Crypto Adoption in Nigeria: Why the Country Is Leading Africa’s Crypto Boom

Nigeria Crypto Adoption Calculator

Estimated Adoption Metrics

Projected Active Users

0

(Millions)

Estimated Transaction Volume

$0

(Billions USD)

This calculator estimates potential crypto adoption in Nigeria based on:

- Inflation Rate: Higher rates often drive people to seek alternatives like crypto

- Unbanked Population: More unbanked individuals may seek crypto for financial access

- Naira Depreciation: Currency weakness makes stablecoins attractive

- Population Size: Larger populations can support more adoption

Note: This is a simplified estimation model based on macroeconomic drivers discussed in the article.

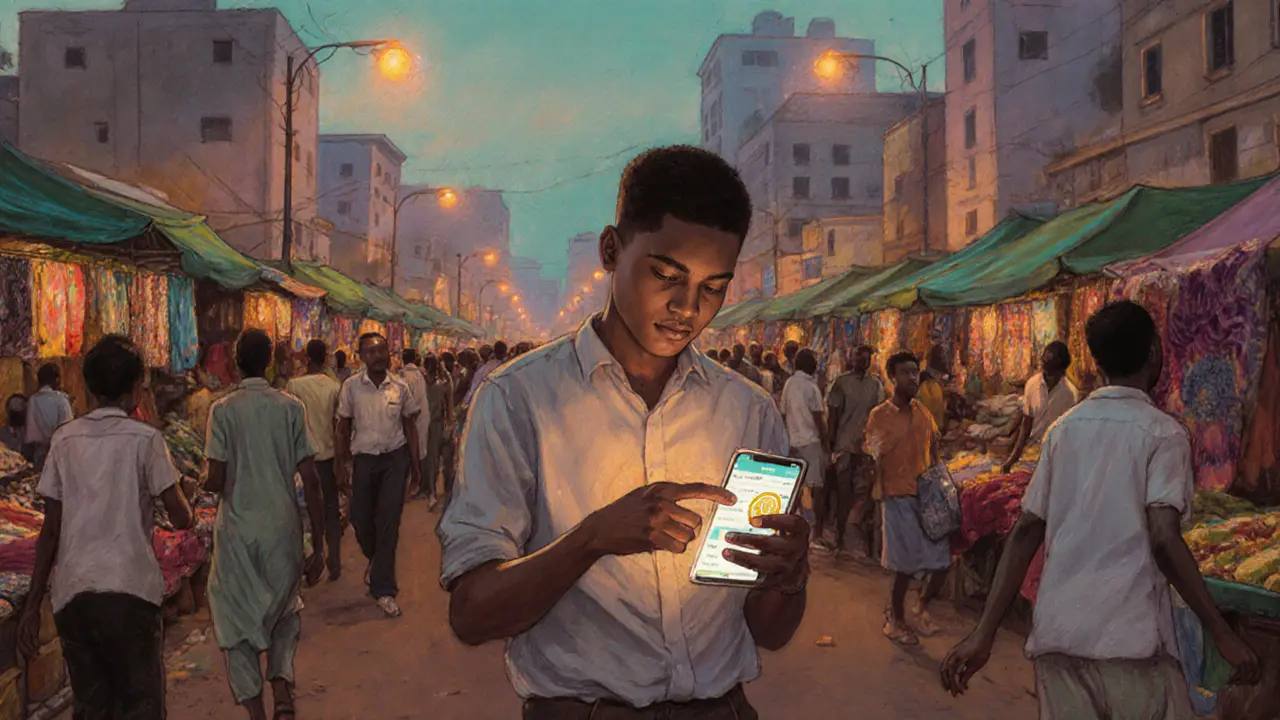

When you hear that crypto adoption in Nigeria is exploding, you might picture a niche hobby. In reality, the country has become a global heavyweight, ranking second worldwide for crypto use as of 2024 and handling more than $59billion in transactions in a single year. That surge isn’t a flash‑in‑the‑pan; it’s rooted in a mix of economic pressure, youthful tech‑savviness, and a regulatory pivot that opened the doors for institutional players.

TL;DR

- Nigeria ranks #2 globally for crypto adoption, with over 22million users by 2025.

