What Are Block Rewards in Cryptocurrency? How Miners and Validators Get Paid

When you hear about Bitcoin or Ethereum being mined or staked, you might wonder: who gets paid, and how? The answer lies in something called block rewards. These are the payments miners or validators receive for keeping the blockchain running. Without them, the whole system would collapse. Block rewards aren’t just a perk-they’re the engine that keeps cryptocurrency secure, functional, and decentralized.

What Exactly Is a Block Reward?

A block reward is the total compensation given to a miner (in proof-of-work systems) or validator (in proof-of-stake systems) for successfully adding a new block to the blockchain. It’s not just one thing-it’s made up of two parts:

- The block subsidy: New coins created out of thin air and awarded to the miner/validator.

- Transaction fees: Small payments users include when they send crypto, which go to whoever adds their transaction to a block.

Think of it like this: the block subsidy is the paycheck, and the transaction fees are the tips. Both matter, but they work differently depending on the cryptocurrency.

How Block Rewards Keep the Network Safe

Block rewards exist for one main reason: incentive. Running a blockchain isn’t free. Miners use powerful computers that eat electricity. Validators lock up thousands of dollars in crypto. Without rewards, nobody would bother.

Here’s how it works in practice:

- When someone sends Bitcoin, the network needs to verify it’s real and hasn’t been spent before.

- Miners compete to solve a complex math puzzle. The first one to solve it gets to bundle a group of transactions into a block.

- As a reward, they get newly minted Bitcoin and all the fees from those transactions.

This system makes it expensive and risky to attack the network. To fake a transaction or double-spend, you’d need to control over half the mining power-a task so costly that it’s not worth it. The reward system turns security into a profitable business.

Bitcoin’s Block Reward: The Halving Engine

Bitcoin was the first to use block rewards, and it still sets the standard. When Bitcoin launched in 2009, the reward was 50 BTC per block. But Satoshi Nakamoto built in a twist: every 210,000 blocks (roughly every four years), the reward cuts in half. This is called a halving.

Here’s what happened so far:

- 2009: 50 BTC per block

- 2012: 25 BTC (first halving)

- 2016: 12.5 BTC

- 2020: 6.25 BTC

- April 20, 2024: 3.125 BTC (current reward)

