Giottus Crypto Exchange Review: Is It the Best Choice for Indian Traders in 2025?

When you're looking to buy Bitcoin or trade altcoins in India, you don't want to pick a crypto exchange that feels like a gamble. You need speed, safety, and simplicity - especially if you're new to this. That’s where Giottus comes in. It’s one of the few Indian exchanges built from the ground up for local users, with INR deposits, Hindi and Tamil support, and features like SIPs and stop-loss orders that most global platforms don’t offer here. But is it actually good? Or just loud with awards? Giottus launched in 2017, and since then, it’s won a handful of industry awards - including 'India's Best Crypto Exchange' in 2025 and 'Cryptocurrency Brand of the Year - Bronze' at the BW Fintech Awards. These aren’t just marketing fluff. They’re backed by real user traction. Over 81,000 people visit the site every month, and nearly all of them find it through organic search. That means people are typing "Giottus" into Google because they’ve heard about it - not because of paid ads. But awards don’t pay your bills. What matters is whether your coins stay safe, your trades execute fast, and your customer support actually answers when you need help.

What Coins Can You Trade on Giottus?

Giottus supports 13 major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Tether (USDT), Chainlink (LINK), USD Coin (USDC), Polygon (MATIC), Stellar (XLM), EOS, Bitcoin Cash (BCH), TrueUSD (TUSD), and Paxos Standard (PAX). That’s not a lot compared to Binance or Coinbase, which list hundreds. But for someone in India who just wants to buy Bitcoin, Ethereum, or a few popular altcoins, it’s enough. The platform is also testing new additions like Solana, which could be a game-changer if it rolls out. Solana’s fast, cheap transactions would fit well with Giottus’s goal of making crypto feel smooth and practical for everyday users. What’s missing? No Dogecoin. No Shiba Inu (though you can invest in it via SIPs). No meme coins beyond what’s listed. If you’re chasing the next viral token, Giottus isn’t your place. But if you want to hold solid, well-known assets with decent liquidity, you’re covered.Fees: Are They Really Zero?

Giottus claims "Zero Fee access across multiple pairs" on its Google Play listing. That sounds too good to be true - and it kind of is. The platform doesn’t charge trading fees on some INR pairs, like BTC/INR or ETH/INR, but it still takes a spread - the difference between the buy and sell price. That’s common in Indian exchanges because they don’t have the same deep order books as global platforms. Compare that to CoinDCX or WazirX, which charge 0.1%-0.2% per trade. Giottus might not have a visible fee, but you’re still paying - just in a less obvious way. For small traders doing occasional buys, it’s not a big deal. For active traders moving large amounts, the spread can add up. The real win? No deposit or withdrawal fees for INR. That’s huge. Many exchanges charge ₹20-₹50 for UPI or bank transfers. Giottus lets you put money in and take it out for free. That’s a rare perk in India’s crowded exchange space.Security: Is Your Money Safe?

This is where Giottus shines - and where it has a quiet weakness. On the good side: they use BitGo for cold storage, which is one of the most trusted custodians in crypto. BitGo insures its holdings, so if there’s a hack, your coins are covered. That’s more than most Indian exchanges can say. Plus, all personal data is encrypted, and they’ve passed FIU (Financial Intelligence Unit) registration - meaning they follow India’s anti-money laundering rules. But here’s the problem: no government regulator oversees Giottus. The FIU isn’t a licensing body. It’s like registering your car with the DMV - it doesn’t mean the DMV checks if your brakes work. India still doesn’t have a clear crypto law. So while Giottus is compliant with current rules, there’s no safety net if the government suddenly changes course. User reviews are mixed. One person reported their account was hacked and their coins stolen - with no alert or support response. Another said their portfolio showed prices dropping even when the market was going up, suggesting possible manipulation. These aren’t isolated complaints. They’re red flags. Giottus says they use two-factor authentication and IP tracking. That’s standard. But if you’re holding serious amounts, you should still move your coins to a hardware wallet after buying. Never leave large sums on any exchange.

Usability: Built for Beginners, Frustrating for Pros

The app is clean. The dashboard is simple. You can see your portfolio, buy Bitcoin with UPI, and set up a weekly SIP in under a minute. That’s why beginners love it. But if you’ve traded on Binance or TradingView before, you’ll feel the gaps. You can’t edit open orders. The charts are basic - no indicators, no drawing tools. The dashboard shows every coin in existence, even ones you’ve never bought. There’s no news feed tied to your holdings. No price alerts. No advanced order types like limit stop or trailing stop. One user put it bluntly: "It’s like using a smartphone from 2015 when everyone else has an iPhone 16." The stop-loss feature is real - and rare in India. Most exchanges don’t offer it. Giottus lets you set a price where your position automatically sells. That’s useful if you’re away from your phone and the market crashes. But even this feature has bugs. Sometimes it doesn’t trigger fast enough. Or it triggers too early.Customer Support: Available, But Not Reliable

