Cryptocurrency Mining Tax Sweden: What You Need to Know

When dealing with Cryptocurrency Mining Tax Sweden, the rules dictate how miners report earnings, claim expenses, and pay the correct amount of tax in Sweden. Also known as crypto mining tax, it combines income tax and possibly self‑employment tax depending on your setup. The Swedish Tax Authority, Skatteverket, enforces these rules and provides guidance for individuals and businesses and expects miners to treat their earnings as crypto mining income, the fair market value of mined coins at the moment they become spendable. This income is generally considered self‑employment income, meaning you may have to file a self‑employment tax, social security contributions on top of regular income tax. At the same time, any later sale of those coins triggers capital gains tax, taxed at the standard rate for gains on financial assets. Understanding how these pieces fit together helps you avoid costly mistakes.

Key Elements and Practical Steps

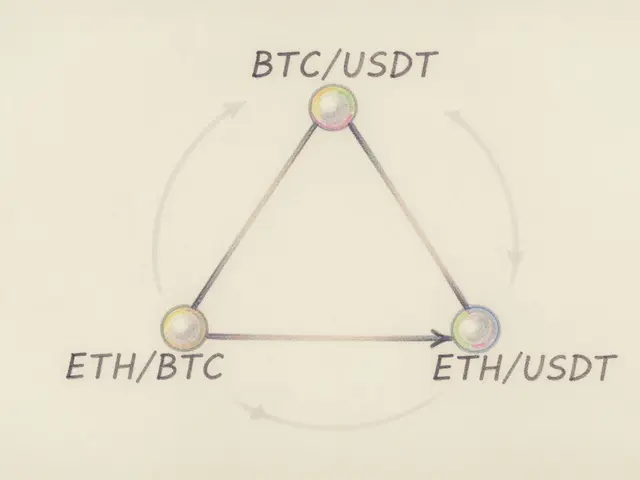

The first step is to calculate the taxable amount of each mining event. You take the market price of the coin at the time it’s mined, convert it to SEK, and record that as income. Next, you can deduct legitimate expenses – electricity, hardware depreciation, internet fees, and even a portion of rent if you run the rigs from home. The Swedish Tax Authority allows these deductions as long as you keep solid records. After you’ve logged income and expenses, you file a self‑employment declaration using the NE‑blanket form, which combines your mining earnings with any other freelance work. When you eventually sell or exchange the mined coins, you report the difference between the sale price and the recorded acquisition cost as a capital gain or loss. Skatteverket provides a detailed guide on how to report crypto transactions in the annual Inkomstdeklaration 1, and many miners use spreadsheet templates to keep everything tidy.

While the basics are straightforward, a few nuances often trip people up. For example, if you mine as a hobby and the activity isn’t regular, the income may be treated as miscellaneous income rather than self‑employment, affecting your tax rate and deduction eligibility. Also, Sweden’s progressive tax brackets mean that high‑earning miners could see a combined marginal rate above 50% when you add municipal tax and social contributions. On the flip side, careful planning – such as timing hardware purchases for depreciation and scheduling sales to stay within lower brackets – can lower your overall burden. Below you’ll find a curated set of articles that dive deeper into each of these topics, from step‑by‑step reporting guides to strategies for optimizing deductions and handling cross‑border mining operations.

Sweden scrapped a 98% crypto mining tax break and raised energy taxes 6,000%, forcing miners to quit or relocate and reshaping Europe's regulatory landscape.

Jonathan Jennings Sep 17, 2025