Non-Custodial Crypto Wallets in Restricted Countries: Take Back Control

When your government blocks crypto exchanges, freezes bank accounts, or shuts down access to platforms like Binance or Coinbase, your money isn’t safe just because it’s digital. It’s only safe if you control it. That’s where non-custodial crypto wallets come in - not as a luxury, but as a lifeline.

What Exactly Is a Non-Custodial Wallet?

A non-custodial wallet is software or hardware that puts you in charge of your private keys. No middleman. No bank. No exchange holding your crypto for you. If you lose your private key or recovery phrase, there’s no customer service line to call. No one can reverse a transaction. No one can freeze your balance. That’s the trade-off: total control, total responsibility.This isn’t theoretical. In countries like Nigeria, Iran, Venezuela, and parts of Southeast Asia, people use non-custodial wallets because they have no other choice. When local exchanges get shut down, or when banks refuse to process crypto-related payments, these wallets are the only way to hold, send, and receive digital assets without asking permission.

Think of it like carrying cash in your pocket instead of keeping it in a bank. The bank can close your account. The government can seize it. But cash? You hold it. You control it. Non-custodial wallets are the digital version of that.

How They Work in Restricted Environments

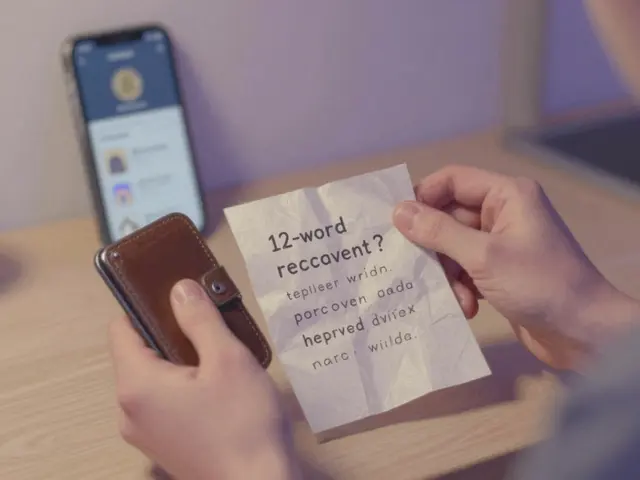

In restricted countries, custodial wallets - the kind offered by exchanges like Binance or Kraken - are dangerous. Why? Because those platforms hold your keys. If the government pressures the exchange, they can freeze your account. They can force the exchange to hand over user data. They can block withdrawals. We saw this happen with FTX in 2022. Over $8 billion in customer funds vanished because the company controlled everything.Non-custodial wallets avoid that entirely. You don’t sign up with an email. You don’t upload ID. You don’t go through KYC. You download an app like MetaMask or Trust Wallet, generate a 12- or 24-word recovery phrase, and you’re done. That phrase is your key. That’s it. No one else has it. No one else can touch your money.

That’s why users in restricted countries rely on these wallets. One Reddit user from Nigeria wrote: “In my country where exchanges are banned, MetaMask is my only gateway to DeFi.” That’s not an exception. It’s the norm for thousands.

Types of Non-Custodial Wallets and What Works Best

There are three main types of non-custodial wallets, each with pros and cons in restricted settings:- Mobile apps (MetaMask, Trust Wallet): Easy to install, free, and work on Android and iOS. Good for beginners and small amounts. But if your phone is lost, stolen, or seized, you’re at risk unless you’ve backed up your phrase securely.

- Browser extensions (MetaMask, Coinbase Wallet): Great for interacting with decentralized apps (dApps) like Uniswap or PancakeSwap. You need a browser that isn’t blocked - which means many users pair these with VPNs to bypass censorship.

- Hardware wallets (Ledger Nano S, Ledger Nano X): These are physical devices that store your keys offline. They cost $79-$149, but they’re the most secure option. Even if your computer is hacked, your crypto stays safe. In high-risk environments, this is the gold standard.

For anyone holding more than a few hundred dollars’ worth of crypto in a restricted country, a hardware wallet isn’t optional - it’s essential. Ledger’s devices, for example, sign transactions offline. That means your private key never touches the internet. Even if you’re using a compromised computer, your funds stay protected.

The Real Risks: No Safety Net

Here’s the hard truth: if you lose your recovery phrase, your crypto is gone forever. No one can help you. Not the wallet maker. Not the blockchain. Not the police.There are stories everywhere. One user on Reddit lost $3,200 when they moved countries and accidentally deleted their backup. Another forgot their phrase after writing it on a sticky note that got thrown out. These aren’t rare cases. They’re common.

