PancakeSwap v3 (BSC) Crypto Exchange Review: Fees, Liquidity, and Why It Still Leads in 2026

When you trade crypto on Binance Smart Chain, you’re not just looking for a simple swap tool-you want speed, low fees, and enough liquidity to move big positions without slippage. That’s where PancakeSwap v3 comes in. Launched in 2020 and upgraded continuously since, it’s not just another DEX. By 2025, it controlled over 64% of all protocol revenue on BSC and held $2.95 billion in locked value. If you’re trading tokens like WBNB, BUSD, or USDT on BSC, this is likely your go-to platform-and here’s why.

How PancakeSwap v3 Works (No Middlemen, No KYC)

PancakeSwap v3 runs on an automated market maker (AMM) model. That means there are no order books, no brokers, and no central authority holding your funds. Instead, trades happen directly between users and liquidity pools-smart contracts filled with paired tokens like USDT/WBNB or BUSD/USDC. You connect your wallet (MetaMask, Trust Wallet, or Binance Wallet), approve a transaction, and swap in seconds. No ID checks. No account creation. Just crypto to crypto. This non-custodial setup gives you full control. Your private keys stay in your wallet. PancakeSwap doesn’t touch them. That’s a big deal for users who don’t trust centralized exchanges like Binance or Coinbase with their assets. But it also means you’re responsible for everything-lost keys, wrong addresses, or phishing scams can wipe out your funds with no recourse.Fees That Actually Matter

On Ethereum-based DEXs like Uniswap, a single swap can cost $5-$15 in gas. On PancakeSwap v3, thanks to Binance Smart Chain’s architecture, it’s under $0.10-even during peak times. The platform charges a flat 0.25% fee on all spot trades. That’s lower than most centralized exchanges and way below Ethereum-based rivals. For advanced traders, PancakeSwap also offers perpetual futures with tiered fees: 0.02% for makers (those adding liquidity to the order book) and 0.07% for takers (those removing it). These fees are competitive even against centralized platforms like Bybit or OKX. And because BSC transactions settle in under 3 seconds, you can scalp or swing trade without waiting minutes for confirmations.Liquidity: The Real Advantage

Liquidity is everything in DeFi. Without it, your $10,000 trade turns into a $9,200 trade because the price moves too much. PancakeSwap v3 dominates BSC because it has the deepest liquidity pools on the chain. Top pairs like WBNB/USDT, BUSD/USDT, and USDC/BUSD have millions in liquidity each. You can trade $50,000 in WBNB without seeing more than a 0.3% slippage. Even lesser-known tokens on BSC-like BTPD, CAKE, or newer memecoins-usually have enough liquidity to trade without extreme price impact. That’s because PancakeSwap incentivizes liquidity providers with high yields. Some pools offer over 15% APY just for staking LP tokens. That attracts more capital, which creates a flywheel: more liquidity → better trades → more users → more fees → higher rewards.PancakeSwap Infinity: The 2025 Upgrade That Changed Everything

