Future of Multi-Chain Ecosystem: How Interoperable Blockchains Are Reshaping Digital Finance in 2026

By 2026, the idea of a single blockchain dominating everything is dead. You can’t build a serious app on Ethereum alone anymore and expect it to scale. You can’t run a global payment network on one chain and ignore cost, speed, or security trade-offs. The future isn’t about choosing one chain-it’s about using them all together. That’s the multi-chain ecosystem.

Why Single Chains Don’t Work Anymore

Five years ago, Ethereum was the only game in town. Developers built everything on it. But as usage exploded, so did fees. In Q4 2025, average gas fees hit $4.27 per transaction. For small payments, microtransactions, or everyday apps, that’s a dealbreaker. Users left. Startups failed. Companies realized: if your app costs more to use than the value it delivers, it doesn’t matter how secure it is. Single chains also hit hard limits. Ethereum handles 15-30 transactions per second. That’s fine for digital gold or high-value DeFi trades. But it’s useless for a gaming platform where players need instant, cheap actions. Or for a supply chain tracker logging hundreds of shipments every minute. That’s where multi-chain came in-not as a trend, but as a necessity.How Multi-Chain Ecosystems Actually Work

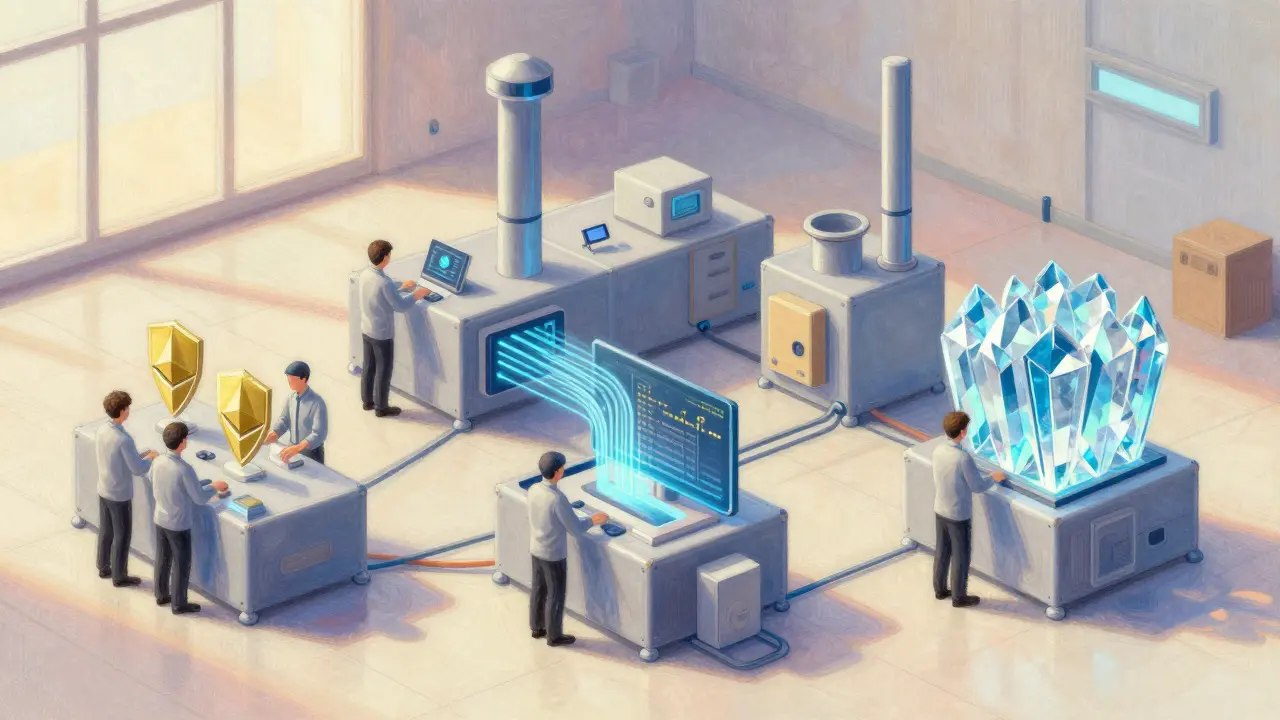

A multi-chain ecosystem isn’t just a bunch of blockchains linked by bridges. That was the early version-and it was messy. Bridges got hacked. Liquidity got stuck. Users lost millions. Today’s systems are built differently. They use modular architecture. Instead of one chain doing everything-consensus, execution, data storage-they split it up. Think of it like a factory: one team handles security, another handles speed, another handles storing data. Each part is optimized. Take Celestia. Launched in late 2023, it’s not a smart contract chain. It’s just a data availability layer. It makes sure transaction data is publicly verifiable and tamper-proof. Other chains, like Polygon 2.0 or Base Network, use Celestia’s data to run faster, cheaper apps. Polygon 2.0, upgraded in November 2025, now handles 125 transactions per second across its whole network. That’s 4x Ethereum’s capacity. Then there’s EigenLayer. It lets Ethereum validators earn extra income by securing other chains. Instead of each new chain needing its own set of validators (which is expensive and risky), they borrow security from Ethereum. By December 2025, $4.7 billion in ETH was being used this way. That cut security costs by 63% for many Layer 2s.Who’s Winning in the Multi-Chain Race?

Not every multi-chain solution is equal. There are four main models dominating the market:- Modular execution environments (34% market share): Chains like Taiko and zkSync that focus on fast, secure execution using modular components.

- Ecosystem-native Layer 2s (29%): Base Network, Optimism, Arbitrum Orbit-built to work with specific ecosystems (like Coinbase or Ethereum) and optimized for real-world use.

- Specialized ZK-rollups (22%): Chains like zkEVM that use zero-knowledge proofs for privacy and efficiency.

- AppChains (15%): Dedicated chains for single apps, like a gaming platform or a DeFi protocol that runs on its own blockchain.