In restricted countries, the risks are even higher. You can’t just call support. You can’t find a local crypto meetup. Educational resources are often censored. Many users don’t know how to verify smart contract addresses, leading to phishing scams that drain wallets in seconds.

Security practices are non-negotiable:

- Write your recovery phrase on paper. Never store it digitally.

- Keep multiple copies in separate, secure locations.

- Use a hardware wallet for anything over $500.

- Never enter your phrase into a website - even if it looks real.

- Use a VPN to access wallet sites if they’re blocked in your country.

There’s no shortcut. This isn’t like setting up a bank account. This is like learning to carry a loaded gun - you need to understand every risk before you use it.

Why People Still Use Them Despite the Risks

The answer is simple: the alternative is worse.In countries with capital controls, inflation, or political instability, crypto isn’t about speculation. It’s about survival. People use non-custodial wallets to:

- Send money to family abroad without going through state-controlled banks.

- Receive payments for freelance work when PayPal and Stripe are blocked.

- Buy goods and services using crypto marketplaces that bypass local currency collapse.

- Store value when their national currency is losing 50% of its value in a year.

According to DappRadar, over 85 million people used non-custodial wallets in mid-2024. That number is growing fastest in places where financial freedom is under threat. It’s not about being tech-savvy. It’s about being desperate enough to learn.

What’s Changing in 2026?

The technology is getting better. Ledger now offers Shamir Backup - a system that splits your recovery phrase into five parts. You only need three to restore your wallet. That’s a game-changer for people who can’t risk losing one copy.Multi-signature wallets are also gaining traction. These require two or more people (or devices) to approve a transaction. Imagine a husband and wife each holding one key. Neither can move the funds alone. That’s powerful for families in high-risk zones.

But here’s the catch: none of these improvements are being marketed specifically to restricted countries. There’s no official support program. No government-friendly version. No localized help center. Everything is built by developers, used by users, and spread through word of mouth.

Is This for You?

If you live in a country where:- Crypto exchanges are banned or unreliable

- Banks freeze accounts linked to crypto

- Government surveillance is high

- You need to send or receive money without permission

…then a non-custodial wallet isn’t just useful - it’s necessary.

But if you’re new to crypto, don’t jump in. Spend 10-40 hours learning first. Watch tutorials. Read guides. Practice with small amounts. Test sending $5 to a friend. Learn how to check transaction confirmations. Understand what a gas fee is. If you’re not ready to be your own bank, wait.

There’s no shame in starting slow. The goal isn’t to get rich. It’s to stay in control.

Final Thought: Sovereignty Is a Skill

Non-custodial wallets don’t make you rich. They don’t guarantee safety. They don’t fix broken governments.But they give you something no bank, no exchange, and no regulator can take away: ownership.

In a world where financial power is concentrated in the hands of institutions, these wallets are the closest thing to digital autonomy. They’re not perfect. They’re not easy. But for millions of people in restricted countries, they’re the only way to keep their money - and their freedom - intact.

I've been using MetaMask since Nigeria's ban hit. My cousin in Lagos sends me crypto to buy meds when the naira crashes. No bank, no problem. Just keep your phrase safe and you're golden. 🙌

In India we dont have full ban but banks block crypto payments all the time. Trust wallet with vpn is my only way to get paid for freelance work. No one helps you if you mess up but at least your money is yours.

This whole thing is just crypto bros romanticizing financial recklessness. You think people in Venezuela are using wallets because they’re empowered? They’re desperate. And now they’re getting scammed by fake airdrops daily. This isn’t freedom-it’s exploitation dressed up as tech.

Let’s be real-non-custodial wallets aren’t about freedom, they’re about avoiding responsibility. You want to be your own bank? Fine. But then stop complaining when you lose your seed phrase because you took a screenshot on your phone. There’s no such thing as ‘digital cash’ without the discipline of physical cash. You don’t get to have the benefits of decentralization and still expect someone to fix your dumb mistakes.

It’s funny how we call this ‘sovereignty’ like it’s some noble revolution. But really, it’s just people trying to survive systems designed to break them. The real tragedy isn’t the lost keys-it’s that the only way to protect yourself from oppression is to become a cryptographer at 3am while your kid sleeps next to you. No one’s handing out manuals. No one’s funding help desks. We’re just… figuring it out.

I got my dad a Ledger for his birthday. He’s 68 and thought it was a USB drive at first. Took me 3 weeks to get him to write down the phrase. Now he sends crypto to his sister in Mexico. He says it’s the first time he’s felt like he’s not at the mercy of banks. That’s worth the hassle.