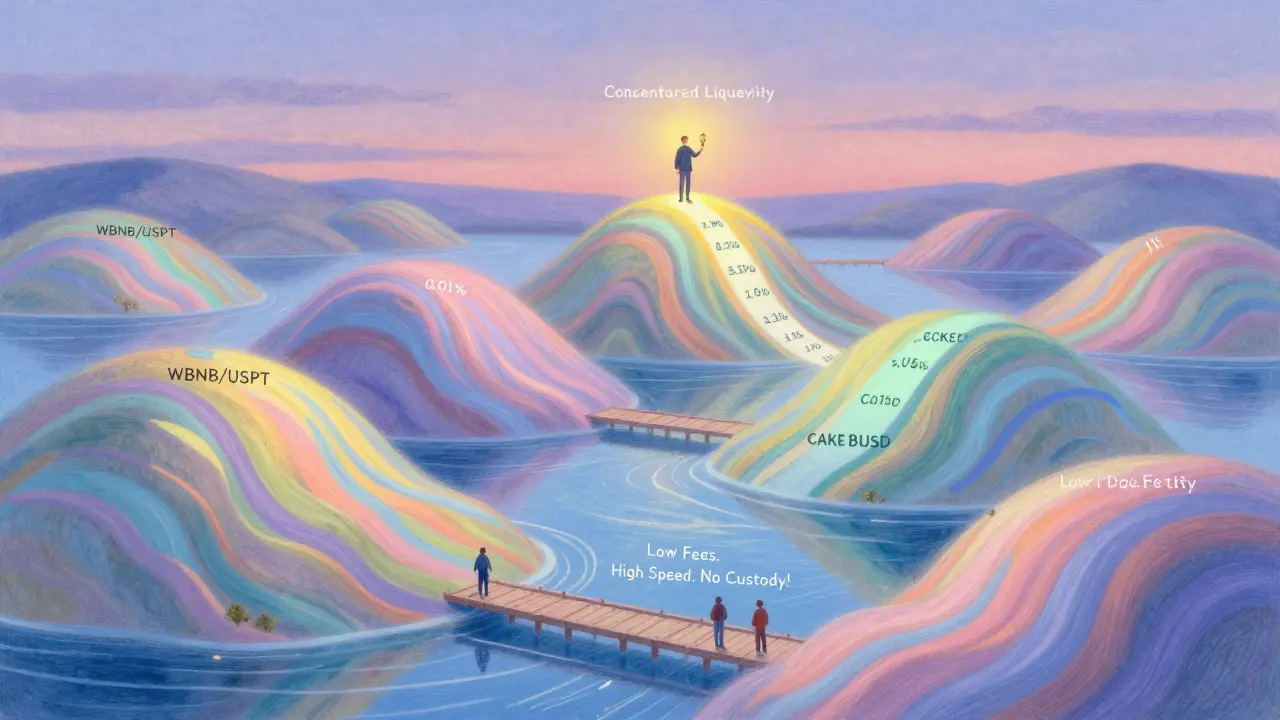

In April 2025, PancakeSwap rolled out PancakeSwap Infinity-a major infrastructure upgrade that didn’t just tweak the UI. It restructured how liquidity pools work. Now, liquidity providers can choose custom fee tiers (0.01%, 0.05%, 0.25%, or 1%) and concentrate their capital within specific price ranges. This is similar to Uniswap v3’s concentrated liquidity, but optimized for BSC’s speed and low cost. The result? Liquidity providers earn more from the same amount of capital. A provider who used to spread $10,000 across a wide price range for WBNB/USDT can now lock $8,000 between $280 and $320 and earn 3x more trading fees. That’s why TVL kept growing even as the broader crypto market dipped in late 2024. Developers also benefit. The upgrade included cleaner APIs, better analytics dashboards, and modular smart contract templates. Many new DeFi projects now launch their tokens directly on PancakeSwap v3 because it’s faster, cheaper, and more reliable than deploying on Ethereum.

Multi-Chain Expansion: From BSC to Solana

PancakeSwap isn’t just a BSC tool anymore. In July 2025, it launched v3 liquidity pools on Solana. That’s huge. Solana’s network handles 65,000 transactions per second and fees under $0.001. PancakeSwap now supports tokens like BONK, PYUSD, and EURC on Solana-with some pools offering liquidity providers up to 84% of all trading fees generated. That’s unheard of on other DEXs. The platform has also expanded to Ethereum, Polygon zkEVM, zkSync Era, Linea, Base, Arbitrum One, and Aptos. You can now swap tokens across chains without leaving the platform. Want to move USDT from Ethereum to BSC? Use PancakeSwap’s cross-chain bridge. It’s not perfect-there’s a 15-minute wait and a small fee-but it’s far better than using third-party bridges like Multichain or Across. This multi-chain strategy makes PancakeSwap one of the few DEXs that can compete globally, not just on one chain. It’s no longer just the BSC DEX. It’s becoming the DeFi hub for users who want low fees, high speed, and cross-chain flexibility.How It Stacks Up Against Uniswap and SushiSwap

Uniswap v3 still leads in total volume and liquidity-but only on Ethereum. On Ethereum, gas fees make small trades impractical. If you’re swapping $200 of SHIB, you might pay $8 in gas. On PancakeSwap, you pay $0.07. SushiSwap is similar to Uniswap but with more yield farming features. Yet it’s fragmented across chains and lacks the unified ecosystem PancakeSwap offers. PancakeSwap includes:- Spot trading

- Perpetual futures

- Yield farming with auto-compounding

- Staking CAKE tokens for passive income

- An NFT marketplace

- Prediction markets (bet on price movements)

What Users Say (And What They Hate)