Costs, Speed, and Real-World Results

The numbers don’t lie. Multi-chain isn’t just theoretical-it’s saving companies money and time. For routine transactions, multi-chain setups cut costs to under $0.03 per transaction. Compare that to Ethereum’s $4.27. That’s a 99% drop. WisdomTree, a financial firm, used multi-chain tech to tokenize ETFs. They cut transfer costs by 89% and moved from T+2 settlements to intraday. That’s huge in finance. JPMorgan’s Kinexys platform slashed settlement times by 97% using a hybrid multi-chain network. It’s not just about crypto-it’s about replacing old banking systems. Uptime matters too. Well-built multi-chain systems hit 99.98% availability for critical functions. That’s banking-grade reliability. And it’s not magic. It’s design: high-value operations stay on secure chains like Ethereum. Low-value, high-volume tasks run on cheaper Layer 2s.The Dark Side: Security, Complexity, and Risk

Multi-chain isn’t easy. And it’s not risk-free. In 2025, $287 million was lost to cross-chain bridge exploits. That’s 68% of all DeFi losses. Why? Because bridges are still the weakest link. They’re complex, poorly audited, and often built by small teams with limited resources. Enterprise developers report a steep learning curve. Getting good at multi-chain takes 8-12 weeks of training, compared to 4-6 for single-chain. And 63% of developers say RPC reliability is their biggest headache. Public endpoints are slow and unstable. Private nodes? They’re mandatory now. Calibraint’s 2026 report found public RPCs had 37% more failures and 2.8 seconds of average latency. For a trading bot or payment system, that’s catastrophic. Vitalik Buterin warned in late 2025 that multi-chain adds too much complexity. More moving parts mean more ways to break. Without standardization, we risk a fragmented mess where security isn’t consistent.Who’s Adopting This-and Why?

Adoption isn’t just happening. It’s accelerating. 68% of Fortune 500 companies now have multi-chain development teams. In 2024, that number was 22%. Banks are leading: 89 of the top 100 banks are running multi-chain pilots. Financial services account for 47% of all enterprise deployments. Supply chain (23%), gaming (17%), and identity (13%) are close behind. The reason? Speed to market. Companies using multi-chain get apps live 42% faster than those stuck on single chains. But here’s the kicker: 31% of startups that failed in 2025 didn’t have multi-chain capability. They weren’t hacked. They weren’t out-innovated. They just couldn’t scale affordably. Coinbase’s $375 million acquisition of Echo in late 2025 wasn’t just a buy-it was a statement. Coinbase COO David Sacks said: "Multi-chain is not optional for serious enterprise applications."

What’s Next? The Roadmap for 2026

The next 12 months will define the next decade.- Universal account abstraction (Q2 2026): One wallet, one login, works across all chains. No more juggling keys or switching networks.

- Cross-chain privacy with ZK-proofs (Q3 2026): Send assets between chains without revealing transaction details. Critical for enterprise and regulated use cases.

- Institutional-grade messaging protocols (Q4 2026): Standardized, audited, secure communication between chains. No more fragile bridges.

Is This the End of Ethereum?

