Coinviva Crypto Exchange Review: Features, Fees, Security & Alternatives

Coinviva Crypto Exchange Comparison Tool

Key Features

- Trading Pairs ~80

- Maker Fee 0.1%

- Taker Fee 0.2%

- ASIC Licence Not Disclosed

- Cold Storage 95%

Comparison Summary

Coinviva offers a simple fee structure and decent security but lacks regulatory clarity. Compare it with leading exchanges below:

- Binance 600+ pairs

- Coinbase 250+ pairs

- Crypto.com 250+ pairs

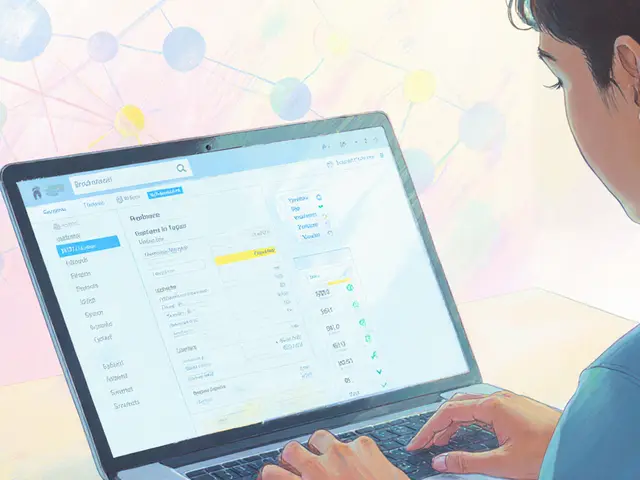

Exchange Comparison Table

| Exchange | Year Launched | Supported Coins | Avg Trading Fee | Security Highlights | ASIC Licence |

|---|---|---|---|---|---|

| Coinviva | 2023 (estimated) | ~80 pairs (top 20 assets) | 0.1% maker / 0.2% taker | 2FA, 95% cold storage, no public audit | Not disclosed |

| Binance | 2017 | 600+ pairs | 0.02%-0.10% tiered | 2FA, 98% cold storage, regular CertiK audits | Operates under Binance Australia licence |

| Coinbase | 2012 | 250+ pairs | 0.5% standard | 2FA, insurance on custodial assets, SOC 2 compliance | ASIC-registered entity |

| Crypto.com | 2016 | 250+ pairs | 0.10%-0.20% tiered | 2FA, 99% cold storage, annual audits | Operates under an Australian subsidiary licence |

Fee Comparison Calculator

Estimate your trading costs on different exchanges:

Estimated Fees:

Important Note

Coinviva lacks a disclosed ASIC licence, making it risky for Australian users. For regulatory protection and better features, consider established exchanges like Binance, Coinbase, or Crypto.com.

TL;DR

- Coinviva is a little‑known exchange with limited public data, but it advertises low fees and a simple UI.

- Security basics (2FA, cold storage) are offered, yet no clear ASIC licence is disclosed.

- Fees appear competitive - around 0.1% maker, 0.2% taker - but exact tiers are opaque.

- For Australian users, established platforms like Binance, Coinbase and Crypto.com provide stronger regulatory confidence.

- Choose Coinviva only if you value a minimalist interface and can tolerate limited transparency.

Coinviva is a cryptocurrency exchange platform that claims to offer spot trading, low fees, and a user‑friendly interface. While the name pops up in a few forums, there’s virtually no detailed public record of its founding date, user base, or regulatory filings. That scarcity makes a thorough review challenging, but we can still evaluate the exchange against the criteria most traders use when picking a platform.

What a Crypto Exchange Review Should Look At

Before we dig into Coinviva specifics, let’s lay out the decision matrix. A solid review covers:

- Company background and licensing.

- Supported cryptocurrencies and trading pairs.

- Fee structure (maker/taker, deposits, withdrawals).

- Security measures (2FA, cold storage, audits).

- User experience - app, web UI, customer support.

- Regulatory compliance, especially for Australian traders.

- Reputation and community feedback.

We’ll examine each of these points for Coinviva and then stack it next to the market leaders.