- Hyper‑inflation, a weakening naira, and 36% of adults unbanked drive mass crypto use.

- The Central Bank of Nigeria lifted its ban on banking for crypto firms in late2023, sparking rapid institutional growth.

- Key players include Binance (P2P), local exchanges like Quidax, and fintech unicorn Moniepoint.

- Future outlook points to CBDC pilots, deeper blockchain‑bank integration, and steady user growth despite regulatory risks.

Macro Drivers: Inflation, Currency Instability, and the Unbanked

At the heart of the craze is the Nigerian economy itself. Inflation topped 24% in 2023, and the naira has lost more than 75% of its value against the US dollar since 2016. When everyday items become unaffordable, people look for anything that can preserve buying power. Crypto, especially stablecoins pegged to the dollar, offers a quick hedge.

Coupled with this is the fact that Nigeria still has a sizable unbanked population-about 36% of adults lack a formal bank account. Traditional banking fees and lengthy onboarding processes push many toward mobile‑first solutions that crypto platforms provide.

For a typical young professional earning in naira, sending a $500 freelance payment through a bank can cost up to 8% in fees. A stablecoin transfer, on the other hand, often lands in a wallet for a fraction of that cost, making crypto the obvious choice for cross‑border earnings.

Regulatory Landscape: From Ban to Blueprint

In 2021, the Central Bank of Nigeria (CBN) ordered banks to shut down accounts linked to crypto exchanges. The move sparked panic, but it also forced the community to innovate with peer‑to‑peer (P2P) channels that bypassed traditional banks altogether.

Late 2023 marked a turning point. CBN announced a licensing framework that allowed banks to service vetted crypto firms. This policy shift unlocked capital for exchanges, lowered compliance costs, and attracted foreign investors. The impact was immediate: regulated platforms saw a 45% increase in new sign‑ups within three months.

Building on that momentum, the Nigeria Inter‑Bank Settlement System (NIBSS) teamed up with the Zone blockchain network in 2025. The partnership aimed to modernize inter‑bank settlements, reduce fraud, and lay a foundation for future central bank digital currency (CBDC) pilots.

Ecosystem Evolution: From P2P Trading to Institutional‑Grade Services

During the ban years, the dominant activity was peer‑to‑peer trading. Platforms like Binance’s P2P marketplace let users match buy and sell orders directly, sidestepping blocked banking routes. The learning curve was short-most newcomers got comfortable within two to four weeks.

Today, the landscape is more layered. International giants such as Binance still dominate volume, but local exchanges like Quidax, Yellow Card, and the home‑grown Breet.io offer services in Pidgin English and other local dialects, lowering the barrier even further.

Stablecoins have become the go‑to instrument for remittances and everyday purchases. Users report that holding USDC or BUSD protects them from daily naira depreciation, and many freelancers receive payments directly into these wallets, cutting out the costly correspondent bank route.

Institutional Milestones: Unicorns, Partnerships, and the Road to Mainstream

One headline that captured global attention in 2025 was the unicorn status of Moniepoint. Valued at $1billion after a funding round led by Google, the fintech platform now offers crypto wallets, seamless fiat‑to‑crypto on‑ramping, and integrations with local merchants. Moniepoint’s rise illustrates how fintech and crypto are converging to solve financial inclusion gaps.

Another milestone was the NIBSS‑Zone blockchain integration. By moving settlement data onto a tamper‑proof ledger, banks can now reconcile inter‑bank transfers in seconds instead of hours, a critical improvement for crypto exchanges that need near‑real‑time liquidity.

These developments have attracted institutional investors. Venture capital inflows into Nigerian crypto startups grew by 68% year‑over‑year, supporting more robust compliance teams, better user education, and localized product development.

Comparative Metrics: How Nigeria Stacks Up Globally

| Country | Adoption Index (0‑1) | Active Users (millions) | Annual Transaction Volume (USDbn) |

|---|---|---|---|

| India | 0.66 | 45 | 120 |

| Nigeria | 0.64 | 22 | 59 |

Despite a smaller population, Nigeria’s per‑capita activity rivals that of many developed markets. Over 8% of all crypto value moved in Sub‑Saharan Africa originates from transactions under $10,000, highlighting a retail‑centric pattern that differs from the institutional‑heavy flows seen in North America.

