Stablecoin Use Cases Beyond Trading: Real‑World Applications

Stablecoin Use Case Explorer

Discover how stablecoins are transforming financial interactions across industries. Select a category to explore specific use cases.

How Stablecoins Are Changing Finance

Stablecoins bridge the gap between traditional finance and the digital economy, offering speed, transparency, and accessibility. From enabling fast global remittances to powering decentralized lending protocols, stablecoins are redefining how we think about money.

When people hear "stablecoin" they usually picture a crypto trader swapping USDC for ETH. But the reality is far richer. Stablecoins now power everyday payments, help businesses move money across oceans, and even let creators get paid the second they finish a song. This article walks through the most compelling stablecoin use cases that go beyond pure speculation, showing how the technology is reshaping finance for consumers, enterprises, and emerging markets.

What a Stablecoin Actually Is

Stablecoin is a digital asset pegged to a reserve asset like the US dollar, euro, or a basket of currencies, designed to keep its price stable. By anchoring value to a trusted reserve, stablecoins give crypto the predictability of fiat while retaining the speed and programmability of blockchain. The market now tops $220billion, a sign that users are finding genuine utility, not just a trading shortcut.

Cross‑Border Payments and Remittances

Traditional international wires can take days and cost 5‑10% in fees. Stablecoins cut out correspondent banks, settle in minutes, and usually charge under 1%.

- Businesses in Africa and Southeast Asia use stablecoins to pay overseas suppliers, avoiding the double‑conversion of local currency → USD → local currency.

- Migrant workers send USDC directly to family wallets, bypassing money‑transfer operators that charge upwards of 8%.

- Enterprise payroll platforms embed stablecoins to settle salaries in real‑time, eliminating month‑end lag.

Because the blockchain settles 24×7, cash‑flow bottlenecks shrink dramatically, giving small merchants a liquidity lifeline that traditional banks simply can’t match.

DeFi Collateral, Lending, and Liquidity Provision

In the decentralized finance arena, stablecoins are the backbone of most protocols.

- Lending platforms like Aave and Compound accept USDC or DAI as collateral, allowing users to borrow crypto without worrying about price swings.

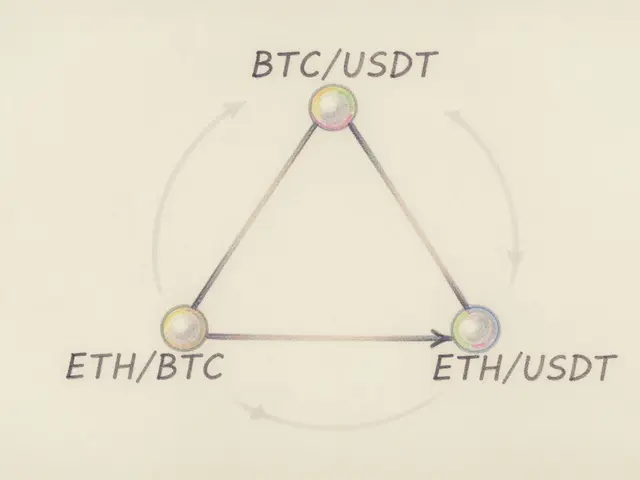

- Liquidity pools on Uniswap or Curve use stablecoins to create low‑slippage trading pairs, which in turn fuels arbitrage opportunities for everyday traders.

- Yield farms reward participants in stablecoins, providing a predictable return that can be reinvested without exposure to market volatility.

These mechanisms turn otherwise idle crypto holdings into productive capital, expanding the overall efficiency of the crypto ecosystem.

E‑Commerce and Merchant Payments

Over 15,000 online stores already accept Bitcoin, but most shy away from crypto because of price volatility. Stablecoins solve that problem.

- Checkout integrations (e.g., Coinbase Commerce, BitPay) let merchants receive USDC instantly, with conversion to fiat occurring at the point of settlement.

- Transaction fees hover around 0.5%-significantly lower than the 2‑3% charged by credit‑card processors.

- Funds settle in seconds, giving sellers immediate access to cash for inventory replenishment.

For digital‑first businesses, that speed and cost advantage translates directly into a healthier bottom line.

Enterprise Treasury and B2B Payments

Large corporates treat cash as a strategic asset. Stablecoins bring new capabilities to treasury teams.

- Inter‑bank settlements via stablecoins reduce settlement risk and enable same‑day finality.

- Cash‑management platforms hold USDC in high‑yield accounts, earning up to 4% APY while retaining liquidity.

- Supply‑chain finance can be automated: once a shipment is confirmed on‑chain, a smart contract releases the stablecoin payment to the supplier.

Matthew Blumenfeld of PwC has highlighted stablecoins as a possible settlement currency for capital‑market transactions, underscoring growing institutional confidence.

Programmable Money & Real‑Time Streaming

Smart contracts turn money into code. Platforms like Superfluid let you stream stablecoins continuously.

