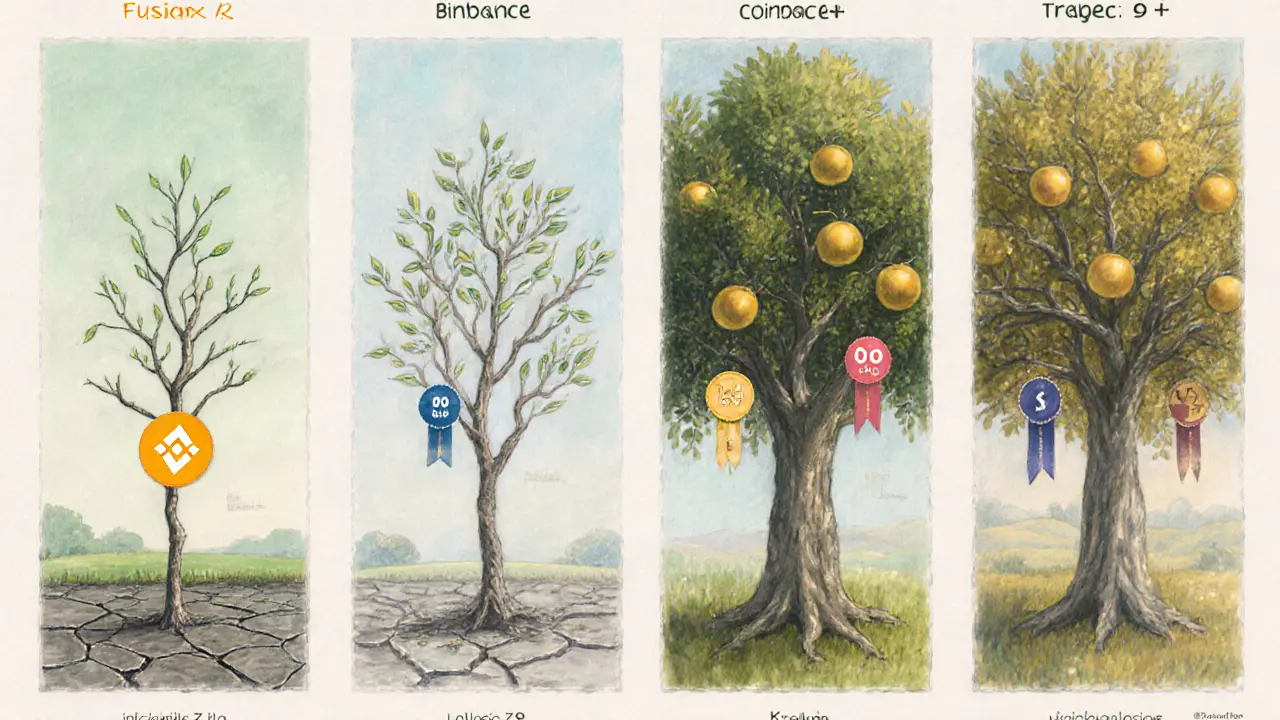

FusionX v2 Crypto Exchange Review - Risks, Liquidity & Alternatives

Crypto Exchange Comparison Tool

FusionX v2

- Assets 2

- Trading Volume $0

- Trust Score 0

- Liquidity Poor

- Community None

Binance

- Assets ~600

- Trading Volume $120B

- Trust Score 9.8

- Liquidity Excellent

- Community Large

Coinbase

- Assets ~400

- Trading Volume $15B

- Trust Score 9.5

- Liquidity Good

- Community Strong

Kraken

- Assets ~300

- Trading Volume $8B

- Trust Score 9.2

- Liquidity Good

- Community Active

Why FusionX v2 Is Risky

- Only 2 assets supported (USDT and 27/WMNT)

- Zero trading volume in the last 30 days

- Trust score of 0 (lowest possible)

- No active user community or development roadmap

- Lack of security audits or transparency

Recommendation: Avoid FusionX v2 for real trading. Use Binance, Coinbase, or Kraken instead.

Exchange Comparison Summary

| Feature | FusionX v2 | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Assets | 2 | ~600 | ~400 | ~300 |

| Trading Volume (30d) | $0 | $120B | $15B | $8B |

| Trust Score | 0 | 9.8 | 9.5 | 9.2 |

| Liquidity | Poor | Excellent | Good | Good |

Recommended Alternatives

- Binance: Best for high-volume traders with deep liquidity

- Coinbase: Great for beginners with strong security and support

- Kraken: Ideal for privacy-focused users with robust security

All alternatives have trust scores above 9, active communities, and transparent operations.

Key Takeaways

- FusionX v2 supports only 2 cryptocurrencies and showed zero trades in the last 30 days (Sep2025).

- CoinGecko gives it a trust score of 0 - the lowest possible rating.

- Liquidity is practically non‑existent; price discovery is unreliable.

- No verified user community or active development road‑map.

- For any real trading, stick with established platforms such as Binance, Coinbase or Kraken.

When you type “FusionX v2 crypto exchange review” into a search box, you’re probably trying to decide whether to trust this platform with your crypto funds. The short answer: the risks outweigh any potential upside. Below we break down every angle that matters - from the technical basics to the red‑flag warning signs - so you can make an informed call.

