POLS token: Your Quick Start Guide

When you hear about POLS token, a blockchain‑based utility and governance asset that powers the Pols ecosystem. Also known as Pols, it lets holders vote on upgrades, earn staking rewards, and access exclusive DeFi services. POLS token is built on Ethereum, follows the ERC‑20 standard, and aims for fast, low‑cost transactions. In simple terms, POLS token encompasses tokenomics and governance, and it requires a compatible wallet to hold.

Understanding the tokenomics, the supply schedule, distribution model, and incentive mechanisms that drive a crypto’s economy is the first step to judging any project. POLS has a capped total supply of 100 million tokens, with 40% allocated to the community through airdrops, 30% reserved for staking rewards, and the rest split between the development team and liquidity pools. The token’s inflation rate drops each year, which means early participants can benefit from higher rewards while later holders enjoy reduced dilution. This structure influences both price stability and long‑term growth.

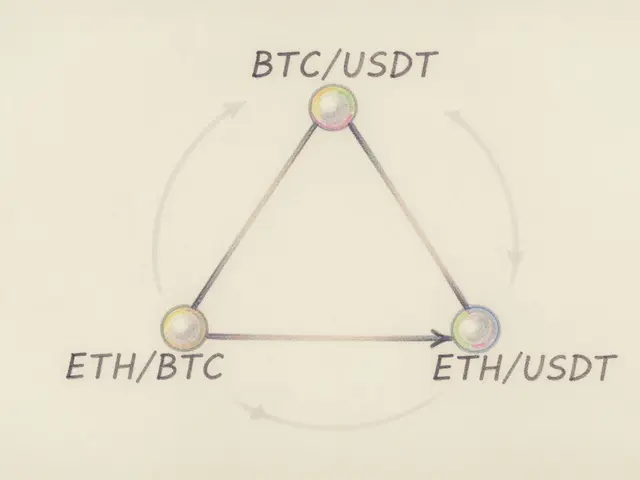

Next up is DeFi, decentralized finance platforms that let users lend, borrow, and trade without a middleman. POLS token is integrated into several DeFi protocols that offer yield farming, liquidity mining, and governance voting. When you provide POLS to a liquidity pool, you earn a share of transaction fees and extra token rewards. Because DeFi platforms influence POLS token performance, many traders watch protocol TVL (total value locked) as a health indicator. The more DeFi services adopt POLS, the broader its utility and the stronger its market demand.

A big driver of early adoption is the crypto airdrop, a free token distribution event that rewards existing holders or community participants. POLS has run multiple airdrop campaigns to bootstrap its user base, often tying eligibility to social actions like joining Telegram, retweeting announcements, or staking a minimum amount of POLS. Airdrop events boost POLS token distribution, increase wallet counts, and create buzz that can spur price movement. However, each airdrop comes with rules, lock‑up periods, and tax considerations that participants should read carefully.

Regulatory outlook matters just as much as tech. Several jurisdictions are drafting crypto‑friendly policies, while others tighten controls on token sales and DeFi services. Changes in cryptocurrency regulation affect POLS token adoption because exchanges may list or delist the asset based on compliance. Keeping an eye on global news helps you anticipate market swings and adjust your strategy before the broader crypto community reacts.

What You’ll Find Below

The articles in this collection cover everything from a step‑by‑step POLS wallet setup to deep dives on tokenomics, airdrop claim guides, and DeFi integration cases. You’ll also see real‑world examples of how regulatory shifts have impacted POLS‑related projects, plus risk assessments for staking and liquidity provision. Whether you’re a beginner looking for a plain‑language overview or an experienced trader seeking the latest yield strategies, these posts give you actionable insights you can apply right away.

Ready to explore? Scroll down to discover detailed guides, market analysis, and practical tips that will help you make informed decisions about the POLS token and its ecosystem.

Learn what Polkastarter (POLS) is, how its cross‑chain launchpad works, token utility, market stats, how to join IDOs, and future outlook.

Jonathan Jennings Jun 2, 2025