VALR Trading: Your Gateway to South African Crypto Markets

When working with VALR trading, the act of buying, selling, and managing digital assets on South Africa’s leading exchange, VALR. Also known as VALR platform, it offers spot markets, fiat on‑ramps, and a range of order types for beginners and pros alike. Cryptocurrency exchange is a digital marketplace that matches buyers with sellers of crypto assets serves as the backbone for this activity, while trading fees are the costs charged per transaction, usually expressed as a percentage of trade value directly affect net returns. Order types define how a trade is executed, ranging from market orders that fill instantly to limit orders that wait for a specific price shape strategy, and understanding them is essential for risk management. In short, VALR trading encompasses spot buying, fee optimization, and order‑type mastery, all within a South African regulatory context.

Key Concepts that Power Successful VALR Trading

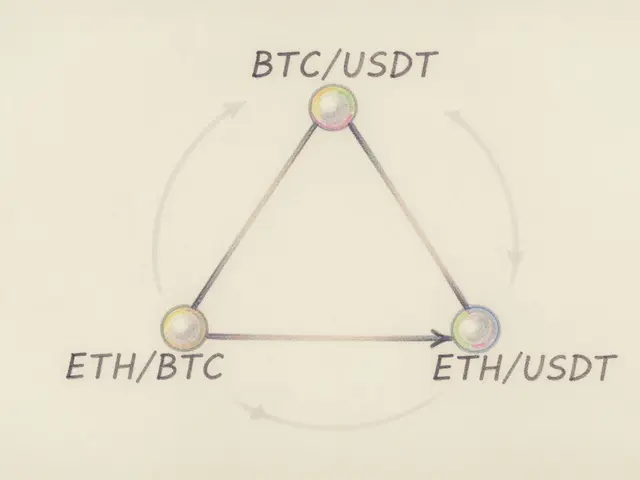

The South African crypto market has grown fast, and VALR sits at the intersection of local fiat liquidity and global digital assets. Because South Africa crypto market features high demand for ZAR‑based crypto pairs and a relatively young trader demographic, exchanges like VALR prioritize low‑cost ZAR deposits and quick withdrawals. This environment pushes traders to compare fee schedules: maker fees reward liquidity provision, while taker fees apply to instant market orders. Knowing the difference helps you decide whether to place limit orders that earn rebates or market orders that guarantee execution. Another critical factor is security; VALR employs cold storage for the bulk of user funds, multi‑factor authentication, and regular audits—attributes shared by most reputable crypto exchanges that prioritize user asset safety. Finally, the platform’s API access lets advanced users automate strategies, linking directly back to the importance of mastering order types such as stop‑loss, take‑profit, and trailing stops to protect positions in volatile markets.

Below you’ll find a curated list of articles that dive deep into each of these areas. From a step‑by‑step guide on how to reduce your trading fees on VALR, to real‑world examples of using advanced order types for risk control, the collection covers practical tips, common pitfalls, and up‑to‑date market data. Whether you’re just opening your first ZAR wallet or you’re looking to fine‑tune a high‑frequency strategy, the posts below give you the insight you need to trade smarter on VALR.

An in‑depth 2025 review of VALR crypto exchange covering fees, security, features, user experience and how it stacks up against global rivals.

Jonathan Jennings Mar 14, 2025