Token Creation Platform: Your Gateway to Launching Crypto Tokens

When working with Token Creation Platform, a web‑based service that lets anyone design, mint, and deploy a cryptocurrency token on a blockchain. Also known as token generator, it streamlines the token launch process for creators of all skill levels. Smart contract, self‑executing code that defines a token’s rules on the blockchain powers every token you create, while Tokenomics, the economic design that determines supply, distribution and incentives shapes how users value and use the token. Finally, a Decentralized exchange, a peer‑to‑peer trading platform without a central authority is where your token finds liquidity and community traction.

Token Creation Platform encompasses a range of services: token templates, automated minting, and built‑in verification tools. It requires a clear tokenomics plan, because without a solid supply model the token can quickly lose credibility. The platform also integrates with decentralized exchanges, which influence token adoption by offering instant trading pairs. In practice, you’ll select a blockchain (Ethereum, BNB Smart Chain, or others), choose a contract standard (ERC‑20, BEP‑20), set total supply, and define custom features like staking or burn mechanisms.

Key Steps From Idea to Market

First, draft your token’s purpose. Whether you’re tokenizing yachts like OSEAN, rewarding creators on Fantrie, or building a utility token for a DeFi protocol, the use‑case guides all later decisions. Second, plug your concept into a token creation platform; most providers let you fill out a simple form and generate the contract in minutes. Third, run a security audit – many platforms partner with third‑party auditors to spot vulnerabilities before you publish the contract. Fourth, list the token on a decentralized exchange; the platform often offers one‑click listing bundles that handle liquidity pool creation and initial pricing.

Security and compliance are not optional. A recent airdrop scam reminded users that any token can be spoofed if the underlying smart contract is poorly written. Therefore, reputable token creation platforms expose the contract source code on public explorers, enable ownership renouncement, and provide a built‑in anti‑phishing guide. On the regulatory side, understanding local crypto rules (like Iraq’s ban or the UAE’s licensing framework) helps you avoid legal hiccups when you promote the token globally.

Beyond launch, the platform’s analytics dashboard tracks real‑time metrics: holder distribution, transaction volume, and token price on major DEXs. These insights let you tweak tokenomics—adjust minting rates, add burn functions, or launch staking rewards—to keep the community engaged. For example, the REV3AL (REV3L) token uses staking to reward early adopters, while the Fautor (FTR) token ties rewards to fan activity on its creator economy.

When you compare platforms, look for features like multi‑chain support, low gas fee options, and community templates. Some platforms even bundle airdrop tools, letting you reward early users with a fair‑market‑value snapshot—useful for projects like Artify’s ART token. Others focus on NFT‑linked tokens, similar to Jade Currency’s gem‑staking model. Choose the service that aligns with your token’s niche and growth strategy.

All of these pieces—smart contracts, tokenomics, DEX integration, security audits, and regulatory awareness—form a cohesive ecosystem. By mastering each, you turn a simple idea into a market‑ready crypto asset. Below you’ll find guides that walk you through specific token examples, airdrop mechanics, exchange reviews, and the latest regulatory news, giving you a full toolbox to launch and grow your own token.

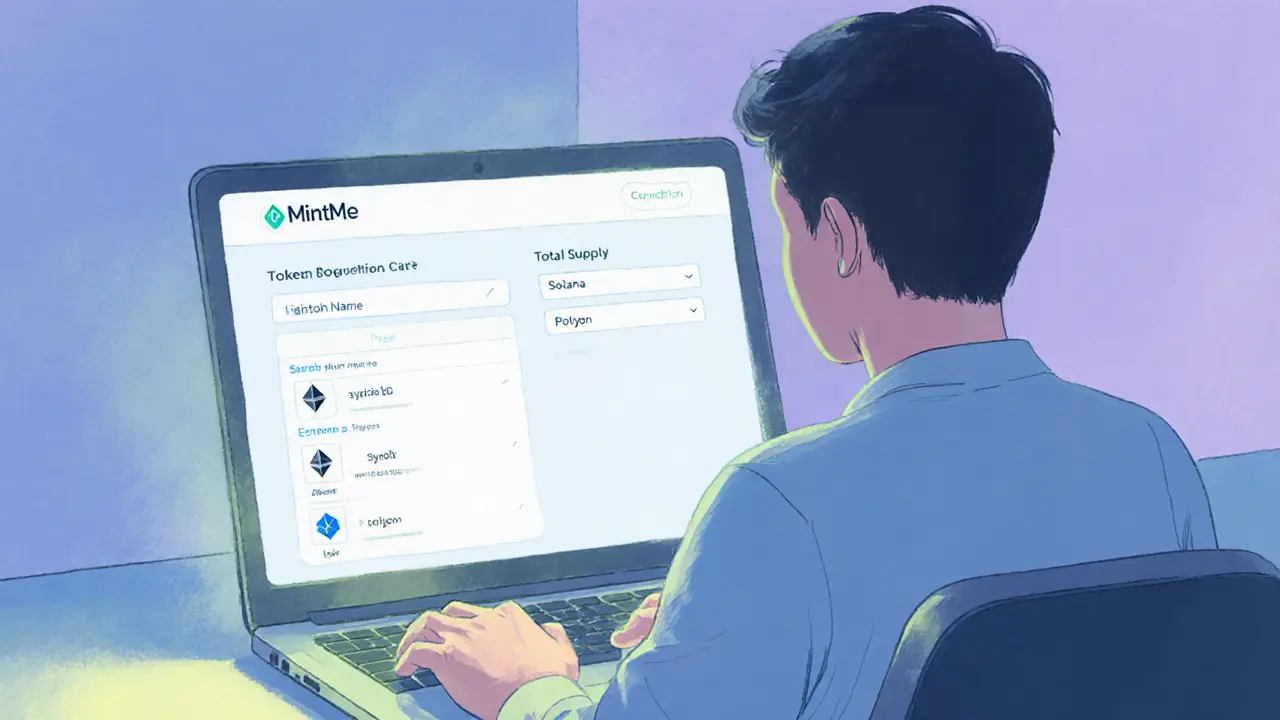

An in‑depth review of MintMe crypto exchange covering token creation, multi‑chain support, social features, fees, security, and how it compares to major exchanges.

Jonathan Jennings Apr 2, 2025