No. Ethereum is the anchor. It’s the security layer. It’s where the most valuable assets settle. But it’s no longer the only place you need to be. Think of it like the internet. You don’t build websites on one server anymore. You use CDNs, cloud storage, edge networks, APIs. Ethereum is the backbone. The rest? That’s the ecosystem. By 2027, the World Economic Forum predicts 78% of institutional blockchain transactions and 52% of consumer apps will run on multi-chain systems. Bank of America says this infrastructure will become as essential as SWIFT. The window for "experimental" Web3 is closed. If you’re building something today, you don’t get to pick one chain. You have to design for many.What Should You Do?

If you’re a developer: Learn modular architecture. Study how Base, Polygon, and EigenLayer work together. Don’t just deploy on Ethereum-think about where your users are, what they’re doing, and which chain gives them the best experience. If you’re a business: Start small. Use Base or Optimism for customer-facing apps. Keep settlements on Ethereum. Don’t try to build everything at once. Use existing tools. Don’t reinvent bridges-use audited, enterprise-grade ones. If you’re an investor: Look beyond tokens. The real value is in infrastructure-node providers, RPC services, security layers, documentation platforms. The winners won’t be the flashiest apps. They’ll be the ones making the ecosystem work. The future isn’t one chain. It’s not even five. It’s dozens, working together. And if you’re not ready for that, you’re already behind.Post Comment

Okay but let’s be real - multi-chain isn’t the future, it’s the messy middle ground we got stuck with because nobody could agree on one good solution. Ethereum’s still the only chain that actually feels secure. Everything else? Just fancy wrappers on top of a sinking ship. I’ve seen too many Layer 2s die overnight because their devs vanished. This isn’t innovation, it’s desperation dressed up as progress.

Bro, I just started learning this stuff and honestly? This post made it click. 🙌 I used to think blockchain = Ethereum only. Now I get it - it’s like the internet. You don’t build websites on one server, you use CDNs, cloud, APIs… same thing now. Base Network is my new best friend for testing dApps. Cheap, fast, no panic when gas spikes. Thanks for the clarity!

78% of new consumer apps on Base? Cute. Let me guess - they’re all NFT profile pic projects with a Coinbase wallet attached. Real innovation doesn’t come from piggybacking on a centralized exchange’s infrastructure. It comes from decentralization. Base is Web3 in name only. It’s Web2 with a blockchain sticker.

They’re lying. All of it. The $4.7B locked in EigenLayer? That’s just ETH being rehypothecated by the same 12 institutions who own 80% of the validators. The whole multi-chain thing is a smoke screen so Wall Street can keep pumping tokens while pretending it’s ‘decentralized.’ They’re building a new financial pyramid - just with more acronyms. ZK-proofs? More like ZK-illusion.

Love this breakdown. The modular architecture point is *chef’s kiss*. I’ve been working on a supply chain project and we switched from a single-chain setup to Celestia + Polygon 2.0. Our transaction costs dropped from $2.10 to $0.02. Our team used to dread Mondays - now we’re actually excited to deploy. This isn’t hype. This is real.

Single chain is dead? LMAO. You mean the chain that’s been hacked 47 times since 2023? You think bridges are the problem? Nah. The problem is you people keep building on code written by 19 year olds who learned Solidity from YouTube. Ethereum’s not dead - it’s just the only one still standing. The rest? Just crypto zombies walking around with ‘decentralized’ on their bio

There are several factual inaccuracies in this post that need correction. First, Ethereum’s TPS is not 15–30 - that’s the base layer. With Layer 2s, it’s over 10,000 TPS aggregate. Second, Celestia is not a ‘data availability layer’ in the sense implied - it’s a modular DA layer, and its role is not to ‘make data verifiable’ but to provide probabilistic availability guarantees. Third, EigenLayer’s $4.7B is not ‘borrowed security’ - it’s restaked ETH under a new economic model. Precision matters in technical discourse.

Big picture: we’re seeing the internet’s evolution all over again. Remember when everyone thought AOL was the web? Then came browsers, then cloud, then mobile. Now it’s chains. The real winners won’t be the flashiest tokens - they’ll be the tools that make switching between chains invisible. Think: one wallet, one gas token, one UI. That’s the real UX win.

As someone from a country where banking access is still a luxury, this is HUGE. I watched my cousin lose $2k in a bridge exploit last year. That’s her rent. Now I’m helping her use Base + a trusted wallet - no bridges, no drama. Multi-chain isn’t about tech bros flexing - it’s about real people finally getting fair access to finance. This isn’t crypto. It’s justice.

