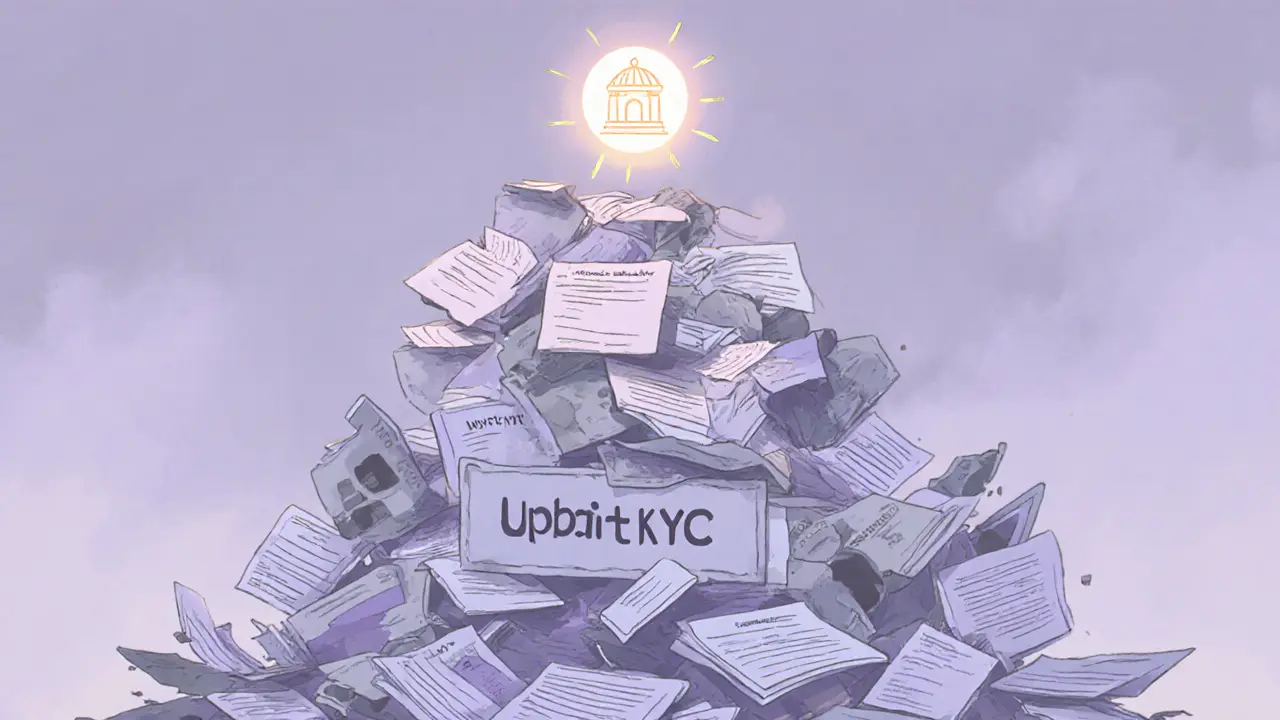

Upbit KYC Violations: What Happened and Why It Matters for Crypto Users

When Upbit KYC violations, a series of failures in identity verification at South Korea’s largest crypto exchange, led to regulatory fines and user distrust. Also known as Upbit compliance failures, these incidents revealed how even major exchanges can cut corners on KYC in cryptocurrency, the mandatory process where users prove their identity to prevent money laundering and fraud.

Upbit didn’t just miss a step—it skipped whole sections of its legal obligations. In 2022, South Korea’s Financial Services Commission found that Upbit allowed users to trade without completing proper identity checks, even after being warned. Some accounts were linked to high-risk jurisdictions with no verification at all. This wasn’t a glitch. It was a pattern. And it put real money at risk. When regulators stepped in, Upbit paid millions in penalties, but the damage to trust was already done. Users who thought they were on a safe, regulated platform suddenly realized their funds were exposed to the same risks as unlicensed exchanges. The crypto exchange compliance, the set of rules exchanges must follow to operate legally, including user verification, transaction monitoring, and reporting wasn’t just a formality—it was the only thing standing between clean markets and criminal activity.

These violations didn’t happen in a vacuum. They connect directly to broader issues in crypto: weak oversight, pressure to grow fast, and the illusion that decentralization means no rules. But crypto isn’t lawless. When an exchange like Upbit ignores crypto identity verification, the process of confirming who a user is before allowing them to trade or withdraw funds, it doesn’t just break rules—it breaks the system everyone else relies on. Other exchanges saw what happened and tightened their own checks. Regulators around the world took note. And users? They started asking harder questions before depositing a single dollar.

What you’ll find below are real stories and investigations that show how KYC failures ripple through the entire crypto ecosystem. From exchange reviews that expose shady practices to deep dives on how sanctions and compliance shape trading today, these posts don’t just report facts—they help you protect yourself. Whether you’re new to crypto or have been trading for years, understanding what went wrong with Upbit isn’t about blame. It’s about staying safe.

Upbit faced over 500,000 KYC violations, exposing systemic failures in South Korea’s largest crypto exchange. This case reshaped crypto regulation in Asia and set new global standards for compliance.

Jonathan Jennings Nov 26, 2025