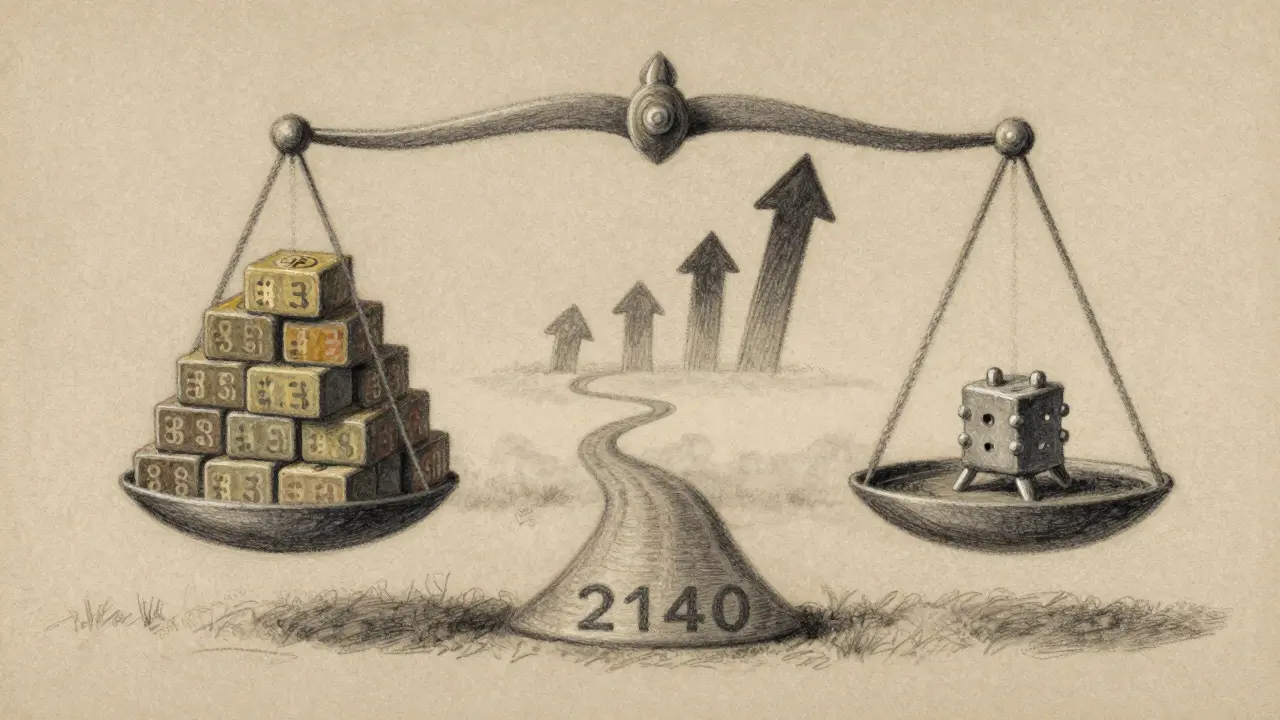

Next halving? Around August 2028, dropping to 1.5625 BTC. The final coin will be mined around 2140, when the 21 million BTC limit is reached.

Why does this matter? Because it controls supply. Unlike governments printing money, Bitcoin’s supply is fixed and predictable. This scarcity is what makes it feel like digital gold.

Transaction Fees: The Future of Mining Income

Right now, Bitcoin miners still get about 98% of their income from the block subsidy. But that’s changing fast.

As block rewards shrink, transaction fees become more important. Right now, fees are low-around $0.50 per transaction on average. But if Bitcoin is to stay secure after 2140, fees will need to rise dramatically. Experts estimate miners will need $50-$100 per block in fees to match today’s security budget. That could mean $15-25 per transaction if usage stays the same.

That’s a big jump. Would users pay that? Maybe. If Bitcoin becomes a settlement layer for big transfers (like banks using it for cross-border payments), fees could be worth it. But if everyday users still send small amounts, the system could struggle.

Ethereum’s Shift: From Mining to Staking

Ethereum didn’t follow Bitcoin’s path. In September 2022, it switched from proof-of-work to proof-of-stake in an event called The Merge. This changed everything about rewards.

Before The Merge:

- Miners got 2 ETH per block + transaction fees.

- It used massive amounts of electricity.

After The Merge:

- Validators stake ETH to participate. No mining hardware needed.

- Rewards vary based on how much ETH is staked across the network.

- Base reward formula: R = B × √(N), where B is a fixed factor and N is total staked ETH.

Now, validators earn roughly 3-5% annual return on their staked ETH. But here’s the twist: Ethereum burns most transaction fees (via EIP-1559). That means the total supply of ETH can actually shrink if fees are high enough. Some months, ETH becomes deflationary.

Validators still get priority fees (tips) and MEV (Maximal Extractable Value) rewards-sometimes more than the base reward. In Q1 2024, transaction fees made up 65-80% of validator income. Ethereum’s model is less about creating new coins and more about redistributing fees.

How Other Coins Handle Rewards

Not every cryptocurrency is like Bitcoin or Ethereum.

- Litecoin: Uses the same halving model as Bitcoin, but with 84 million total coins and faster blocks (every 2.5 minutes). It halved in 2023, dropping from 12.5 to 6.25 LTC per block.

- Bitcoin Cash: Also follows halving, but with larger block sizes. It’s more about transaction volume than scarcity.

- Cardano: Uses a fixed 0.3% annual inflation rate. Rewards are distributed from a treasury system, not just block subsidies.

- Solana: Starts with 8% annual inflation, dropping to 1.5% over 10 years. It’s designed to phase out over time.

- Monero: After its 2022 halving, it introduced a “tail emission” of 0.6 XMR per minute forever. This ensures miners always have a reason to keep securing the network.

Each design reflects different goals: some want scarcity, others want sustainability, and some just want to keep things running.

Who Gets Paid? The Real Players

It’s not just individuals mining at home anymore.

In 2024, 37% of Bitcoin blocks are mined by corporate entities-mining farms, hedge funds, and even publicly traded companies. The rest come from mining pools like F2Pool and Antpool, which let smaller miners combine their power and split rewards.

