P2E Economics: How Play-to-Earn Games Really Make Money (And Why Most Fail)

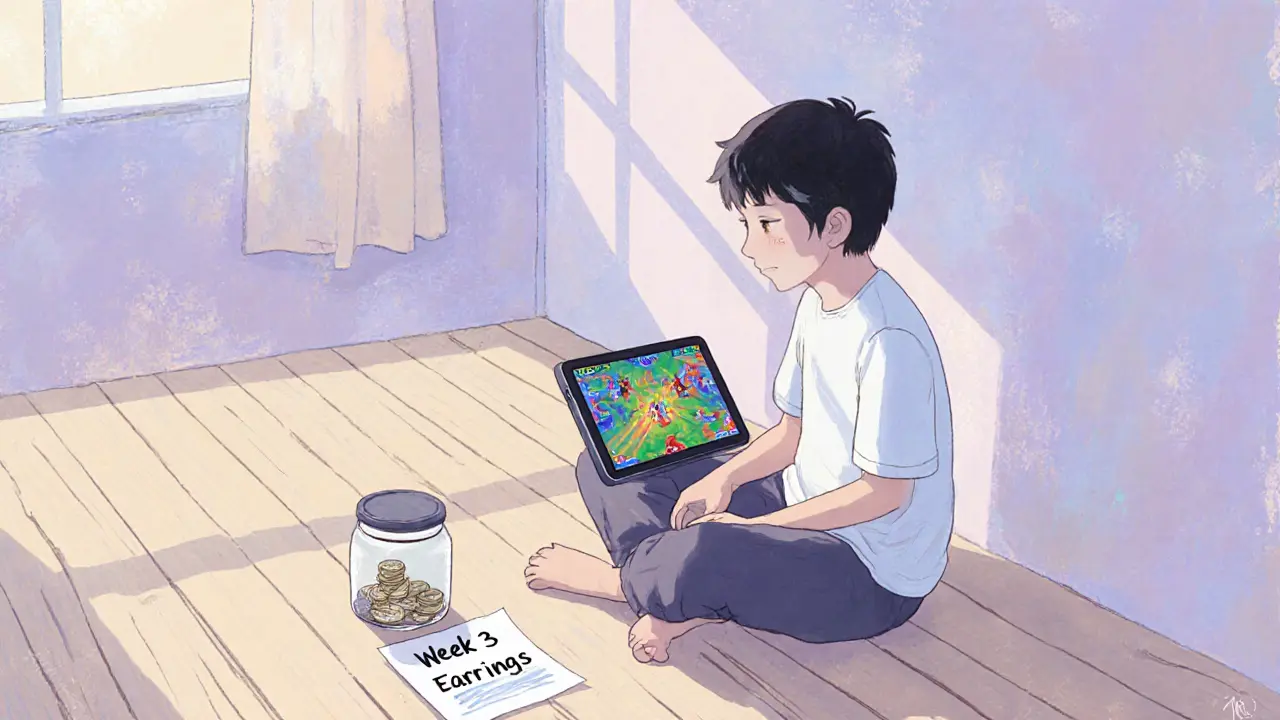

When you hear P2E economics, the financial model behind blockchain games that reward players with tokens or NFTs. Also known as play-to-earn, it crypto gaming, it sounds simple: play games, earn money. But the reality? Most P2E games collapse within months because their economics don’t add up. It’s not about fun or graphics—it’s about token supply, player demand, and whether the game can keep new players coming in faster than old ones cash out.

Think of it like a pyramid. If a game gives you $10 in tokens just for logging in, where does that $10 come from? It’s not magic. It usually comes from new players buying tokens to join, or from the developers selling their own stash. Once the flow of new players slows down, the token price crashes, and everyone holding it loses money. That’s why so many P2E games—like WNT from Wicrypt or NUUM from Bit.Country—ended up worthless. Their tokenomics were built on hype, not sustainability. Real P2E success needs a balance: enough rewards to keep players engaged, but not so many that they flood the market and kill value.

Successful P2E games, like MagicCraft’s MCRT airdrop, didn’t just hand out tokens. They tied rewards to real in-game actions—winning matches, completing quests, or owning rare NFTs. That created real demand. Players weren’t just speculating—they were playing to improve their position. That’s the difference between a Ponzi scheme and a game with staying power. And when you look at the posts here, you’ll see the pattern: the ones that survived had clear rules, limited token supply, and players who actually used the tokens inside the game—not just sold them on exchanges.

It’s not just about the game design. P2E economics also depends on regulation, market mood, and whether players trust the team behind it. Take THDax or Amaterasu Finance—both claimed to be crypto platforms, but without transparency or real users, they vanished. The same applies to P2E. If the developers disappear, the tokens become digital trash. That’s why you’ll find reviews here on exchanges, airdrops, and tokens that actually delivered—or failed hard. This collection doesn’t just list games. It shows you which ones had real economic foundations, and which were just flashy fronts for quick cash grabs.

What you’ll find below aren’t just reviews. They’re case studies. From the rise and fall of DUCK on Telegram, to the quiet collapse of Dot Finance, to how TopGoal’s NFT airdrop worked before it vanished—each post cuts through the noise. You’ll see exactly how tokenomics broke, how players got burned, and what made a few models last. No fluff. Just the facts behind the earnings.

Play-to-earn gaming lets players earn real cryptocurrency by playing blockchain-based games. Learn how the economy works, who's making money, and how to start safely in 2025.

Jonathan Jennings Nov 8, 2025