User Experience: Benefits, Pain Points, and Community Support

On the ground, users love the speed and low cost. A typical P2P trade for $200 settles within minutes, compared to a week‑long bank transfer. Community groups on Telegram and WhatsApp act as informal help desks, guiding newcomers on private‑key safety, fee calculations, and platform selection.

However, challenges remain. Exchange downtime spikes during high‑volatility periods, and some users still fear regulatory crackdowns despite the CBN’s recent openness. Security concerns also surface, especially for those venturing into DeFi where smart‑contract bugs can lead to losses.

Education is improving. Major platforms now publish tutorials in Nigerian Pidgin, and the CBN’s Consumer Education Unit runs quarterly webinars about crypto risks and best practices.

Future Outlook: CBDCs, Continued Growth, and Potential Risks

Looking ahead, the most exciting prospect is the possible rollout of a Nigerian CBDC, hinted at in the 2025 NIBSS‑Zone pilot. A digital naira could coexist with private crypto, offering a state‑backed stablecoin that settles instantly across banks and mobile wallets.

Growth projections remain bullish. Analysts estimate that by 2027, over 30million Nigerians-roughly 14% of the population-will hold crypto assets. Retail usage will stay strong, while institutional interest will deepen as licensing clarity strengthens.

Risks shouldn’t be ignored. A sudden regulatory reversal or international pressure could curtail exchange operations. Nonetheless, the underlying economic drivers-high inflation, currency devaluation, and limited banking-are likely to keep crypto relevant for the foreseeable future.

Frequently Asked Questions

How many Nigerians actually use cryptocurrency?

By mid‑2025, roughly 22million people-about 10% of the country’s population-are estimated to own a crypto wallet, according to Chainalysis data.

Is crypto legal in Nigeria?

Cryptocurrency itself is not illegal. The Central Bank of Nigeria prohibits banks from facilitating unlicensed crypto activities, but licensed exchanges can operate under the 2023 regulatory framework.

What are the most popular crypto platforms in Nigeria?

Binance P2P leads in volume, followed by local exchanges such as Quidax, Yellow Card, and Breet.io. Fintechs like Moniepoint now also offer integrated crypto wallets.

How do Nigerians protect their crypto holdings?

Most users store assets in mobile wallets with a backup phrase. Community groups stress the importance of never sharing private keys and using hardware wallets for larger sums.

Will a Nigerian CBDC replace private crypto?

A digital naira is expected to complement, not replace, private crypto. It would give the central bank a tool for monetary policy while users could still turn to Bitcoin, Ethereum, or stablecoins for hedging and cross‑border payments.

In short, crypto adoption Nigeria is propelled by a perfect storm of economic need, youthful tech affinity, and a regulatory environment that’s finally giving the space a chance to mature. Whether you’re a newcomer curious about stablecoins or an investor tracking emerging markets, Nigeria’s journey offers a real‑world case of how digital money can fill the gaps left by traditional finance.

Behold, the digital tide that sweeps across Lagos and Abuja alike, a testament to humanity's yearning for freedom from the shackles of fiat. In a land where the naira falters, the crypto rebellion rises like a phoenix, bright and unrelenting. It is not merely a trend; it is the inevitable metamorphosis of finance.

Hey folks, this article really shows how crypto helps people who don’t have banks in Nigeria its simple and it matters a lot

So the Central Bank says it’s fine, but have you ever considered that the real power behind this crypto surge is a coordinated effort by shadowy elites to siphon wealth? The numbers look clean, yet the narrative conveniently omits who profits most when the naira collapses.

Crypto is just hype.

Wow, what an inspiring story! The fact that young Nigerians are turning challenges into opportunities gives me hope for the whole continent. Keep pushing forward, you’re showing the world what resilience looks like.

I see the data, and it makes sense. Inflation drives people to alternatives, and the tech‑savvy youth are ready to adopt. It’ll be interesting to watch how the ecosystem matures over the next few years.

While some celebrate this boom, it’s worth noting that rapid adoption can also mask systemic risks, especially when regulation lags. Investors should stay vigilant, as volatility remains a constant companion in these markets :)

Absolute fire! The energy buzzing through Nigerian crypto circles is electrifying, and the colorful memes flooding Telegram are proof that this movement is alive and kicking. Keep the hype train rolling, and let’s see where it takes us.