For Ethereum validators, the barrier is higher: you need 32 ETH to run a full validator node. At $3,200 per ETH, that’s over $100,000. Most people use staking services like Coinbase or Lido, which pool ETH from thousands of users and distribute rewards proportionally.

Hardware matters too. The latest Bitcoin miner, Bitmain’s Antminer S21 Hydro, costs $12,500 and uses 21.5 joules per terahash. It’s not a hobby-it’s a capital-intensive business.

Why Block Rewards Matter for the Whole Economy

Block rewards aren’t just technical details. They shape markets.

- In 2023, the global block reward market was worth $11.7 billion. Bitcoin alone accounted for $9.2 billion.

- Bitcoin mining used 121.89 terawatt-hours of electricity in 2023-more than the entire country of Argentina.

- The EU now taxes block rewards as income when received. The IRS treats them the same way.

- Miners calculate profitability based on block reward size, electricity cost, and hardware efficiency. A 2023 study found 78% of mining operations use block reward as their top factor in deciding where to operate.

There’s also a big debate: is Bitcoin’s model sustainable? Some experts, like Dr. David Easley from Cornell, say the halving creates a stable, predictable monetary policy. Others, like Dr. Emin Gün Sirer, warn that as mining becomes centralized around big players, decentralization suffers.

Ethereum’s approach avoids the energy waste, but introduces new risks: if too many people stake, rewards drop. If too few stake, security weakens. It’s a balancing act.

What’s Next? The Fee Market Transition

The biggest question for Bitcoin is: what happens when the block subsidy hits zero?

Right now, miners rely on subsidies. In 2030, they’ll rely on fees. Will users pay more? Will Bitcoin become a high-value settlement layer? Will new technologies like Layer 2 (Lightning Network) reduce on-chain fees?

Some think Bitcoin will become like a gold-backed payment network-used only for big, infrequent transfers. Others believe it’ll evolve into a global settlement layer, with fees rising naturally as adoption grows.

Ethereum is already halfway there. Validators earn more from fees than from new issuance. That’s the future: rewards tied to real usage, not artificial inflation.

Final Thoughts

Block rewards are the invisible hand that keeps cryptocurrency alive. They’re not just payments-they’re a contract between users, miners, and validators. They ensure security, control supply, and align incentives.

Bitcoin’s halving is a brilliant economic experiment. Ethereum’s fee-based model is a smarter, greener evolution. Other coins are testing their own versions.

One thing is clear: whoever controls the block reward controls the future of the network. And that’s why understanding block rewards isn’t just for tech fans-it’s essential for anyone trying to make sense of crypto’s long-term value.

What is the current Bitcoin block reward?

As of April 20, 2024, the Bitcoin block reward is 3.125 BTC. This followed the fourth halving event, which cut the reward in half from 6.25 BTC. The next halving is expected in August 2028, reducing it to 1.5625 BTC.

How do Ethereum validators earn rewards?

Ethereum validators earn rewards through staking ETH. They receive a base reward based on network participation, calculated using the formula R = B × √(N), where B is a fixed factor and N is the total staked ETH. They also earn priority fees and MEV (Maximal Extractable Value) from transactions. Since The Merge in 2022, transaction fees make up 65-80% of validator income.

Why does Bitcoin have halvings?

Bitcoin’s halvings were designed by Satoshi Nakamoto to control the rate at which new coins enter circulation. By cutting the block reward in half every 210,000 blocks (roughly every four years), Bitcoin ensures a predictable, decreasing supply. This mimics the scarcity of precious metals like gold and prevents inflation.

Do all cryptocurrencies use block rewards?

Most do, but not all the same way. Proof-of-work coins like Bitcoin and Litecoin use block subsidies + fees. Proof-of-stake coins like Ethereum and Cardano use staking rewards, often with inflation or fee-based models. Some, like Monero, use a permanent tail emission to ensure long-term miner incentives.

Will block rewards disappear?

In Bitcoin, the block subsidy will disappear around 2140 when the 21 million coin limit is reached. After that, miners will rely entirely on transaction fees. Other networks like Ethereum never planned for a zero-supply model-they’re already transitioning to fee-based rewards. So while the subsidy may vanish, the incentive to validate blocks won’t.