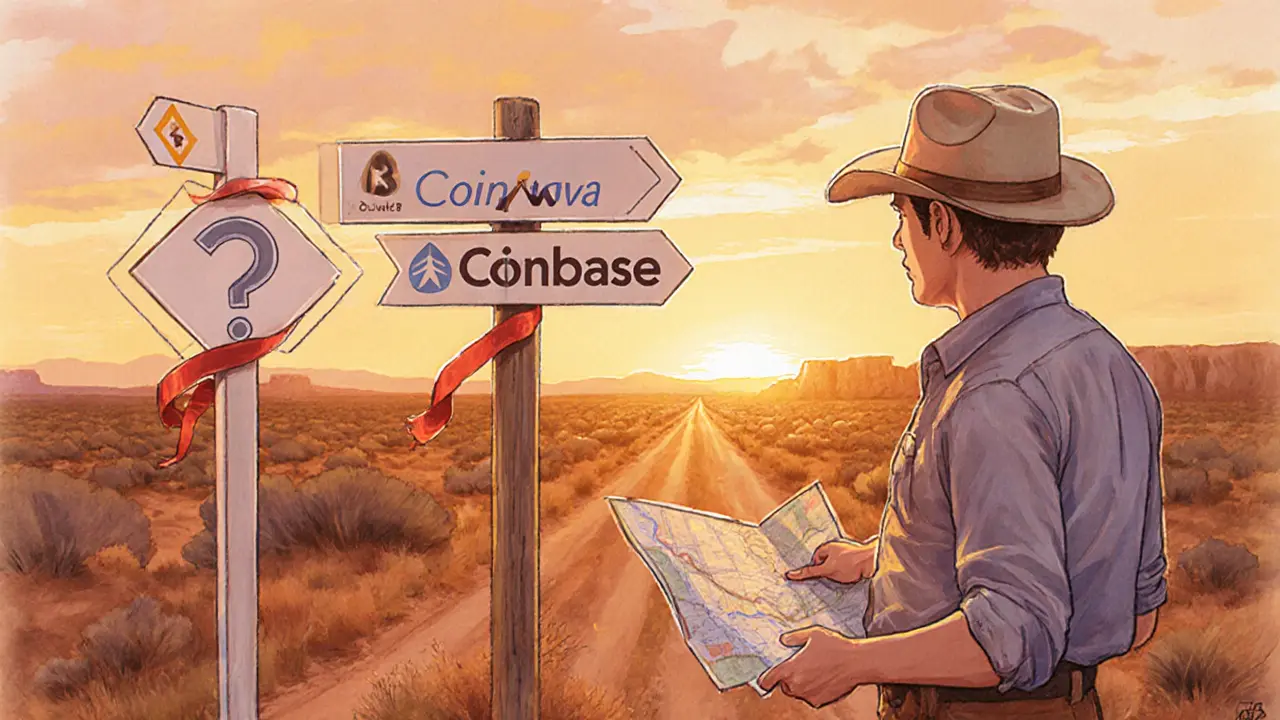

Company Background & Licensing

The Australian Securities and Investments Commission (ASIC) requires any platform that lets Australians trade crypto assets classified as financial products to hold an Australian market licence. A quick search of ASIC’s public register shows no licence issued to Coinviva. That doesn’t automatically mean the exchange is illegal - many offshore platforms operate without an Australian licence, but they must explicitly state they are not a “financial market” under Australian law.

For comparison, big players such as Binance - launched in 2017 and now handling over 30 million daily trades - holds a licence in jurisdictions like Malta and the Cayman Islands, and it offers a tailored “Binance Australia” service that complies with ASIC rules.

Similarly, Coinbase operates in Australia under a separate entity that is registered with ASIC, giving users a clear regulatory safety net.

Without a disclosed licence, Coinviva’s legal standing in Australia remains uncertain - a red flag for risk‑averse traders.

Supported Coins & Trading Pairs

Coinviva’s website (as of October2025) lists roughly 80 trading pairs, focusing on the top 20 cryptocurrencies - Bitcoin (BTC), Ethereum (ETH), USDT, BNB, and a handful of DeFi tokens. This is modest compared with Binance’s 600+ pairs or Crypto.com’s 250+.

If you need niche altcoins, the limited catalogue could be a deal‑breaker. On the bright side, a smaller selection often means tighter liquidity for the major pairs, which can reduce slippage for everyday traders.

Fee Structure

Coinviva advertises a flat 0.1% maker fee and 0.2% taker fee, with no hidden deposit charges for bank transfers. Withdrawal fees appear tiered by coin - for example, 0.0005BTC per withdrawal, which equates to about $15 at current rates.

By contrast, Binance offers a tiered schedule that can dip below 0.02% for high‑volume users, while Coinbase’s standard taker fee sits at 0.5% for most retail accounts. Crypto.com sits around 0.1%‑0.2% after the first $10,000 of monthly volume. So, Coinviva’s fees are competitive on paper, but the lack of transparent volume‑based discounts might make it less appealing for power traders.

Security & Compliance

Every reputable exchange should tick three security boxes:

- Two‑factor authentication (2FA) - Coinviva supports Google Authenticator and SMS 2FA.

- Cold storage of the majority of user funds - Coinviva claims 95% of assets are kept offline, a figure similar to Binance and Coinbase.

- Regular security audits - there’s no public audit report from a known firm (e.g., CertiK, Trail of Bits) for Coinviva.