- Freelancers receive a per‑second payout for hours billed, eliminating the “wait‑for‑invoice” cycle.

- Subscription services can charge users exactly for the time they consume, down to the minute.

- Music platforms such as Audius use USDC to pay artists automatically as listeners stream tracks.

This “money‑as‑data” model opens business models that were previously impossible, from pay‑as‑you‑go SaaS to on‑demand content royalties.

Financial Inclusion in Emerging Economies

In countries where inflation erodes local currency or banking infrastructure is scarce, stablecoins become a reliable store of value.

- Venezuelan workers use USDC to preserve purchasing power and to transact internationally.

- Micro‑entrepreneurs in Kenya accept stablecoins via mobile wallets, bypassing the need for a traditional bank account.

- Remittance corridors that once cost 7% now see costs dip below 2% when stablecoins are used.

Because stablecoins are globally accessible, anyone with a smartphone can participate in the digital economy.

Supply‑Chain Financing & SME Funding

SMEs often struggle to secure working capital. Stablecoin‑based financing protocols address that gap.

- Factoring platforms issue invoice‑backed stablecoin loans, releasing cash to suppliers within hours.

- Smart contracts trigger payments when IoT sensors confirm delivery, reducing disputes and fraud.

- Tokenized inventory can be used as collateral for stablecoin loans, unlocking value stuck in physical assets.

The transparency of blockchain trails also improves credit assessment, giving lenders confidence to extend more favorable terms.

Loyalty Programs and Consumer Rewards

Traditional point systems lock value within a single brand. Stablecoin‑backed rewards are portable.

- Airlines issue USDC‑based travel credits that can be spent on partner hotels or even exchanged for fiat.

- Gaming platforms let players earn stablecoin tokens that can be cashed out or used across multiple games.

- Retail chains experiment with “cash‑back” in stablecoins, letting shoppers decide how to spend their reward.

This interoperability boosts engagement because users feel true ownership of their rewards.

Peer‑to‑Peer (P2P) Payments

For everyday transactions, stablecoins act like a digital cash app.

- Friends split a dinner bill by sending a few USDC via a wallet app-no need for a bank account.

- Community groups in remote regions use stablecoins to fund collective purchases, avoiding cash‑handling risks.

- Mobile money services integrate stablecoins to provide a low‑cost alternative to SMS‑based transfers.

The key advantage is speed: funds appear instantly, not after a banking cut‑off period.

Risks, Compliance, and the Regulatory Landscape

Stablecoins are not a free‑pass. Users must watch for:

- Reserve transparency - does the issuer publish regular attestations?

- Regulatory classification - some jurisdictions treat stablecoins as securities, others as money‑transmission services.

- Smart‑contract bugs - even a perfectly stable peg can be compromised by flawed code.

Regulators worldwide are moving toward clearer frameworks. In the U.S., the Treasury’s “Stablecoin Act” (expected 2025) will set capital‑reserve requirements, while the EU’s MiCA regime already mandates audited reserves. Forward‑looking businesses are already building compliance layers into their stablecoin pipelines to stay ahead of the curve.

Choosing the Right Stablecoin for Your Use Case

Not all stablecoins are created equal. Below is a quick comparison of the most widely adopted options.

| Stablecoin | Peg | Reserve Type | Market Cap (B) | Transparency Rating* |

|---|---|---|---|---|

| USDC | USD | Cash & short‑term Treasuries | 53 | ★★★★★ |

| USDT | USD | Mixed (cash, commercial paper, crypto) | 71 | ★★★★☆ |

| DAI | USD (soft‑peg) | Over‑collateralized crypto | 7 | ★★★★☆ |

| BUSD | USD | Cash & FDIC‑insured deposits | 15 | ★★★★★ |

*Transparency rating reflects frequency of third‑party audits and public attestations.

Getting Started: Practical Steps

- Identify the most relevant use case for your operation (e.g., cross‑border payroll, e‑commerce checkout, DeFi collateral).

- Select a stablecoin that matches regulatory and liquidity needs - USDC for highest audit confidence, DAI if you prefer all‑crypto backing.

- Open a custodial or non‑custodial wallet that supports the chosen chain (Ethereum, Solana, Polygon).

- Integrate a payment API or smart‑contract library; most providers offer SDKs for JavaScript, Python, and Java.

- Run a pilot with a small transaction volume, monitor settlement times, fees, and audit reports.

- Scale up and embed compliance checks (KYC/AML) as required by your jurisdiction.

Following this roadmap lets you capture the efficiency gains of stablecoins while keeping risk under control.

Future Outlook

Stablecoins are transitioning from a niche crypto tool to mainstream financial infrastructure. Expect deeper integration with traditional banking APIs, more central‑bank digital currency (CBDC) bridges, and industry‑wide standards for reserve reporting. As the ecosystem matures, the line between “crypto” and “real‑world finance” will blur, and stablecoins will sit at the intersection.

