Rabbit Token: What It Is and Why It Matters

When you hear about Rabbit token, a community‑driven cryptocurrency that aims to combine fast transaction speeds with low fees. Also known as RAB, it is built on a scalable blockchain and often shows up in airdrop campaigns and DeFi projects. Airdrop, a distribution method where free tokens are given to eligible users is a common way the Rabbit token reaches new holders, while Tokenomics, the economics behind a token, including supply, allocation, and incentive structures determines how the token’s value can grow over time. Finally, Crypto exchange, platforms where users can trade digital assets play a crucial role in providing liquidity and price discovery for the Rabbit token.

Key Aspects of Rabbit Token

Rabbit token encompasses three core pillars: airdrop mechanics, tokenomics design, and exchange accessibility. The airdrop mechanic requires participants to complete simple tasks—such as joining a Telegram group or holding a minimum balance—so the token can quickly expand its community. Tokenomics influences the token’s scarcity by capping total supply and allocating portions to developers, liquidity pools, and community rewards. Meanwhile, crypto exchanges enable users to buy, sell, and swap Rabbit token against major coins, ensuring that price signals remain transparent.

Beyond distribution, the Rabbit token often ties into blockchain validator roles. Validators support the underlying network by staking tokens and confirming transactions, which in turn can earn additional Rabbit token rewards. This staking dynamic creates a feedback loop: the more validators lock up, the stronger the network security, and the higher the potential token appreciation. Our collection includes a step‑by‑step guide on becoming a validator in 2025, so you can see exactly how Rabbit token fits into that ecosystem.

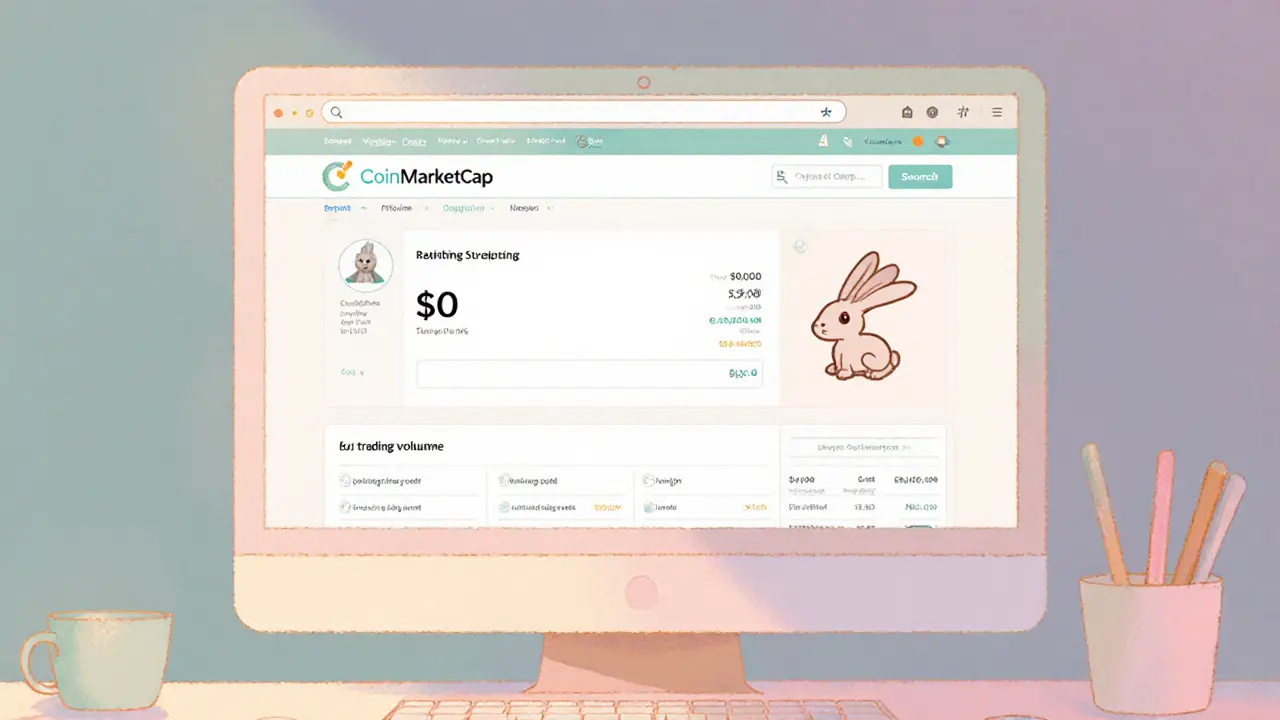

Market watchers also keep an eye on how exchange listings affect Rabbit token’s liquidity. When a reputable exchange adds the token, it usually triggers a spike in trading volume and draws attention from investors looking for new opportunities. Conversely, delistings can hurt price stability, which is why understanding exchange fees, security measures, and compliance requirements is essential before placing any trade.

All of these pieces—airdrop eligibility, tokenomics fundamentals, validator incentives, and exchange dynamics—shape the Rabbit token’s overall health. Below you’ll find a curated set of articles that break down each element in plain language, from airdrop claim instructions to deep‑dive validator tutorials and exchange reviews. Dive in to get the practical knowledge you need to navigate the Rabbit token landscape with confidence.

Explore the uncertain status of the RBT (Rabbit Token) airdrop, its CoinMarketCap listing, and how to safely verify any future token giveaways.

Jonathan Jennings Oct 8, 2025