TRIV Security: What It Is, Why It Matters, and Where You'll Find It

When people talk about TRIV security, a term that likely refers to transaction, identity, and verification security in decentralized finance. It's not a standard industry label, but it captures what actually keeps your crypto safe: how transactions are verified, who you are on the network, and whether the platform you're using can be trusted. If you've ever wondered why some exchanges get hacked while others don't, or why some airdrops vanish after you claim them, the answer often lies in these three pillars.

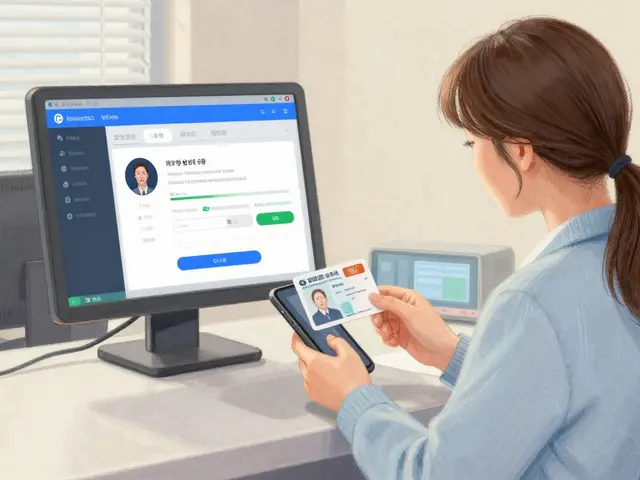

Think about Biteeu, an EU-licensed exchange that prioritizes regulatory-backed security. It doesn't just say it's secure—it shows it with licenses, audits, and satellite-backed data systems. That’s TRIV security in action: verified identity (KYC), tamper-proof transactions (on-chain verification), and transparent infrastructure. Compare that to Crypcore, a platform that doesn’t even exist as a real exchange, or THDax, a known scam with deleted pages and vanished founders. Those aren’t just bad platforms—they’re TRIV failures. No identity checks, no verifiable transactions, no accountability.

TRIV security isn’t about flashy marketing. It’s about what happens behind the scenes. Did the exchange run a security audit? Are transactions recorded on a public chain you can verify? Can you prove you’re you without handing over your passport to a sketchy website? These are the real questions. The posts below dive into exactly that: platforms that get it right, like Biteeu, and those that don’t, like Crypcore and THDax. You’ll also find deep dives into how KYC works, why running a node matters for decentralization, and how OFAC sanctions force exchanges to tighten their verification systems. This isn’t theory. It’s what keeps your funds alive when the market crashes. What you’re about to read isn’t just information—it’s a survival guide for anyone holding crypto today.

TRIV is a regulated Indonesian crypto exchange offering spot trading, 25x leverage futures, and staking. It's legal locally but has low security ratings and no investor protection. Best for risk-aware Indonesian retail traders.

Jonathan Jennings Nov 14, 2025