What is Eurite (EURI) crypto coin? Euro-backed stablecoin explained

Eurite (EURI) is a euro-pegged stablecoin launched in 2024 that lets users hold and transfer digital value tied directly to the European euro. Unlike Bitcoin or Ethereum, which swing wildly in price, EURI stays stable-1 EURI always equals 1 euro. This makes it ideal for people in Europe who want to use crypto without risking their money to wild price swings. It’s not meant to be a speculative asset. It’s meant to be money you can use every day, like digital cash backed by real euros.

How Eurite works: 1:1 euro backing

Every single EURI token in circulation is backed by an equal amount of euros held in secure, regulated bank accounts. This isn’t just a claim-it’s verified. Banking Circle, the company behind EURI, holds these euros in fiduciary reserve accounts. They’re not mixed with other funds. They’re locked away, ready to be exchanged for real euros anytime you need them. If you hold 100 EURI, you can redeem them for €100 in cash. That’s the whole point.This 1:1 backing is checked regularly through audits. Unlike some stablecoins that use opaque or complex reserve structures, EURI’s reserves are simple: euros in, tokens out. No algorithmic tricks. No collateralized crypto assets. Just euros. That’s why it’s called an Electronic Money Token (EMT), not just a crypto token. It’s legally treated like digital cash under European law.

Why MiCA compliance matters

Eurite isn’t just another stablecoin. It’s one of the first to fully comply with Europe’s Markets in Crypto-Assets (MiCA) regulation, which came into full effect in 2024. MiCA sets strict rules for transparency, reserve management, and consumer protection across the entire European Economic Area. Most stablecoins before EURI operated in a gray zone. They didn’t follow European financial rules. EURI does.This means if you’re a business or individual in Germany, France, or Spain, you can use EURI with confidence. Regulators know where the money is. Audits are public. The issuer is licensed. There’s no guesswork. That kind of trust opens doors-banks, payment processors, and even government services are more likely to accept MiCA-compliant tokens. It’s not just safer. It’s legally recognized.

Works on Ethereum and BNB Smart Chain

Eurite isn’t stuck on one blockchain. It runs on two: Ethereum (as an ERC-20 token) and BNB Smart Chain (as a BEP-20 token). That gives you options. Ethereum is more secure and widely supported, but gas fees can be high. BNB Smart Chain is cheaper and faster, perfect for small transactions or frequent swaps.Each version has its own unique Digital Token Identifier (DTI) under ISO 24165: V6S4PH8ZL for ERC-20 and T6M9T84LS for BEP-20. These aren’t just random codes-they’re official identifiers used by exchanges and regulators to track the token accurately. Whether you’re trading, sending, or storing EURI, you can pick the network that fits your needs.

Real-world use cases

Eurite isn’t just for traders. It’s built for everyday use. Here’s how people are using it:- European digital payments: Online shops in the EU can accept EURI and avoid USD conversion fees.

- Fast cross-border transfers: Send money from Berlin to Lisbon in minutes, not days, with low fees.

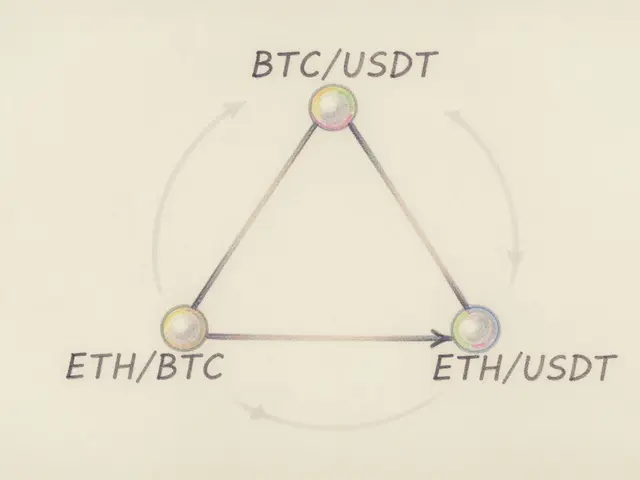

- DeFi lending and borrowing: Use EURI as collateral in decentralized finance apps without worrying about your collateral suddenly losing 20% of its value.

- Business payroll: Companies can pay freelancers in euros using crypto, bypassing traditional banking delays.

- Stable savings: Hold euros digitally without needing a bank account-useful for unbanked or underbanked users in Europe.

Compare that to USDT or USDC. They’re great if you’re dealing in dollars. But if you live in Italy and earn in euros, why tie your digital money to the dollar? You’re still exposed to EUR/USD swings. EURI removes that layer of risk.

Security and transparency

The smart contracts behind EURI were audited by PeckShield, a top blockchain security firm. That means the code has been tested for bugs, exploits, and backdoors. No surprises.Banking Circle also performs regular, independent audits to confirm that the euro reserves match the number of EURI tokens in circulation. These reports aren’t hidden. They’re published for anyone to see. That’s rare in crypto. Most stablecoins don’t show you their bank statements. EURI does.

