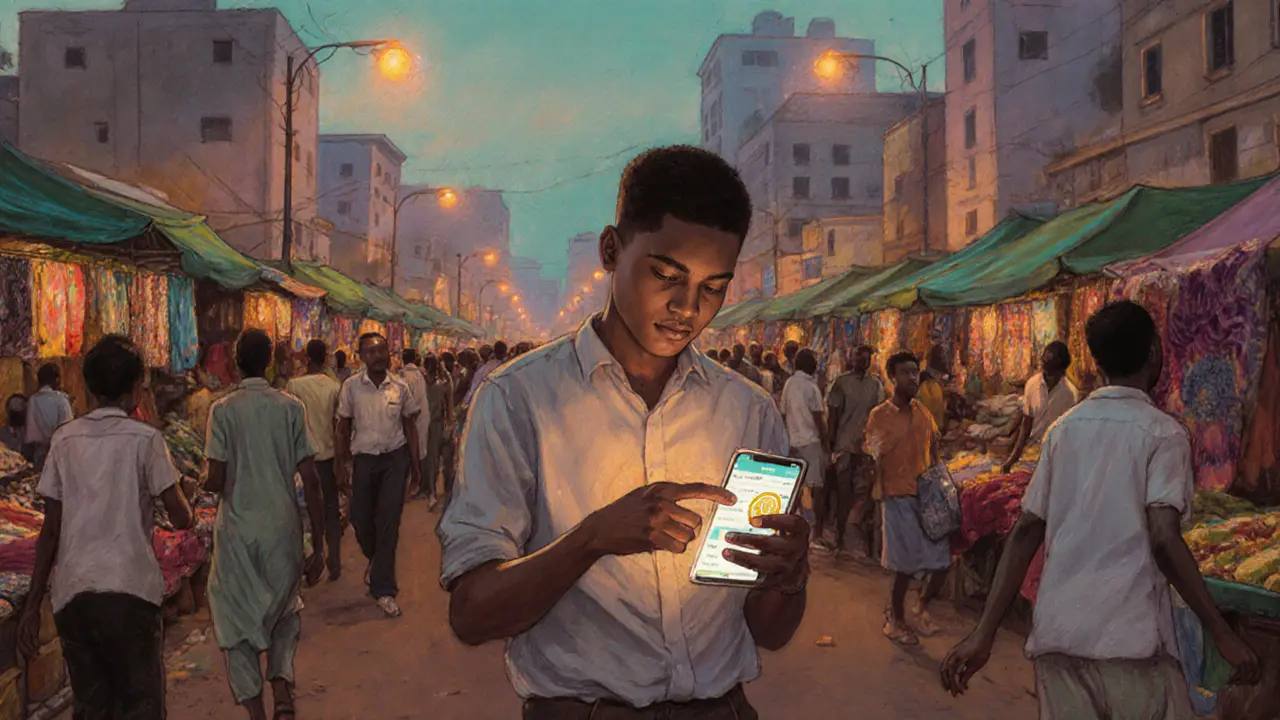

Cryptocurrency Nigeria: What You Need to Know

When talking about Cryptocurrency Nigeria, the growing use of digital assets in Nigeria. Also known as NG crypto, it blends local payment habits with global blockchain tech. The market is shaped by three core forces: crypto regulation, government rules that define what’s legal, the availability of crypto exchanges, platforms where traders buy, sell, and store coins, and the popularity of airdrops, free token distributions that attract new users. Together they influence how everyday Nigerians interact with Bitcoin, Ethereum, and newer tokens. For example, the Central Bank’s stance on stablecoins stablecoins, digital dollars pegged to fiat directly affects cross‑border payments and remittances. In short, cryptocurrency Nigeria encompasses regulation, exchange access, and community incentives, all while driving financial inclusion.

Key Areas to Explore

First up, regulation is the rulebook that determines which tokens can be offered, how exchanges must register, and what tax obligations users face. Recent drafts from the Securities and Exchange Commission (SEC) show a tilt toward licensed exchanges, which means platforms that comply can attract institutional liquidity. Second, exchanges are the gateway. Local players like Quidax and Binance Nigeria compete on fee structures, fiat on‑ramps, and security features. Their success is tied to how well they implement KYC/AML checks—a direct outcome of the regulatory environment. Third, airdrops act as low‑cost marketing engines; they let projects seed tokens to a broad audience, but participants need to watch for phishing scams and tax reporting duties. Finally, stablecoins such as USDT or the emerging Naija‑stable serve merchants who want price stability while still enjoying crypto’s speed. They bridge the gap between volatile assets and real‑world commerce, making everyday purchases like groceries or utility bills possible without converting back to naira.

Below you’ll find a curated list of articles that dive deeper into each of these topics. Whether you’re hunting for a step‑by‑step guide on buying crypto on a Nigerian exchange, need to decode the latest regulatory draft, want to claim a legit airdrop, or are curious about how stablecoins can ease payments, the posts are organized to give you practical, bite‑size knowledge you can act on right now. Let’s get into the details and see how the pieces fit together in the fast‑moving world of cryptocurrency Nigeria.

Nigeria ranks #2 globally for crypto adoption, driven by inflation, unbanked population, and new regulations, with over 22 million users and growing institutional support.

Jonathan Jennings Oct 3, 2025