Giottus says they offer live chat, phone, email, and Telegram support - and it’s available from 9 AM to 11 PM. That’s better than most. But users report long waits. One person waited 14 hours for a response after their account was locked. Another said their support ticket vanished into thin air. The team responds faster to small issues - like resetting a password or fixing a UPI deposit delay. But if you’re dealing with a security breach or a lost trade, you’re on your own. That’s not acceptable for a platform handling real money.Local Advantages: Why Giottus Stands Out in India

Here’s the truth: Giottus isn’t trying to beat Binance. It’s trying to beat the confusion. Most global exchanges shut down INR trading in India after the 2021 banking crackdown. Giottus stayed. They kept UPI, NEFT, and IMPS support alive. They added multi-language support - Hindi, Tamil, Telugu, Bengali - so grandparents can use it too. They built SIPs so people can invest ₹500 a week in Bitcoin without thinking about market timing. They’re not the biggest. They’re not the fastest. But they’re one of the few that actually understand the Indian user. If you’re new, you don’t need 200 coins. You need a simple way to start. Giottus gives you that.

What’s Coming Next?

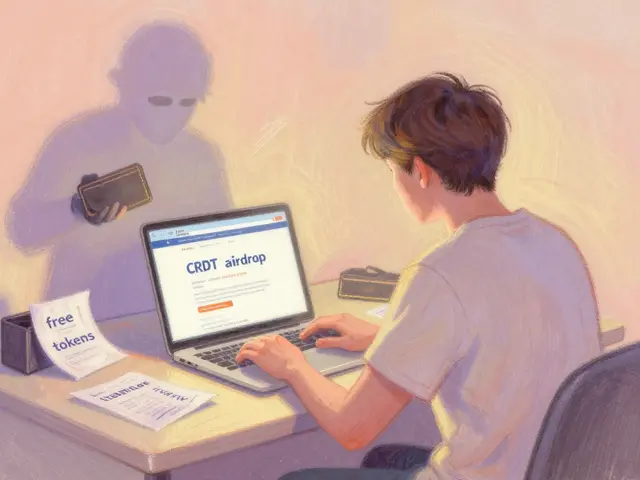

Giottus is working on two big features: crypto staking and fixed deposits. If they launch these, it could change the game. Staking lets you earn interest on coins like Ethereum or Polygon. Fixed deposits let you lock up INR and earn a fixed return - like a savings account, but for crypto. These aren’t just features. They’re a shift in strategy. Giottus isn’t just a trading platform anymore. They’re trying to become a crypto financial hub - like a bank, but for digital assets. They’ve also started publishing educational content on their blog - explaining how crypto works, what taxes apply, how to avoid scams. That’s smart. India has millions of first-time investors. Most of them have no idea what they’re doing. Giottus could become a trusted teacher.Who Should Use Giottus?

Use Giottus if:- You’re new to crypto and want a simple, Indian-focused app

- You want to use UPI or bank transfers without fees

- You like SIPs to invest small amounts regularly

- You value local language support and INR integration

- You’re not trading large sums or doing advanced strategies

- You trade frequently and need advanced charts or order types

- You want to trade hundreds of altcoins

- You’re holding large amounts of crypto and need top-tier security guarantees

- You’ve had bad experiences with customer support before

Final Verdict

Giottus isn’t perfect. It’s not even close to being the most powerful exchange in India. But it’s one of the most thoughtful. It’s built for people who don’t care about leverage or futures. They just want to buy Bitcoin, hold it, and maybe earn a little interest later. For that, Giottus works. The awards? They’re real. The traffic? It’s growing. The security? Solid, but not flawless. The support? Often slow. The app? Easy for beginners, clunky for experts. If you’re starting out in India, Giottus is one of the safest, simplest places to begin. Just don’t stay there forever. Once you’re comfortable, move your coins to a wallet. And keep an eye on how they handle staking and fixed deposits - those could be the real next steps for Indian crypto.Is Giottus safe to use in India?

Giottus uses BitGo for cold storage with insurance, encrypts user data, and is registered with India’s FIU - which means it follows anti-money laundering rules. But it’s not regulated by any government financial authority, so there’s no legal safety net if things go wrong. For small to medium amounts, it’s reasonably safe. For large holdings, transfer coins to a personal hardware wallet.

Does Giottus charge trading fees?

Giottus doesn’t charge visible trading fees on many INR pairs like BTC/INR or ETH/INR. But it makes money through the spread - the difference between the buy and sell price. This is common in Indian exchanges. For small traders, this isn’t a big issue. For active traders, it can add up over time.

Can I withdraw INR from Giottus for free?

Yes. Giottus allows free INR withdrawals via UPI, NEFT, and IMPS. There are no deposit or withdrawal fees, which is rare among Indian exchanges. Most platforms charge ₹10-₹50 per transaction. Giottus removes that barrier entirely.

Does Giottus offer stop-loss orders?