Plus, MiCA forces full disclosure. You know who issued it. You know where the money is. You know how often it’s checked. That’s not just good practice-it’s the law.

Where to buy and store EURI

You can buy EURI on over 30 crypto exchanges. Popular platforms like ChangeNOW let you swap Bitcoin, Ethereum, or even fiat for EURI in minutes. There’s no need to go through a full KYC process on every platform-some allow small purchases without ID.For storage, use wallets that support ERC-20 and BEP-20 tokens. NOW Wallet is a popular choice because it’s simple, secure, and lets you manage multiple assets in one place. You can also use MetaMask, Trust Wallet, or any wallet that supports Ethereum and BNB Smart Chain.

Don’t store EURI on exchanges long-term. Use a private wallet. That’s the golden rule of crypto security.

Market data as of January 2026

As of early 2026, EURI has a circulating supply of about 50.6 million tokens. Its price hovers around $1.17 USD, which reflects the current exchange rate between the euro and the dollar. That’s not a flaw-it’s proof the peg works. When the euro strengthens against the dollar, EURI’s USD value rises. When the euro weakens, it drops. That’s exactly how a 1:1 euro peg should behave.Daily trading volume is over $8.5 million across 31 trading pairs. That’s healthy for a new stablecoin. It means liquidity is good-buying and selling is easy without big price swings. Daily price movement is under 0.01%, which is near zero. That’s stability.

How EURI compares to other stablecoins

| Feature | Eurite (EURI) | Tether (USDT) | USD Coin (USDC) | DAI |

|---|---|---|---|---|

| Pegged to | EUR (euro) | USD (US dollar) | USD (US dollar) | USD (US dollar) |

| Backing | 1:1 euro reserves | Mixed reserves (cash, bonds, crypto) | 1:1 USD reserves | Overcollateralized crypto |

| Regulation | MiCA compliant (EU) | Not MiCA compliant | Partially compliant | No central issuer |

| Blockchains | Ethereum, BSC | Many (Ethereum, Tron, Solana) | Ethereum, Solana, others | Ethereum, Polygon |

| Transparency | Public audits, regulated issuer | Opaque reserve disclosures | Monthly attestation reports | Algorithmic, no central control |

| Best for | European users avoiding USD exposure | Global liquidity, high volume | US-centric users, regulated environments | Decentralized finance purists |

EURI stands out because it’s the only major stablecoin built specifically for Europe, with full regulatory backing. If you’re in the EU and want to use crypto without touching the dollar, it’s the only real option.

Future outlook

Eurite’s early MiCA compliance gives it a big advantage. As more European banks and fintech firms move into crypto, they’ll need compliant tools. EURI is already there. Expect to see it integrated into digital wallets, payment gateways, and even public services in the next few years.The European DeFi scene is growing fast. Right now, most DeFi apps use USDC or DAI. But as more European users join, demand for euro-denominated assets will rise. EURI is positioned to become the default stablecoin for EU-based DeFi, lending, and trading.

It’s not going to replace the euro. But it might replace the need to convert euros to dollars just to use crypto. That’s a big deal.

Is Eurite (EURI) a good investment?

Eurite isn’t designed as an investment. It’s a stablecoin, so its value stays near €1. You won’t get rich from price gains. But if you live in Europe and want to avoid USD volatility while using crypto, EURI is one of the safest ways to hold digital euros. Think of it as digital cash, not a stock.

Can I redeem EURI for real euros?

Yes. Every EURI token is backed by a euro held in reserve. You can redeem it for euros through authorized channels managed by Banking Circle. This isn’t theoretical-it’s legally required under MiCA. The redemption process is being rolled out gradually to exchanges and wallet providers.

Is EURI safer than USDT or USDC?

For European users, yes. EURI is regulated under MiCA, which demands full reserve transparency and independent audits. USDT has faced scrutiny over its reserve composition, and USDC, while more transparent, is still tied to the dollar. If you’re in Europe and want to avoid USD exposure, EURI is the safer, more direct option.

Why is EURI priced at $1.17 if it’s pegged to the euro?

Because the euro is worth $1.17 against the US dollar right now. EURI is pegged to the euro, not the dollar. So when the euro rises or falls against the dollar, EURI’s USD price moves accordingly. That’s normal and expected. It proves the peg is working correctly.

Can I use EURI outside the EU?

Yes. You can send and trade EURI anywhere in the world. But its real advantage is for people in Europe who want to avoid USD exposure. Outside the EU, USDT or USDC might be more widely accepted. EURI’s regulatory edge only matters where MiCA applies.

What happens if Banking Circle goes bankrupt?

The euro reserves backing EURI are held in segregated fiduciary accounts, separate from Banking Circle’s own assets. Even if the company fails, those euros are protected and can still be redeemed by token holders. MiCA requires this structure to protect users. Your euros aren’t at risk from the issuer’s financial health.

This is just Europe trying to be special again. Why should I care about a euro stablecoin when USDC and USDT work everywhere? You're just creating more fragmentation in crypto. Pathetic.

