Crypto Law Enforcement: How Governments Track and Crack Down on Crypto Crime

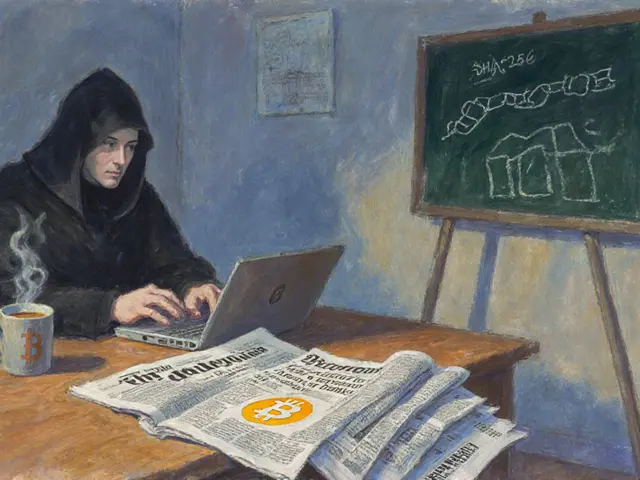

When you hear crypto law enforcement, the system governments use to track, investigate, and penalize illegal cryptocurrency activity. Also known as blockchain compliance, it’s no longer just about catching hackers—it’s about stopping entire networks that move money for sanctions evaders, ransomware gangs, and fraud rings. This isn’t sci-fi. In 2024, over $15.8 billion in crypto flowed to entities on the OFAC sanctions list. Bitcoin didn’t make crime anonymous—it made it traceable.

OFAC crypto sanctions, the U.S. Treasury’s list of blocked crypto wallets and exchanges tied to terrorism, narcotics, or rogue states. Also known as SDN list for crypto, it’s now actively enforced. Exchanges like Garantex got hit. Wallets got frozen. Companies got fined up to $750,000 for not blocking them. This isn’t theoretical. If your wallet ever interacted with a sanctioned address—even unknowingly—you could be flagged. And it’s not just the U.S. South Korea fined Upbit over 500,000 times for failing KYC checks. Tunisia banned crypto entirely. Turkey lets you trade but freezes accounts if you use it for payments. These aren’t random rules—they’re part of a global push to tie crypto to real-world identity.

KYC in cryptocurrency, the mandatory identity check every major exchange requires to verify who you are before letting you trade. Also known as crypto identity verification, it’s the first line of defense for law enforcement. Without KYC, tracing crypto is like chasing ghosts. With it, authorities can link a wallet to a name, a phone number, a bank account. That’s why scams like fake airdrops often ask you to skip KYC—they know if you’re doing it right, you’re already under watch. The result? Crypto isn’t going dark. It’s going regulated. And the posts below show exactly how this plays out: from the real story behind sanctioned transactions to how exchanges get shut down for non-compliance, how airdrops are used to disguise fraud, and why some platforms vanish overnight because they never did the basics.

What you’ll find here isn’t theory. It’s real cases. Real fines. Real scams exposed. You’ll see how a single KYC failure can trigger a national crackdown. How a $15 billion money trail led to a global policy shift. How a fake airdrop isn’t just a phishing trick—it’s a legal red flag. This isn’t about stopping innovation. It’s about making sure innovation doesn’t become a tool for crime. And if you’re trading, holding, or just curious—this is the landscape you’re operating in now.

Governments worldwide are seizing billions in cryptocurrency, with the U.S. now holding over $17 billion in Bitcoin as a strategic reserve. Learn how different countries handle crypto seizures, what assets are targeted, and what it means for users.

Jonathan Jennings Dec 4, 2025