Synthetic Assets: On‑Chain Replicas of Real‑World Value

When working with synthetic assets, digital constructs that mirror the price movements of real‑world assets without holding the underlying token. Also known as synthetic tokens, they let users gain exposure to stocks, commodities, or fiat currencies directly on a blockchain. In plain terms, you’re buying a contract that behaves like the real thing, but you never need to store the actual stock or gold.

One piece that makes this possible is price oracles, services that feed external market data to smart contracts in a trustworthy way. Without reliable oracles, a synthetic asset would have no way to know whether the price of Apple stock has risen or the gold spot has slipped. Most platforms rely on decentralized oracle networks that aggregate multiple data sources, reducing the chance of a single point of failure.

Another key concept is derivatives, financial contracts whose value is derived from an underlying asset. Synthetic assets are essentially on‑chain derivatives: they derive their price from real‑world markets while living on a blockchain. This relationship means that the mechanics of traditional futures, options, and swaps often map directly onto synthetic token designs, letting developers reuse proven financial logic in a decentralized setting.

Why DeFi Platforms Matter for Synthetic Assets

Enter DeFi platforms, protocols that provide financial services without intermediaries. These ecosystems supply the smart‑contract infrastructure, liquidity pools, and governance tools needed to mint, trade, and settle synthetic assets. By integrating with lending, staking, and automated market makers, DeFi platforms turn a simple price‑tracking contract into a full‑featured trading experience where you can collateralize, earn yield, or hedge risk.

Real‑world use cases keep expanding. Investors can access foreign equities like Tesla or Amazon without a brokerage account, traders can hedge commodity exposure with synthetic oil tokens, and gamers can lock in the price of in‑game items using synthetic NFTs. The flexibility comes from the fact that the underlying asset never leaves its native market – the synthetic token just reflects its price.

Of course, there are risks. oracle manipulation, smart‑contract bugs, and liquidity shortfalls can cause a synthetic asset to deviate from its target price. Regulatory uncertainty also looms, especially when synthetic tokens mimic regulated securities. Users should always check the collateralization ratio, audit reports, and community governance before committing capital.

Below you’ll find a curated collection of articles that dive deeper into each of these angles – from how price oracles secure data to the tax implications of holding synthetic tokens. Whether you’re a beginner curious about on‑chain replicas or a seasoned trader looking for new hedging tools, the pieces ahead will give you practical insights and actionable steps to navigate the world of synthetic assets with confidence.

Discover why there's no official Mobius Finance airdrop, learn MOT token distribution, current price, how to buy safely, and avoid scams.

Jonathan Jennings Aug 4, 2025

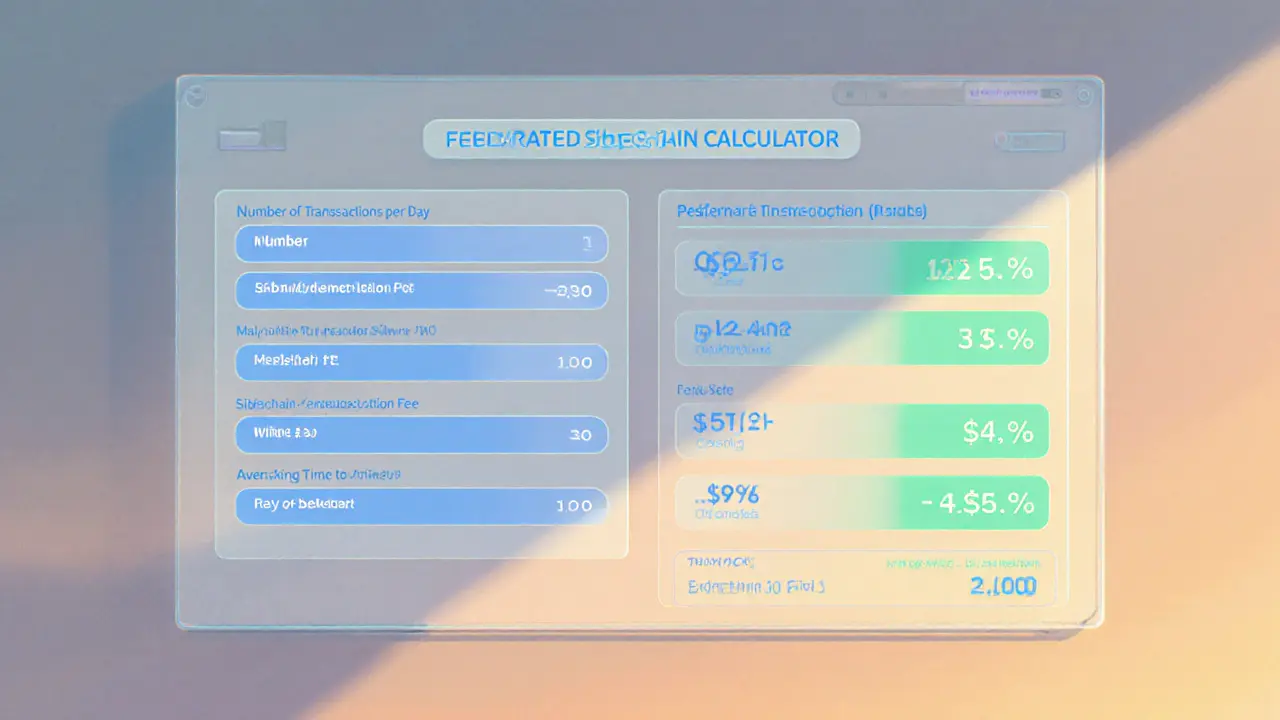

Learn how federated sidechains let Bitcoin scale, enable fast low‑cost transactions, and support smart contracts while staying linked to the main chain.

Jonathan Jennings May 16, 2025