EURI as an EMT under MiCA represents a paradigm shift in tokenized fiat infrastructure. The segregated fiduciary custody model via Banking Circle is a regulatory innovation that preempts the opacity issues plaguing USDT's reserve composition. The ISO 24165 DTI standardization is non-trivial for cross-chain reconciliation.

Yessss!! Finally someone gets it!! 🙌 EURI is the answer for Europeans who are tired of being forced into USD-based systems. This is financial sovereignty in action!! 💪🔥

Oh great, another 'regulated' stablecoin. Let me guess - the auditors are paid by the issuer and the 'transparency' is just a PR stunt. You think MiCA makes this safe? LOL. You're just trusting a bank again. Crypto is supposed to be trustless.

I love how this is actually designed for real people, not just speculators!! 🌍✨ It’s not about getting rich overnight - it’s about having stable, reliable digital money that doesn’t make your savings vanish because of some dollar fluctuation. This is what crypto should be!!

Another euro fantasy. The dollar rules. Everyone uses USD. This is just a vanity project for bureaucrats who think they can outsmart the market. Waste of time.

This is very important development for Africa too because many of us use euros for trade with Europe and this makes transactions easier without currency conversion fees. Thank you for making this accessible

Is stability really freedom? Or just a different kind of cage? If we build financial systems that avoid volatility, are we just avoiding the truth that all value is subjective? Maybe the real revolution isn't in pegging to a currency - but in letting go of pegs entirely.

You people are missing the point entirely. EURI isn't just a stablecoin - it's a geopolitical tool. The EU is trying to break the dollar's dominance in digital finance by creating a compliant, regulated alternative that forces banks and fintechs to adopt euro-denominated infrastructure. This isn't about convenience - it's about sovereignty. And yes, the fact that it runs on Ethereum and BSC means it's not just another central bank digital currency clone - it's a hybrid model that leverages decentralized infrastructure while maintaining centralized legal accountability. That's the real innovation here. Most people don't get that because they're too busy yelling about 'trustless' nonsense.

I mean… it’s kinda cute that they made a euro stablecoin. Like, good for them. But I still use USDC because it’s everywhere. And honestly? I don’t care if it’s pegged to the dollar. I just want it to work.

OMG I can’t believe someone actually wrote a whole article about this. Like, who even uses this?? I tried to buy EURI once and my wallet crashed. Now I just use USDT and pretend I’m not emotionally attached to my crypto portfolio. 😭

This is a well-structured and informative article. For users in developing economies, having a euro-backed stablecoin accessible via BNB Smart Chain reduces transaction costs significantly. It is a practical solution for cross-border remittances.

I’ve been waiting for something like this for years. I run a small business in South Africa and I get paid in euros from EU clients. Before EURI, I had to convert to USD first, then to rand - losing 8% every time. Now I can receive EURI directly, hold it, and convert when I want. No more middlemen. No more fees. This is the future. Thank you to the team behind this. You’ve changed my life.

I’ve been using EURI for my freelance payments and it’s been smooth as butter. No weird delays, no surprise fees. I used to hate dealing with banks but now I just send EURI and call it a day. Seriously, if you’re in Europe and you’re still using USD stablecoins - just try this once.

Bro this is actually the real deal. I’m from India and I work with EU clients - I used to lose money every time the dollar moved. Now I get paid in EURI and I just hold it until I need euros. No stress. No guesswork. Just clean, simple money. Crypto finally got it right.

MiCA compliance is just regulation by another name. You think auditors are gonna catch anything? The system is still centralized. The reserves are still held by a single company. You’re not safer - you’re just more controlled. And don’t even get me started on the USD price being $1.17. That’s not stability - that’s volatility dressed up in a suit.

Interesting. I’m from the UK and while we’re not in the EU anymore, I still find EURI useful for cross-border payments with EU partners. The transparency is refreshing compared to the usual crypto opacity. Not perfect, but a step in the right direction.

I’m so tired of people acting like this is revolutionary. It’s just a bank account with a blockchain label. You’re still trusting a corporation. You’re still dependent on the euro. Where’s the rebellion? Where’s the decentralization? This isn’t crypto - it’s fintech cosplay.

I just tried redeeming my EURI for euros and it took 48 hours. Not bad, but not instant. I expected better. Still, the fact that it’s possible at all is huge. I’ll give it another shot next time.

EURI? More like E-UR-I-need-a-nap. Why would I use this when I can just buy USDC on Coinbase and sleep at night? This feels like a government project trying to look cool. Boring.

The technical documentation for EURI is exemplary. The use of ISO 24165 for Digital Token Identifiers ensures regulatory interoperability across jurisdictions. The audit trail from PeckShield and Banking Circle provides verifiable proof of reserve integrity. This is the gold standard for tokenized fiat.

Let’s be real - EURI’s market cap is 0.1% of USDC’s. The trading volume? A joke. This isn’t a competitor. It’s a footnote. People are gonna keep using USDT because it’s liquid. No amount of MiCA compliance changes that.