Anyone else think this is all a CIA psyop? Crypto wallets are perfect for tracking people under the guise of ‘freedom’. You think your seed phrase is private? The NSA has every single one of them already. They just let you think you’re safe so they can map your network. Look at how many ‘decentralized’ apps are hosted on AWS. It’s all a lie.

In South Africa, we’ve been living with this for years. Your bank can freeze your account for ‘suspicious activity’ just because you bought ETH. So yeah, we use MetaMask. We use hardware wallets. We use VPNs. We memorize our phrases. We make backups in different cities. And yes, we’ve lost friends to scams. But we’re still here. And we’re not waiting for permission to survive. This isn’t a tech trend-it’s a resistance movement.

The notion that non-custodial wallets are a ‘lifeline’ is both misleading and dangerous. It ignores the fact that most users in these regions lack basic financial literacy. The result? Millions of dollars lost to phishing, malware, and social engineering. This is not empowerment-it is negligence masquerading as innovation.

Bro I know a guy in Lucknow who used to work for a crypto exchange. Got fired when they got shut down. Now he uses Trust Wallet to get paid for teaching kids coding. He says he didn’t even know what a private key was a year ago. Now he teaches his neighbors how to backup phrases on paper. It’s wild. No one gave him a manual. He just figured it out. That’s the real story here.

You people act like this is some kind of civil rights victory but the truth is most of these wallets are built by Americans who don’t live under sanctions and have no idea what it’s like to have your phone seized at a checkpoint. You’re not helping. You’re just selling a product to desperate people and calling it liberation

If you don’t back up your seed phrase properly you deserve to lose everything and honestly why are you even here if you think crypto is a good idea in the first place

For beginners: Always test with 0.001 ETH first. Send to a friend. Wait for 3 confirmations. Check the address on Etherscan. If it matches, you’re good. Never skip this. I’ve seen too many people lose everything because they rushed. You’re not late. You’re just being smart. 💪

I spent 6 months learning this stuff before touching any real money. Watched videos in Spanish, read Reddit threads from Nigeria, practiced on testnets. Now I help my uncle in Guatemala send remittances. It’s not glamorous. But it’s real. And it works.

I’m so proud of how people are taking control. Even if they mess up, they’re trying. That’s more than most people do when they just accept the system. I’ve seen a 70-year-old woman in Ohio learn to use MetaMask to send crypto to her grandson in Ukraine. She cried when it worked. That’s the future right there.

This is exactly why I hate crypto. It’s a tool for the rich to exploit the poor. People in Venezuela don’t need wallets-they need food. You think a Ledger is going to stop inflation? It’s just a distraction. The real problem is capitalism, not banks.

The most overlooked aspect of non-custodial wallets is their role in preserving cultural and familial financial autonomy. In communities where traditional banking excludes or surveils, these tools allow for intergenerational wealth transfer without institutional mediation. A grandmother in Jakarta can send Bitcoin to her granddaughter in Toronto without needing a passport or a SWIFT code. This is not merely financial-it is relational sovereignty.

I used to think this was cool until my cousin lost $12k because he typed his phrase into a fake website. Now I just laugh at people who call this freedom. It’s just gambling with your life savings and pretending it’s activism.

I work in IT in Brazil. Every week someone comes in with a phone full of crypto scams. They think MetaMask is like PayPal. They don’t know what a seed phrase is. We fix their phones. We wipe them. We tell them to stop. But they still go back. Because they’re scared of the bank. And honestly? I get it.

The real issue isn’t the wallets-it’s the fact that governments are so terrified of decentralization that they’re willing to crush entire economies to maintain control. If you’re not outraged by this, you’re not paying attention. This isn’t about crypto. It’s about who owns your future.

You people act like this is some grassroots revolution. But let’s be honest-most of these wallets are built by Silicon Valley startups with VC money. They’re not trying to empower the oppressed. They’re trying to make money off the oppressed. Don’t confuse exploitation with emancipation.

I read this whole thing and I’m just wondering why anyone would risk their life savings on something that can vanish because you accidentally deleted a text message? Like… why not just… get a job? Or move? Or… I don’t know… not be so reckless?

They’re not just using wallets-they’re being tracked by blockchain analytics firms that sell data to intelligence agencies. Every transaction is logged. Every IP is pinned. This isn’t freedom. It’s the next generation of digital surveillance. And you’re all just handing over your data with a smile.