FusionX v2 is a non‑centralized cryptocurrency exchange launched in 2018. It claims to offer a decentralized trading environment, but as of September2025 it lists only two tradable assets and registers zero transactions over the past month.

What FusionX v2 Actually Offers

The platform’s asset roster consists of USDT and a token coded “27/WMNT”. No other major coins - Bitcoin, Ethereum, or even popular stablecoins - are available. This limited selection makes it impossible to diversify or hedge within the same exchange.

Furthermore, the exchange operates as a DEX‑style service, meaning users retain private keys. While that can be a security advantage, the lack of a liquidity pool means you’ll likely face huge slippage or even failed orders.

Liquidity - The Core Issue

Liquidity is the lifeblood of any exchange. Without it, you can’t execute trades at reasonable prices. FusionX v2’s most active pair, USDT‑27/WMNT, shows no public volume data, and holder.io reported “no transactions in the last 30days”. In practice, that translates to a market where you might place an order and never see a matching counter‑order.

Compare that with major exchanges that process billions of dollars daily. The difference isn’t just scale - it’s the ability to actually buy or sell when you need to.

Trust Score and Reputation

CoinGecko’s trust scoring system evaluates exchanges on security, transparency, and volume consistency. FusionX v2 currently sits at a trust score of 0, the lowest possible rating. A zero score flags serious concerns about reliability, potential security gaps, or even abandonment.

Other reputable sources such as ICO Rankings label the platform as “micro‑scale” and “quiet”, reinforcing the view that it’s not a serious market participant.

User Community and Feedback

Active user communities are a good proxy for platform health. Search Reddit, Trustpilot, or specialist crypto forums - you’ll find virtually no mentions of FusionX v2. No user reviews, no complaint threads, no success stories. The silence suggests either an extremely tiny user base or a dormant project.

In contrast, exchanges like Binance or Kraken have vibrant communities where users discuss fees, new listings, and security incidents. That transparency provides an extra safety net for traders.

Security Considerations

Because FusionX v2 is described as a non‑centralized exchange, users hold their own private keys. That removes custodial risk but adds personal responsibility: you must manage backups and protect against phishing. The platform itself does not publish any security audits, bug bounty programs, or compliance certifications, which is a red flag for any service handling crypto assets.

Comparison with Mainstream Exchanges

| Feature | FusionX v2 | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Number of supported assets | 2 | ≈600 | ≈400 | ≈300 |

| 30‑day trading volume | 0USD (no trades) | ≈$120B | ≈$15B | ≈$8B |

| CoinGecko trust score | 0 (lowest) | 9.8 | 9.5 | 9.2 |

| Liquidity depth (average spread) | Very high (poor) | Low (good) | Low (good) | Low (good) |

| Active community presence | None detectable | Large Reddit & forums | Strong social media | Active Discord |

| Security audits | No public audits | Multiple third‑party audits | Regular audits | Annual audits |

Red Flags and Potential Scams

Beyond the technical shortcomings, promotional material linked to the “FUSION fusionx” name promises “massive monthly returns” on a $100 investment. Such guarantees are typical of fraudulent schemes. Even if the marketing isn’t directly from the exchange, the name similarity can confuse users and draw them into risky offers.

Combined with the zero trust score, zero activity, and lack of community, the platform falls into a high‑risk category. Proceed only if you have a very specific, low‑value test case and are prepared to lose the entire amount.

Better Alternatives for Different Needs

If you’re a beginner wanting a simple UI and strong support, Coinbase is a solid choice. For high‑volume traders looking for low fees, Binance offers deep liquidity and a massive asset list.

For privacy‑focused users who still need reliable liquidity, Kraken provides a reputable DEX‑compatible solution with robust security features.

All three alternatives score above 9 on CoinGecko’s trust metric, have active developer road‑maps, and host vibrant user communities - the exact opposite of what you find with FusionX v2.

Final Verdict

FusionX v2 is essentially a dormant project. Its two‑asset lineup, zero 30‑day volume, and a trust score of 0 signal severe liquidity and reliability problems. The absence of user feedback, security audits, or clear development plans makes it unsuitable for any serious trading activity. If you’re looking to move crypto, allocate your funds to a proven exchange instead.

Frequently Asked Questions

Is FusionX v2 safe to use?

Safety is questionable. The platform has no public security audits, a trust score of 0 on CoinGecko, and reported zero trades in the last 30days. Those factors indicate high risk.

How many cryptocurrencies can I trade on FusionX v2?

Only two: USDT and the token listed as 27/WMNT. No major coins like Bitcoin or Ethereum are available.

What does a CoinGecko trust score of 0 mean?

Zero is the lowest possible rating. It signals serious concerns about reliability, security, or even operational status.

Are there any legitimate use‑cases for FusionX v2?

Given the lack of liquidity and asset support, practical use‑cases are virtually nonexistent. Any experiment would carry a high risk of loss.

Which exchanges should I consider instead?