Block rewards are the heartbeat of crypto. No reward, no network. Simple as that. Miners don't do it for fun, they do it because they get paid. Period.

You say block rewards keep the network secure? That's a fairy tale. The reality is that 37% of Bitcoin mining is controlled by corporate farms. This isn't decentralization-it's a cartel with ASICs. And you call this innovation?

I just want to say-WHOA. The Merge was a cinematic masterpiece. Ethereum didn't just upgrade, it ascended. Validators glowing like digital monks in a blockchain temple, fees burning like sacred fire. This isn't code. This is poetry written in SHA-256.

i just read this and like?? why do people even care about halvings?? like its not like bitcoin is gonna make me rich or anything?? i mean im still paying 300 bucks for rent and my dog needs a vet visit lol

You think the block reward system is real? Think again. The entire crypto economy is a Fed-backed ponzi scheme. The halvings? A distraction. The real game is who controls the mining rigs. Hint: It’s not you. It’s never been you.

Let me unpack this for you. The entire premise of block rewards is built on a foundational assumption: that humans are rational actors motivated solely by economic incentives. But what if we're not? What if people mine because they believe in the myth? What if the reward is symbolic, not financial? The blockchain is a cathedral built on collective delusion-and we're all just the monks chanting in the aisles.

It's interesting how we frame this as a technical system, but really it's about trust. The reward isn't just coins-it's the promise that someone else will keep the lights on. Maybe that's the real innovation: a system where strangers believe in each other without a contract.

The fact that you're even talking about Bitcoin’s 'scarcity' as a virtue shows how deeply you’ve drunk the Kool-Aid. Scarcity doesn’t create value. Utility does. And right now, Bitcoin’s utility is 'holding value in a world where governments print money.' Which is fine. But don’t pretend it’s a revolution.

India has better infrastructure than the US for staking. We have 1.4 billion people and 70% internet penetration. Your block reward model is outdated. We are building decentralized validators on solar-powered edge nodes. You are still stuck in 2015.

The mathematical elegance of R = B × √(N) is non-trivial. It introduces a non-linear incentive structure that prevents centralization while maintaining participation. This is not merely a consensus mechanism-it is a sociotechnical equilibrium. The elegance is in the equilibrium.

I love how crypto lets ordinary people be part of something bigger. I staked 0.5 ETH through Lido and got paid every week. It felt like I was helping build the future. Not because I'm rich, but because I showed up. That’s powerful.

Wait-so if transaction fees need to rise to $50-$100 per block to sustain Bitcoin after 2140, and there are roughly 144 blocks per day, that’s $7,200-$14,400 per day in fees… which means, per transaction, if we assume 1,000 tx/day, that’s $7.20-$14.40 per tx? But what if volume increases? Then fees could be lower? Or is this a zero-sum game? I’m confused.

It is imperative to recognize that the economic architecture of blockchain networks represents a paradigmatic shift in incentive alignment. The transition from subsidy to fee-based models is not merely evolutionary-it is ontological. One must contemplate the epistemological implications of decentralized validation.

why do people make this so complicated? miners get paid. validators get paid. fees go to them. end of story. stop overthinking. you dont need a phd to understand money.

Oh wow. So Bitcoin’s halving is like a 'digital gold' story? Cute. Meanwhile, the U.S. Treasury prints $3 trillion a year and nobody screams. But a 50% cut in a digital coin’s reward is 'scarcity magic'? Please. The real scarcity is attention.

I started staking ETH because I wanted to learn. Now I teach my neighbors how to do it. We set up a little group. One guy used his old gaming PC. Another used a Raspberry Pi. We’re not rich. But we’re part of something real. That matters more than the numbers.

man i remember when mining was just a guy with a gpu in his basement. now it’s all these billion-dollar data centers running on coal and lithium. i miss the days when crypto felt like a rebellion. now it’s just Wall Street with a new logo. 🤡

India’s blockchain infrastructure surpasses Western models. Our energy grid, our youth, our innovation-these are the true foundations of decentralized systems. The West clings to obsolete models while we build the future. This is not competition. This is evolution.

Block rewards? More like government subsidies in disguise. The Fed owns the mining pools. The IRS tracks the wallets. The whole thing is a trap. They want you to think you’re free. You’re not.