In addition, compliance with Reserve Bank of Australia (RBA) standards is essential for fiat‑on‑ramp stability. Coinviva’s KYC process uses basic email verification and a photo ID upload, but it does not mention anti‑money‑laundering (AML) monitoring tools that larger exchanges openly publish.

User Experience (UI/UX) & Customer Support

The platform’s web UI is intentionally minimal - a dark‑mode dashboard with a single “Buy”, “Sell”, and “Trade” tab. New users often praise the clean layout, but power traders miss advanced charting tools like TradingView integration.

Mobile apps for iOS and Android are available, though early reviews note occasional crashes during high‑volatility spikes. Customer support is limited to an email ticket system with a typical 24‑48hour response window; no live chat or phone line is offered.

In contrast, Binance and Crypto.com provide 24/7 live chat, extensive knowledge bases, and in‑app tutorials. Coinbase’s support includes phone callbacks for premium users.

Pros & Cons of Coinviva

Pros

- Simple fee schedule that’s lower than many retail‑focused exchanges.

- Clean, easy‑to‑navigate interface suitable for beginners.

- Two‑factor authentication and high cold‑storage ratio.

Cons

- No transparent ASIC licence or clear regulatory status in Australia.

- Limited crypto selection compared with market leaders.

- Lack of published security audits and modest customer‑support channels.

- Liquidity can be thin for less‑popular pairs.

How Coinviva Stacks Up - Quick Comparison

| Exchange | Year Launched | Supported Coins | Avg Trading Fee | Security Highlights | ASIC Licence |

|---|---|---|---|---|---|

| Coinviva | 2023 (estimated) | ~80 pairs (top 20 assets) | 0.1% maker / 0.2% taker | 2FA, 95% cold storage, no public audit | Not disclosed |

| Binance | 2017 | 600+ pairs | 0.02%‑0.10% tiered | 2FA, 98% cold storage, regular CertiK audits | Operates under Binance Australia licence |

| Coinbase | 2012 | 250+ pairs | 0.5% standard | 2FA, insurance on custodial assets, SOC 2 compliance | ASIC‑registered entity |

| Crypto.com | 2016 | 250+ pairs | 0.10%‑0.20% tiered | 2FA, 99% cold storage, annual audits | Operates under an Australian subsidiary licence |

Who Might Actually Need Coinviva?

If you’re an Australian newcomer who wants a no‑frills platform to buy Bitcoin or Ethereum and you don’t mind the uncertainty around licensing, Coinviva could serve as a quick entry point. Hobbyist investors who trade under $5,000 a month may find the fee simplicity attractive.

However, if you plan to move large sums, need a wide range of altcoins, or value regulatory protection, the safer route is to stick with Binance, Coinbase, or Crypto.com, all of which have clear ASIC compliance and richer feature sets.

Final Takeaway

The lack of public data makes a definitive verdict hard, but the evidence points to a platform that’s still finding its footing. Its fee structure is appealing, yet the regulatory opacity and limited support could expose users to unnecessary risk. Treat Coinviva as a supplementary account rather than your primary gateway to crypto, especially if you’re operating out of Australia.

Frequently Asked Questions

Is Coinviva licensed by ASIC?

No publicly available record shows an ASIC licence for Coinviva. Users should assume the platform operates offshore and does not provide the regulatory guarantees that licensed Australian exchanges do.

What are the withdrawal fees on Coinviva?

Withdrawal fees are coin‑specific: 0.0005BTC, 0.01ETH, 5USDT, etc. Fees are comparable to other mid‑size exchanges and are clearly listed on the platform’s fee page.

Does Coinviva offer fiat on‑ramps for Australian dollars?

Yes, the exchange supports AUD bank transfers via the local ACH system, but processing can take 2‑3 business days. Credit‑card purchases are not currently available.

How does Coinviva’s security compare to Binance?

Both platforms require 2FA and store the majority of assets offline. Binance, however, publishes regular third‑party audits (e.g., CertiK) and has a proven track record of handling high‑volume attacks, whereas Coinviva has not released any independent audit reports.

Can I trade on Coinviva via a mobile app?

Yes, Coinviva provides iOS and Android apps. They mirror the web UI but have reported occasional stability issues during market spikes.

Coinviva looks decent for beginners, low fees are a nice plus. If you’re just dipping your toes, it might be worth a try.

Meh, another exchange trying to be slick 😒. The fee story is the same old hype.

From a regulatory standpoint, the absence of a disclosed ASIC licence for Coinviva should be a primary concern for Australian traders. While the platform advertises a flat 0.1% maker and 0.2% taker fee, the lack of transparent tiered volumes undermines confidence for high‑frequency participants. Security claims such as 95% cold storage are respectable, yet the omission of any third‑party audit leaves a gap in verification. Comparatively, Binance and Coinbase provide publicly available audit reports that reinforce their security postures.