Yes. Giottus claims to be the only Indian exchange that offers stop-loss orders - allowing you to automatically sell your coins if the price drops to a set level. This feature helps protect against sudden market crashes. However, users report occasional delays or inaccuracies in execution, so it’s not foolproof.

What cryptocurrencies does Giottus support?

Giottus supports 13 cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Tether (USDT), TrueUSD (TUSD), Chainlink (LINK), USD Coin (USDC), Paxos Standard (PAX), Polygon (MATIC), Stellar (XLM), EOS, and Bitcoin Cash (BCH). It does not support Dogecoin or Shiba Inu for direct trading, but you can invest in Shiba Inu via SIPs.

Is Giottus better than CoinDCX or WazirX?

It depends on your needs. CoinDCX and WazirX offer more coins, higher liquidity, and better charts for active traders. Giottus wins on simplicity, INR support, no withdrawal fees, and beginner-friendly features like SIPs and multi-language support. If you’re new or want a hassle-free experience, Giottus is better. If you’re an active trader, CoinDCX or WazirX are stronger choices.

Does Giottus have a mobile app?

Yes. Giottus has a mobile app available on Google Play and the App Store. It’s rated 4.2 on Trustpilot and 4.1 on Google Play. Users praise the clean interface but criticize missing features like editing open orders, poor charting tools, and a cluttered dashboard with coins they haven’t bought.

Can I stake crypto on Giottus right now?

Not yet. As of December 2025, staking and fixed deposits are listed as upcoming features on Giottus’s app. The company has announced plans to launch these in early 2026. If they deliver, this could make Giottus one of the first Indian platforms to offer passive income on crypto holdings.

Zero fees? Lol. Spread is just a sneaky fee. I’ve lost more on Giottus’s spread than I saved on ‘no fees’. 🤡

I love how Giottus lets my grandma buy BTC with UPI in Tamil. 🌱 That’s real inclusion. Not all platforms care about people like her.

13 coins? You’re kidding me. This isn’t an exchange-it’s a crypto kindergarten. 🤦♂️

They don’t support DOGE? Unforgivable. 😭 This is why India’s crypto scene is still stuck in 2017.

Honestly? If you’re new, Giottus is the best on-ramp in India. No fees on INR, SIPs, local languages? That’s gold. Don’t overthink it. Just start.

The fact that they’re not regulated is a dealbreaker. You’re trusting a company with no legal accountability. That’s not a feature-it’s a liability.

I started with Giottus. Then I moved to Binance. But I still recommend it to my sister who doesn’t know what a wallet is. Sometimes simple is better.

India needs more platforms like this. Not every investor needs leverage or futures. Some just want to buy Bitcoin without getting scammed. Giottus does that.

The claim that they’re ‘built for Indian users’ is laughable. You can’t build a legitimate exchange without compliance, liquidity, or institutional-grade security. This is a glorified P2P gateway.

Been using Giottus for 2 years. Never had an issue with deposits. Support took 8 hours once but fixed it. SIPs saved my budget. Not perfect, but works.

Stop-loss bugs? Bro. I lost $300 because it triggered at the wrong price. Now I use a manual alert. This isn’t finance. It’s roulette with a pretty app.

If you're holding more than a few hundred bucks, move it off exchange. Always. Doesn't matter if they use BitGo. Exchanges aren't banks.

I’ve seen people cry because their account got locked for 12 hours. Giottus has heart, but zero backup plan. They’re like that one friend who says ‘I got you’ then vanishes when you need help.

‘Built for beginners’? More like built for people who don’t know better. Congrats, Giottus-you’ve mastered the art of low expectations.

The absence of regulatory oversight fundamentally undermines the risk-assessment framework of any crypto intermediary operating in a jurisdiction with evolving statutory ambiguity. Their FIU registration is procedural, not substantive.

In Nigeria we laugh at people who think 13 coins is enough. But I get it-India’s different. You don’t need chaos. You need calm. Giottus gives that. Respect.

No Dogecoin. Not even a meme? Sad.

There’s poetry in how Giottus refuses to chase hype. In a world of 500-token exchanges, they quietly serve the quiet ones-the ones who just want to save, not gamble. That’s rare.

Let me tell you something real. I used to think Giottus was just another Indian exchange. Then I saw my uncle-72, speaks only Bengali, never used a smartphone-buy his first 0.001 BTC on it. He cried. Not because it made him rich. Because he finally felt included. That’s not a feature. That’s a revolution. And yeah, the charts suck. The support is slow. But you can’t put a price on dignity. They’re not trying to be Binance. They’re trying to be home.

I just started with Giottus last week. Bought my first ETH. The app felt like a warm hug. No jargon. No panic buttons. Just ‘buy’ and ‘hold’. I’m gonna stick with it until I’m ready for more. And yeah, I’m already saving for the staking launch!

They don’t support DOGE? That’s not a flaw. That’s a virtue. The entire crypto space is drowning in meme noise. Giottus is the only one with the guts to say ‘no’. Respect.