It’s amazing to see a country leading the charge, and it reflects the vibrant cultural tapestry of Africa. When you blend tradition with cutting‑edge tech, you get something truly unique-cheers to the innovators!

Your analysis is spot on; the blend of economic pressure and youthful ingenuity creates a perfect storm for adoption. I appreciate the balanced perspective and the clear data points you provided.

Whoa, this is lit! 🤩 The numbers are crazy and the community vibes are super strong, but watch out for the scams that love to hide in the shadows 😅.

Great breakdown, I think many folks will learn a lot from this. The way you explained the P2P transition was super clear, even if I typoed a few words lol.

Honestly, the whole crypto hype is just Western propaganda trying to control our money. We should stick to our own solutions and not let foreign exchanges dictate our future.

One could argue that the intersection of technology and necessity creates a philosophical lesson about adaptability. Nigeria illustrates how constraints can foster innovative thinking.

Reading your upbeat take reminded me of the ancient proverb that every hardship carries the seed of an opportunity. In the bustling markets of Kano, traders have long used barter to survive, and now they barter with digital tokens. This evolution feels almost mythic, a narrative where the protagonist-Nigeria-overcomes adversity through daring ingenuity. The drama unfolds daily as families shift savings into stablecoins, turning uncertainty into hope. It’s a living saga, and you captured its spirit beautifully.

Exactly, the veil is thin and the puppeteers are smiling behind the screens. When the CBN loosens its grip, the shadow financiers rush in, cashing in on the very instability they helped create. The data points you mentioned are just breadcrumbs leading to a larger plot where foreign interests reap the rewards while locals bear the cost. It’s a bold assertion, but the patterns are hard to ignore.

Wow, love the vibe, the hype, the energy, the memes, the unstoppable momentum, the community spirit, the relentless optimism-everything is just exploding, and it's impossible not to get caught up in the excitement, right?

sure the risks are real but folks need to chill the alarmist tone is overblown

I appreciate your straightforward view, and I agree that simplicity helps many understand the impact of crypto in Nigeria.

Esteemed contributor, your observations merit commendation; indeed, the symbiosis of macroeconomic strain and youthful adoption presents a compelling case study. It is both enlightening and, dare I say, invigorating to witness such dynamism. 🙂

Sure, the community is vibrant, but let’s not pretend there aren’t serious issues lurking beneath the hype-balance is key.

Thank you for the clear explanation; it reminded me of how essential education is in demystifying crypto for everyday users. When a newcomer sees a step‑by‑step guide, the intimidation factor drops dramatically, allowing confidence to grow. In Nigeria, where many rely on mobile phones as their primary gateway to the internet, such tutorials become lifelines. Moreover, the community‑driven support on WhatsApp and Telegram fills gaps left by formal institutions, creating a grassroots safety net. This organic mentorship model fosters trust, which is crucial given the prevalence of scams. As more people share their successes, a positive feedback loop emerges, encouraging further adoption. It is also worth noting that stablecoins serve as a bridge between volatile local currency and global markets, reducing transaction friction. The seamless fiat‑to‑crypto on‑ramping offered by platforms like Moniepoint exemplifies how fintech can lower barriers. Yet, we must remain vigilant about regulatory shifts that could disrupt this progress. Continuous dialogue between regulators and innovators will help mitigate unexpected crackdowns. The data indicating that 22 million users already hold crypto wallets signals a tipping point, where network effects amplify growth. Education initiatives, both formal and informal, will determine whether this momentum sustains or stalls. In the meantime, sharing resources, best practices, and personal anecdotes empowers individuals to make informed decisions. Ultimately, the convergence of technology, community, and policy shapes the trajectory of Nigeria’s crypto landscape. Let us celebrate the strides made while acknowledging the work still ahead.

While your depiction of crypto as a phoenix is poetically resonant, I must interject that the reality is far more nuanced and fraught with systemic challenges. The narrative of unfettered freedom overlooks the regulatory ambiguities and the potential for economic destabilization. A balanced assessment would consider both the empowering aspects and the attendant risks associated with rapid digital asset integration.