Crypto Compliance: What It Means and Why It Matters for Every Trader

When you hear crypto compliance, the set of rules and checks crypto businesses must follow to operate legally under government oversight. Also known as crypto regulation, it's not something that happens behind closed doors—it directly affects whether you can deposit fiat, withdraw funds, or even sign up for an exchange. If you’ve ever been asked for a photo of your ID or a utility bill to use Binance, Kraken, or Biteeu, that’s crypto compliance in action. It’s not optional. It’s the backbone of any platform that wants to stay open and avoid shutdowns by regulators.

Behind crypto compliance are two big players: KYC (Know Your Customer), the process of verifying your identity before letting you trade. Also known as crypto identity verification, it’s how exchanges stop fraudsters, money launderers, and scammers from using their platforms. And then there’s AML (Anti-Money Laundering), the rules that force exchanges to track suspicious transactions and report them to authorities. These aren’t just buzzwords—they’re legal requirements enforced by the FATF, the SEC, and EU financial watchdogs. If a platform skips KYC, like Web3.World or Crypcore, it’s a red flag. No compliance means no legal protection, no recourse if funds disappear, and no future. That’s why platforms like Biteeu and TRIV highlight their licenses—it’s not marketing, it’s survival.

Crypto compliance doesn’t just protect regulators. It protects you. When an exchange follows these rules, your funds are less likely to vanish overnight. It’s why THDax is a scam and Biteeu isn’t. One ignores compliance; the other embraces it. Even decentralized exchanges like SundaeSwap and Cube Exchange have to deal with it—sometimes by refusing fiat, sometimes by limiting users from certain countries. There’s no perfect system, but ignoring compliance is a fast track to losing everything.

What you’ll find below are real-world examples of how crypto compliance shapes trading, exchange safety, and even airdrop eligibility. Some posts show you how to pass KYC without getting rejected. Others expose platforms that pretend compliance doesn’t matter—and what happens when they get caught. This isn’t theory. It’s what’s happening right now, on the exchanges you use, in the wallets you hold, and in the rules that decide whether you can trade or not.

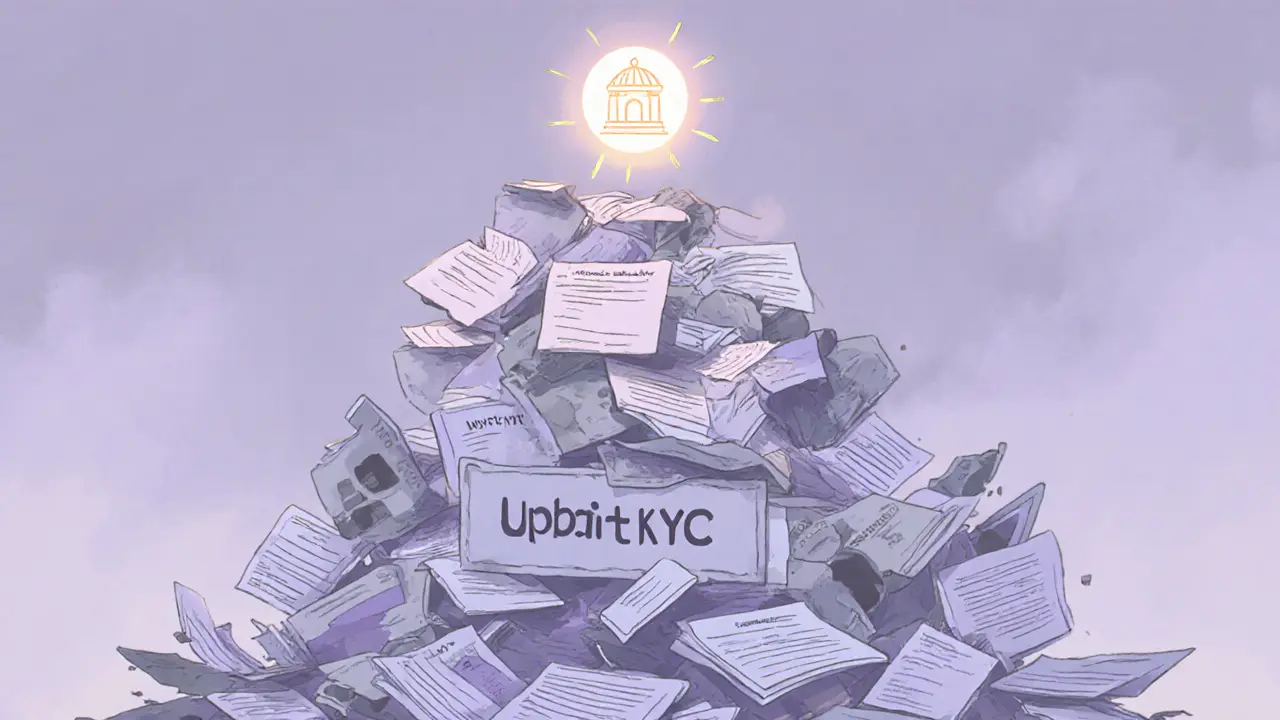

Upbit faced over 500,000 KYC violations, exposing systemic failures in South Korea’s largest crypto exchange. This case reshaped crypto regulation in Asia and set new global standards for compliance.

Jonathan Jennings Nov 26, 2025

OFAC cryptocurrency sanctions are now enforceable, with fines up to $750,000 for non-compliance. Learn what crypto businesses must do in 2025 to avoid penalties, block sanctioned wallets, and build a real compliance program.

Jonathan Jennings Nov 13, 2025