They say Ethereum is the anchor. But what if the anchor is rusting? What if the entire foundation is built on a moral compromise - that we accept centralization in security because it’s ‘convenient’? We traded freedom for speed. We traded decentralization for scalability. And now we call it progress. I don’t know if this is evolution… or surrender.

Let’s not forget the human cost. Developers are drowning in tooling fragmentation. I spent three weeks last month just trying to get a simple cross-chain transfer working. Documentation was outdated, RPCs timed out, and the ‘standard’ libraries conflicted. This isn’t a revolution - it’s a maintenance nightmare. We need standards, not more chains.

Just finished reading the AggLayer docs. Honestly? They’re the best blockchain documentation I’ve ever seen. Clear diagrams, real-world use cases, even a troubleshooting guide for RPC failures. This is what innovation looks like - not just code, but care. Polygon deserves credit for making this accessible.

My startup built a loyalty program on Optimism. We launched in 6 weeks. Our users don’t even know they’re on a Layer 2. They just get free coffee after 10 purchases. That’s the magic. The tech is invisible. The experience is real. That’s how you win. Not by preaching decentralization - by making people’s lives better. This is Web3 that actually works.

As a Nigerian fintech engineer, I’ve watched our country’s unbanked population explode - and seen how traditional systems fail them daily. Multi-chain isn’t a trend; it’s a lifeline. We’re deploying micro-payment rails on Base and zkSync, enabling farmers to receive payments instantly after harvest, bypassing banks entirely. The cost per transaction? Less than a kobo. This isn’t speculative finance - it’s economic dignity. The world is finally catching up to what we’ve been building in the shadows.

Let me be clear: this isn’t about Ethereum versus others. It’s about who gets to participate. When your grandmother can send money to her grandchild in Lagos without paying $5 in fees, that’s not innovation - that’s revolution. And it’s happening right now, not in some future lab, but in village markets with flickering internet and Android phones.

Yes, bridges are risky. Yes, complexity is high. But we’re not waiting for permission. We’re building anyway. Because when you’ve been excluded for centuries, you don’t wait for the gate to open - you build a new door.

So to the Silicon Valley VCs reading this: your funding rounds don’t define value. Our users’ smiles do. And we’re not building for your quarterly reports. We’re building for survival.

Let the chains multiply. Let the protocols evolve. But never forget: the most important chain is the one that connects a person to their dignity.

USA built the internet. USA will build the next-gen blockchain. Everything else is just copy-paste. Stop pretending other countries are leading. They’re not. They’re just using our tech. Base? Coinbase. Ethereum? American. ZK-proofs? Developed in U.S. labs. This isn’t global. It’s American innovation with a global audience. Respect the source.

Man I’ve been in this space since 2017 and I still get confused by all the chains. But I get this: if I can send $5 to my buddy in Mexico without paying $4 in fees, I don’t care if it’s called a rollup or a modular stack. Just make it work. Also, who’s building the UI that lets me pick my chain without a PhD? That’s the real bottleneck.

To everyone panicking about complexity: take a breath. You don’t need to understand every layer. Just use the tools that work. If you’re a dev, start with Base. If you’re a business, use a trusted wallet provider. If you’re a user, pick an app that feels smooth. The ecosystem will sort itself out. We don’t need to be experts - we just need to be users. And we’re already doing better than the banks ever did.

Just got my first cross-chain payment through the new AggLayer testnet. No bridge. No waiting. No gas drama. Just sent 0.1 ETH from Base to Polygon and it showed up in 3 seconds. I cried. Not because it’s tech - because it’s the first time I felt like I actually own my money. No middleman. No bank. No fees. Just… flow. Thank you to the devs who made this possible. You’re building something beautiful.

Wait - if multi-chain is so great, why are we still seeing $287M lost to bridges in 2025? And why do 63% of devs say RPC reliability is their biggest headache? Isn’t this just trading one problem for ten? I’m not against progress - I just want to know: who’s testing this at scale? Real-world stress? Not just lab demos?

Let’s be honest - this post is the best summary of multi-chain I’ve seen this year. Clear, accurate, grounded. But I’d add one thing: the real metric isn’t TPS or cost per tx. It’s user retention. If users abandon your chain because switching is a nightmare, you’ve lost. The winners will be the ones who make interoperability invisible. Not just technically - emotionally. That’s the next frontier.

So Ethereum’s the anchor? Cool. Then why did it take 5 years to fix its own gas fees? Why did it take 6 years to get to a stable Layer 2 ecosystem? Why are we still talking about ‘scalability solutions’ like they’re new? We’re not building the future - we’re just patching the past. And now we’re calling it ‘innovation.’ I’m tired of the hype. Show me the results. Not the slides.