For most traders, Binance, Coinbase, or Kraken provide deep liquidity, robust security, and active community support. Choose based on your fee sensitivity, UI preference, and regulatory needs.

Yo, the on‑chain metrics for FusionX v2 read like a dry‑run of a dead liquidity pool 🚀. Zero volume, zero order‑book depth, and a trust score that screams “abort mission”. The token pair USDT‑27/WMNT offers no arbitrage windows, so any HFT hopes are futile. In short, the protocol’s tokenomics are engineered for dust‑collecting, not profit‑making 🧹.

Just read the numbers and move on.

When you stare at a spreadsheet of zeroes, you’re really looking at a mirror reflecting an empty promise. The silence of the community is louder than any hype could ever be. It’s a reminder that scarcity of activity often signals deeper structural voids.

Looks like a dead horse to me.

Even if you loved the idea of a “decentralized” DEX, the reality here is a barren desert of trades. Liquidity is the lifeblood of any exchange, and without it you’re just swapping dust. Stick with platforms that have proven order‑book health.

The lack of audits is a glaring red flag, especially when you consider the zero‑trust score. Users holding private keys on a platform that shows no activity are basically playing russian roulette with their funds. In the crypto world, “no volume” is practically synonymous with “no value”. It’s a textbook case of a project that should stay on the sidelines.

One could argue that the novelty of a two‑asset DEX is sufficient, yet novelty without substance is merely an illusion. The absence of a roadmap makes any speculation feel like chasing shadows. Pragmatically, the risk/reward ratio is catastrophically skewed.

Hey folks, great analysis here! 👍 The data points you’ve shared clearly illustrate why FusionX v2 is a high‑risk playground. If you’re looking for reliable trading, the alternatives listed are far more solid.

Zero volume is a deal breaker. No community, no support.

FusionX v2's metrics are an exercise in futility. The platform offers nothing but noise.

Honestly, the numbers don’t lie – this exchange is practically a ghost town. For newcomers, the safest bet is to stick with the big names. Your capital deserves better than a dead market.

In my country we would never trust a platform with a trust score of zero. Such projects are a threat to our national crypto ecosystem.

The stark contrast between FusionX v2’s two‑asset offering and the sprawling catalogs of Binance, Coinbase, and Kraken reads like a culinary comparison between a wilted lettuce leaf and a fully stocked buffet.

The notion of a minimalist exchange sounds romantic, but minimalism without liquidity is simply emptiness dressed in a sleek UI.

The absence of any recorded trades over the past thirty days signals not just low activity but a systemic deadlock where even market makers have fled.

In DeFi, “order book depth” is the substrate upon which price discovery and slippage mitigation are built.

FusionX v2, with its zero‑volume ledger, offers no substrate, leaving users stranded in a price vacuum.

Moreover, the trust score of zero on CoinGecko is not a benign placeholder; it aggregates security audits, community vibrancy, and transactional consistency-all glaringly absent here.

Without a transparent roadmap, developers cannot be held accountable, and investors are left to speculate in the dark.

The community vacuum is equally disconcerting; a thriving forum or active Discord channel often serves as a real‑time pulse check for platform health, and FusionX v2 provides none of that.

Security audits, a cornerstone for any platform handling private keys, are conspicuously missing, raising the specter of undisclosed vulnerabilities.

Even the token pair USDT‑27/WMNT is an odd selection, lacking cross‑chain appeal that would attract arbitrageurs or liquidity providers.

When you juxtapose these shortcomings against robust alternatives-high‑frequency engines, deep liquidity pools, and multi‑layered security-the choice becomes starkly evident.

Users seeking to preserve capital should gravitate toward exchanges that boast strong regulatory compliance and regular third‑party audits.

The risk/reward calculus tilts dramatically toward risk, with virtually no compensating upside.

The only scenario where FusionX v2 could be justified is as a sandbox for experimental, low‑stakes testing, and even then, the lack of documentation is a barrier.

Bottom line: for serious trading, the platform is a black hole that will likely consume rather than amplify your assets.

While some may romanticize the notion of a two‑asset exchange, such naiveté betrays a lack of sophisticated market insight. Accordingly, one should align with platforms that demonstrate substantive depth and rigor.

Yo, if you want real action, skip the ghost exchange and head to the big leagues. It’s that simple.

FusionX v2 looks like a placeholder on the crypto map 🌍. Stick with the heavyweights for actual trades 🚀.

Stefano’s enthusiasm for a dead market is misplaced; the underlying data simply does not support any bullish narrative.

Courtney’s poetic take masks the cold hard truth: zero activity equals zero value.

Bobby’s warning about audits is spot on; without that safety net, any token swap becomes an exercise in blind faith.

National pride won’t fix a platform that has no users.

katie’s deep dive underscores the same conclusion I drew – stay away from the dead exchange.

Even the most rigorous critique cannot resurrect a market that never existed.

Andy’s succinct truth hits the nail on the head; community vacuum is the fatal flaw.

Honestly, who even cares about a dead exchange? 😂

It is imperative that investors prioritize platforms with demonstrable credibility and transparent governance. Endorsing projects like FusionX v2 compromises the ethical standards of the crypto ecosystem.