Frequently Asked Questions

Can I use stablecoins without owning any crypto?

Yes. Many wallets let you buy USDC directly with a credit card or bank transfer, so you never have to hold Bitcoin or Ethereum first.

Are stablecoins really stable?

Most major stablecoins maintain a deviation of less than 0.1% from their peg, thanks to daily reserve audits and algorithmic mechanisms.

Which stablecoin is best for business settlements?

USDC is often preferred for enterprise use because of its high transparency rating, regulatory clarity, and wide‑scale support across payment processors.

Do stablecoins incur capital gains tax?

In most jurisdictions, a stablecoin is treated like cash. You only owe tax when you convert it to a different currency or asset and realize a gain.

How do I ensure the reserve backing is real?

Look for regular third‑party attestations, audit reports, and real‑time reserve dashboards provided by the issuer. USDC, for example, publishes daily reserve reports on its website.

Stablecoins are just a glorified ponzi scheme masquerading as digital cash.

Anyone who pretends stablecoins are a Western invention ignores that Africa has been pioneering on‑ramps for years. The continent’s diaspora relies on USDC to bypass predatory remittance fees that can exceed 8 percent. By using a dollar‑pegged token, families receive more of their hard‑earned money in minutes instead of weeks. It also forces banks to modernize or become irrelevant. The technology is neutral; it’s the policies that decide who benefits.

stablecoins are getting used for everyday stuff like buying coffee and paying freelancers it’s kind of wild how fast the adoption is growing

When you look at the mosaic of financial innovation, stablecoins splash bright colors across the canvas of commerce. They act like a bridge of liquid glass, transparent yet sturdy, letting value flow without the usual friction. It’s fascinating how a token tied to a fiat can still feel like the wild west of code.

Stablecoins have moved beyond speculative trading and now serve as a practical bridge between fiat and blockchain. Their price stability makes them suitable for everyday transactions, eliminating the volatility risk that deters many users. In cross‑border remittances, they cut settlement times from days to minutes while keeping fees under one percent. Enterprises can hold stablecoins in treasury accounts to earn modest yields without sacrificing liquidity. Supply‑chain participants benefit from programmable payments that trigger automatically upon delivery confirmation. DeFi platforms rely on stablecoins as collateral, enabling borrowers to access liquidity without exposing themselves to market swings. Merchants adopting stablecoin checkout enjoy instant settlement, reducing cash‑flow gaps. Financial inclusion initiatives leverage mobile wallets to bring low‑cost, stable digital cash to unbanked populations. Regulators are beginning to craft frameworks that require transparent reserve attestations, boosting confidence. The growing ecosystem of custodial and non‑custodial wallets gives users flexibility in how they store assets. Smart‑contract based streaming payments open new business models for freelancers and subscription services. By integrating stablecoins with existing ERP systems, companies can automate inter‑company transfers. Audit trails on the blockchain improve credit assessments for SME financing. Interoperability standards are emerging, allowing stablecoins to move seamlessly between private and public ledgers. Overall, the utility curve of stablecoins is steepening as more real‑world use cases mature.

Here’s a quick starter guide: pick USDC for the best audit transparency 👍, set up a wallet that supports ERC‑20 or Solana, use an API like Stripe for crypto to handle checkout 🚀, and run a tiny pilot to monitor fees and settlement speed. It’s surprisingly simple once you have the right tools.

The liquidity provisioning mechanisms inherent in USD‑pegged stablecoins facilitate on‑chain settlement layers, thereby reducing counterparty exposure. When integrating with KYC/AML compliance stacks, ensure real‑time attestations of reserve backing to mitigate systemic risk. The tokenomics model also supports yield‑bearing vaults that can be leveraged for treasury optimization.

One might argue that the philosophical underpinnings of digital fiat challenge traditional monetary sovereignty, yet the pragmatic benefits of near‑instant settlement cannot be dismissed.

It’s great to see communities experimenting with stablecoin micro‑payments; keep the momentum and share any lessons learned with the broader group.

Sure, stablecoins sound cool, but the hype will fade once the novelty wears off.

While the technical merits of stablecoins are evident, it is incumbent upon us to scrutinize their ethical implications, particularly concerning access equity and potential regulatory arbitrage.

Anyone still doubting stablecoins needs to wake up; the data shows undeniable adoption across sectors.

Exciting times ahead! The more businesses try out stablecoins, the faster we’ll see real‑world efficiencies take shape.

Absolutely, the integration of programmable finance modules can accelerate ROI by reducing reconciliation lag and unlocking new revenue streams.

Glad you see the upside! 😊 Let’s keep sharing best practices so everyone can benefit from smoother cash flows.

Thanks for the diverse perspectives, everyone. It’s clear stablecoins are reshaping finance in many ways.