Operational longevity is another metric; Coinviva, with an estimated launch in 2023, has not yet demonstrated resilience through multiple market cycles. Established exchanges have survived bear markets, regulatory scrutiny, and high‑traffic events, thereby building a track record that newcomers cannot match.

Liquidity depth is also limited. With roughly 80 trading pairs, the order book depth for less‑popular assets may be insufficient, leading to slippage for sizable orders. In contrast, Binance’s 600+ pairs ensure ample market depth across most tokens.

On the user‑experience front, Coinviva’s minimalist interface could appeal to novices, but power users will miss advanced charting tools and API integrations. The platform’s customer support, restricted to email tickets with a 24‑48 hour turnaround, falls short of the 24/7 live‑chat services offered by top exchanges.

Finally, the legal ambiguity surrounding the exchange’s jurisdiction may expose users to regulatory risk, especially if future Australian legislation tightens crypto compliance. Until Coinviva provides a clear regulatory framework and third‑party security attestations, its attractiveness remains limited.

From a technical perspective, Coinviva’s fee schedule is straightforward, but the absence of maker‑taker rebates suggests they are not incentivizing liquidity provision. Their 95% cold‑storage ratio aligns with industry standards, yet without a published audit trail you’re essentially trusting a black box. The UI leverages a dark‑mode dashboard that’s ergonomically sound for low‑frequency traders, but the lack of TradingView integration limits analytical depth. On‑ramp friction is higher than ideal; AUD ACH transfers taking 2‑3 days can deter active day‑traders who need instantaneous capital deployment. Overall, the platform offers a bare‑bones solution-adequate for casual buy‑and‑hold, but sub‑par for sophisticated strategies.

Imagine stepping onto a trading floor where every button lights up with purpose-that’s the vibe Coinviva tries to capture. The simplicity is almost poetic, a breath of fresh air amid the chaos of feature‑bloat on bigger exchanges. Yet, poetry without substance can be dangerous; when the market spikes, the platform’s occasional crashes may leave you stranded. The 0.1%/0.2% fees are a sweet whisper compared to the roar of Binance’s tiered discounts, but they’re a static melody that doesn’t reward high volume. Security is solid on paper, but the missing audit feels like a hidden stanza waiting to be revealed. If you’re a newcomer looking for a calm entry point, the minimalist design can be a sanctuary; if you crave the bustling bazaar of alt‑coins, you’ll likely outgrow it quickly.

Coinviva offers low fees and a clean UI. It lacks regulatory clarity and advanced tools.

While some praise the low fees, the undisclosed licence is a red flag. Traders should demand full transparency before committing capital.

Fee simplicity is nice, but the delayed AUD deposits can be a hassle for everyday folks. I’d still keep an eye on the bigger exchanges for speed.

Reading through the review felt like taking a scenic train ride through the world of crypto exchanges. The author paints Coinviva as a modest, no‑frills station where you can hop on with a small budget and enjoy a smooth, if somewhat limited, journey. The low‑fee promise is like a discounted ticket-appealing, especially when you’re just learning the routes. However, the missing regulatory paperwork is akin to an unchecked safety inspection; without it, you’re riding on uncertain tracks. The comparison table is a helpful map, clearly showing why giants like Binance and Coinbase dominate the landscape with extensive routes and frequent service. For a traveler who values simplicity over speed, Coinviva could be a pleasant stop, but seasoned voyagers will likely prefer the larger hubs that guarantee both speed and security. In short, treat it as a side‑trip rather than your main destination.

Sure, the UI is clean, but clean doesn’t equal competent 🙄. Without tiered incentives, serious traders will bounce to platforms that reward volume.

Profit isn’t just about numbers; it’s about trust. When an exchange hides its license, it whispers doubts into the market’s collective psyche.

Trust is earned, not begged. If Coinviva wants credibility, it should stop hiding behind vague statements and start publishing hard data.

Hey folks! 👍 Coinviva’s low fees are a nice perk for beginners, but the missing ASIC licence is something to keep on your radar. Always good to have a backup plan!

Another glossy brochure, same old empty promises.

Imagine a garden where every plant is neatly labeled, but the gardener never shows you the soil composition. That’s how Coinviva feels-organized on the surface, yet mysterious beneath.

It is wholly incongruous that an exchange, which purports to serve the discerning Australian investor, would omit any reference to ASIC registration. Such an omission is not merely an oversight; it is a flagrant breach of the fiduciary expectations that govern financial intermediaries within this jurisdiction.

Bottom line: if you’re just testing the waters, give Coinviva a spin, but keep a bigger, regulated exchange as your mainstay.

Looks like another copy‑paste review to me; not impressed.