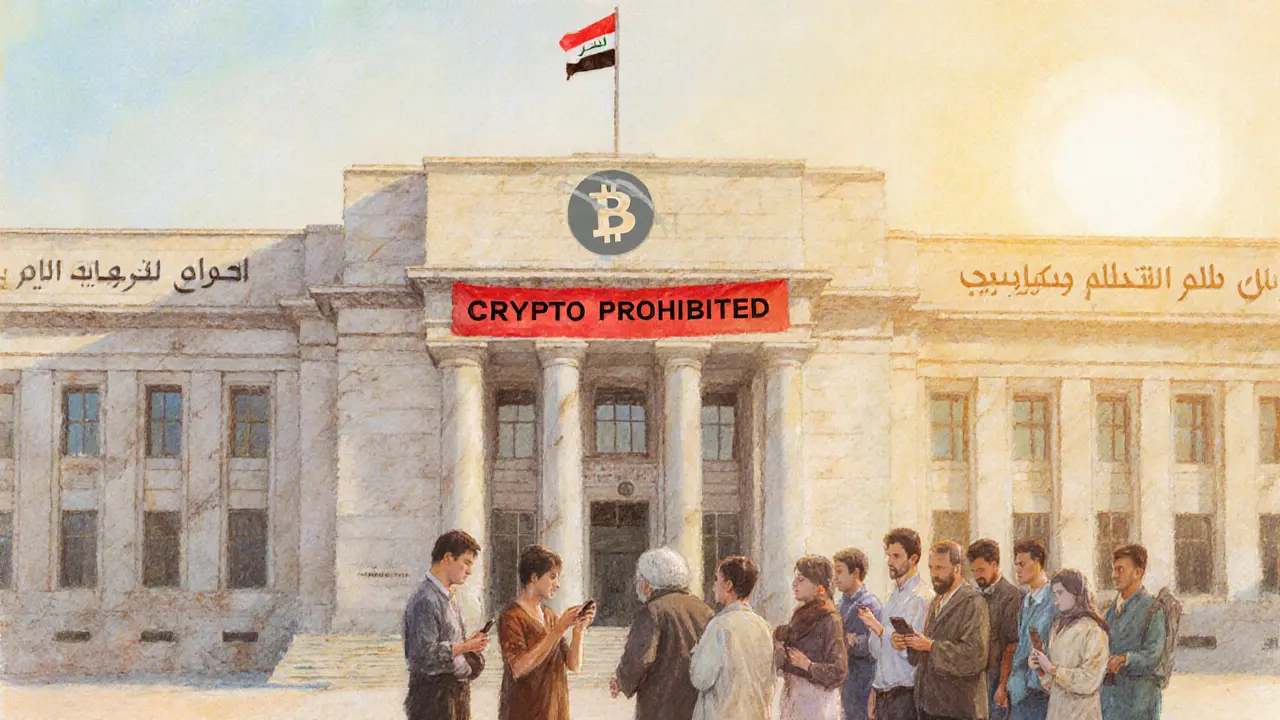

Explore Iraq's total cryptocurrency ban, its legal framework, impact on banks and users, and the country's move toward a state‑run CBDC, with expert analysis and practical takeaways.

Jonathan Jennings Aug 26, 2025