UAE Crypto Hub – Your Gateway to the Middle East’s Blockchain Boom

UAE crypto hub, the fast‑growing ecosystem of blockchain projects, exchanges, and investors based in the United Arab Emirates. UAE crypto scene If you’re hunting for the latest on the UAE crypto hub, you’ve landed in the right spot. This space pulls together everything from government‑backed token projects to home‑grown exchange platforms. Think of it as a single hub where regulation, technology, and market demand intersect, shaping how digital assets move across the Gulf. Below you’ll see why the UAE has become a magnet for both global crypto firms and local innovators.

Regulation and Legal Framework

crypto regulation in the UAE, the set of laws, licensing requirements, and anti‑money‑laundering rules that govern digital assets across the Emirates. UAE digital asset law The government’s approach is a key pillar of the hub. The Central Bank of the UAE and the Financial Services Regulatory Authority have issued clear licensing pathways for exchanges and token issuers. That clarity reduces risk for investors and encourages startups to launch compliant projects. For example, the Dubai International Financial Centre (DIFC) now offers a sandbox where DeFi protocols can test services under supervision. This regulatory environment not only protects users but also fuels a steady inflow of capital, which you’ll notice reflected in the market‑driven articles below.

crypto exchanges in the UAE, platforms that enable buying, selling, and trading of digital assets, often with local fiat support and Arabic language interfaces. UAE crypto platforms With regulation in place, exchange operators have flourished. Local players like BitOasis and emerging Dubai‑based services now compete with global giants such as Binance and Coinbase, offering lower fees, faster KYC, and tailored customer support. These exchanges act as the transaction backbone of the hub, feeding liquidity into DeFi protocols and bridging investors to token sales. Their growth also drives ancillary services—custody, analytics, and compliance tools—that further cement the UAE’s position as a regional crypto gateway.

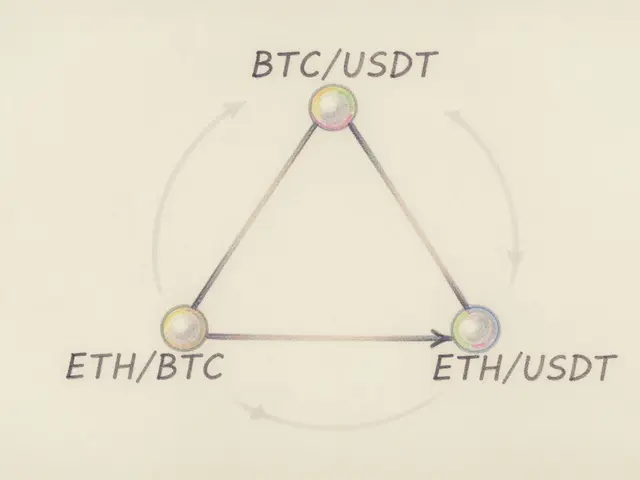

DeFi in the UAE, decentralized finance projects that provide lending, staking, and yield‑generation services without traditional intermediaries. UAE decentralized finance Decentralized finance is the engine that keeps the hub humming. Projects built on Binance Smart Chain, Polygon, and the emerging Aurora network are finding local backers who value high‑yield opportunities and borderless access. The regulatory sandbox mentioned earlier lets these protocols test compliance‑by‑design models, which in turn attracts institutional interest. When you read about staking rewards, tokenomics, or cross‑chain bridges in the articles below, you’ll see how DeFi shapes investor behavior and creates new pathways for capital within the UAE crypto hub.

All of these pieces—clear regulation, vibrant exchanges, and thriving DeFi—form a self‑reinforcing loop that makes the UAE a standout market in the global crypto landscape. The collection of posts below covers everything from new token guides and airdrop instructions to deep dives on regional policy shifts and technical tutorials. Whether you’re a casual trader, a developer, or an investor looking for the next opportunity, you’ll find practical insights that reflect the real‑world dynamics of the UAE crypto hub.

Explore why the UAE has become a top global crypto hub, covering its regulatory framework, licensing steps, tax benefits, and how major exchanges are thriving there.

Jonathan Jennings Oct 24, 2024