QCB circular 6: What It Means for Crypto and Finance in Qatar

When navigating QCB circular 6, the sixth regulatory circular issued by the Qatar Central Bank that sets rules for digital asset activities in the country. Also known as Qatar Central Bank Circular No.6, it defines how banks, exchanges, and investors must handle crypto‑related services. Understanding this circular is the first step to staying compliant and avoiding costly penalties.

Key Players and Concepts Behind the Circular

The Qatar Central Bank, Qatar’s principal monetary authority authored the document to align local practice with global Anti‑Money‑Laundering (AML), regulations that prevent illicit finance standards. It also introduces a broader digital asset regulation, a framework covering token issuance, custodial services, and market surveillance. Together these entities form a safety net that protects investors while giving the sector clear operating rules.

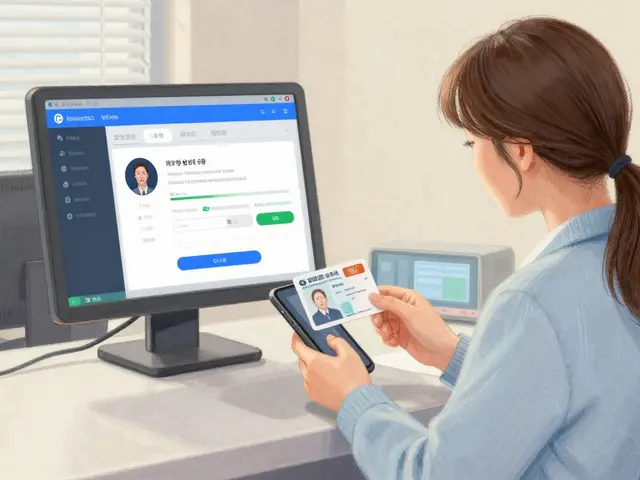

At its core, QCB circular 6 requires licensed financial institutions to register any crypto‑related activity with the regulator, implement robust KYC procedures, and maintain transaction logs for at least five years. The circular also mandates real‑time reporting of large transfers and imposes capital adequacy buffers for firms offering custodial services. These attributes aim to boost transparency and reduce fraud risk.

For banks, the circular reshapes product development. Traditional banks now need dedicated compliance teams to assess token offerings, evaluate smart‑contract risk, and update IT systems for blockchain data capture. Crypto exchanges operating in Qatar must obtain a specific license, undergo periodic audits, and provide proof of AML controls. Investors, on the other hand, gain greater confidence knowing that their assets are overseen by a clear regulatory regime.

Practical compliance steps start with a gap analysis: compare existing policies against the circular’s checklist, upgrade KYC tools to flag high‑risk wallets, and train staff on blockchain fundamentals. Next, file the required registration with the Qatar Central Bank, set up a dedicated AML monitoring system, and document all custody procedures. Ongoing monitoring includes quarterly reports to the regulator and internal reviews to ensure that any new token launches meet the stipulated risk‑assessment standards.

Our collection of articles below touches on many of these themes—from Iraq’s crypto ban and the rise of CBDCs to tax implications of airdrops and the latest exchange reviews. Together they give you a rounded view of how QCB circular 6 fits into the global push for tighter crypto oversight. Dive in to see how these regulations play out across borders and what actionable insights you can apply right now.

A clear, conversational guide to Qatar's institutional cryptocurrency ban, its legal framework, enforcement, and impact on banks and fintech firms, plus a GCC comparison and FAQs.

Jonathan Jennings Oct 22, 2024