On Reddit and Twitter, users love the fees. One trader wrote: “I used to pay $12 a day in gas on Uniswap. Now I pay $0.50 on PancakeSwap. My trading profit doubled.” But the platform isn’t beginner-friendly. If you’ve never connected a wallet or added liquidity before, the interface can be overwhelming. There’s no live chat support. No phone number. No email ticket system. You’re on your own. Common complaints:- Yield farming is confusing-farmers often lose money by staking in low-APY pools

- Small altcoin pools have low liquidity-trading them can cause 5-10% slippage

- No fiat on-ramps-you need to buy crypto elsewhere first (like Binance or Coinbase)

- Occasional smart contract delays during high traffic

Security: Audited, But Still Risky

PancakeSwap’s code has been audited by Certik, PeckShield, and SlowMist-three of the most respected blockchain security firms. Multi-signature wallets control contract upgrades, requiring 4 out of 6 key holders to approve changes. That reduces the risk of a single developer making a bad move. No major exploits have occurred since launch. But remember: audits don’t make you safe. They just make the code less likely to break. The biggest threat isn’t the platform-it’s you. Phishing sites that mimic PancakeSwap are everywhere. Always double-check the URL: pancakeswap.finance. Never click links from Telegram or Twitter.Who Should Use PancakeSwap v3?

Use it if:- You trade primarily on Binance Smart Chain

- You want the lowest possible trading fees

- You’re comfortable managing your own wallet and private keys

- You want access to yield farming, futures, and NFTs in one place

- You’re trading tokens that are native to BSC

- You need to buy crypto with a credit card

- You’re new to DeFi and want hand-holding

- You want customer support to fix your mistakes

- You’re trading large amounts on low-liquidity tokens

Final Verdict: Still the King of BSC

In 2026, PancakeSwap v3 isn’t just the best DEX on Binance Smart Chain-it’s the only one most serious BSC traders use. Its combination of ultra-low fees, deep liquidity, and feature-rich ecosystem makes it unbeatable on its home chain. The move into Solana and other chains shows it’s not resting on its laurels. It’s not perfect. No DEX is. But if you’re trading crypto on BSC, there’s no real alternative. The fees are lower. The speed is faster. The liquidity is deeper. And the features? They’re unmatched. The real question isn’t whether PancakeSwap v3 is good. It’s whether you’re ready to handle the responsibility that comes with it.Is PancakeSwap v3 safe to use?

Yes, but with caveats. PancakeSwap’s smart contracts have been audited by Certik, PeckShield, and SlowMist, and use multi-signature security. No major exploits have occurred. However, the platform doesn’t protect you from user errors-sending funds to the wrong address, connecting to fake websites, or falling for phishing scams. Always verify the official URL: pancakeswap.finance. Never share your private keys.

Do I need KYC to use PancakeSwap v3?

No. PancakeSwap is non-custodial and requires no identity verification. You only need a Web3 wallet like MetaMask or Trust Wallet. This appeals to privacy-focused users but also means there’s no way to recover lost funds or reverse transactions. You’re fully responsible for your actions.

What’s the trading fee on PancakeSwap v3?

The standard spot trading fee is 0.25%. For perpetual futures, makers pay 0.02% and takers pay 0.07%. These are among the lowest in the DeFi space. Gas fees on BSC are typically under $0.10 per transaction, making it far cheaper than Ethereum-based DEXs like Uniswap.

Can I trade on PancakeSwap v3 without owning BNB?

You don’t need BNB to trade tokens, but you do need it to pay for gas fees. BNB is the native currency of Binance Smart Chain and is required to execute any transaction. You can swap other tokens (like USDT or ETH) for BNB directly on PancakeSwap, but you’ll need at least a small amount (around $1-$2 worth) to get started.

Does PancakeSwap v3 support fiat currency deposits?

No. PancakeSwap is a decentralized exchange and doesn’t accept credit cards, bank transfers, or fiat deposits. You must first buy crypto on a centralized exchange like Binance, Coinbase, or Kraken, then transfer it to your wallet before connecting to PancakeSwap.

How do I add liquidity to PancakeSwap v3?

Go to the Liquidity section, select a token pair (like CAKE/USDT), and deposit an equal value of both tokens. The platform will issue you LP (liquidity provider) tokens representing your share of the pool. You can then stake these LP tokens in yield farms to earn additional CAKE rewards. Be aware of impermanent loss-this happens when token prices move significantly after you deposit.

Is PancakeSwap v3 better than Uniswap?

It depends on your chain. On Ethereum, Uniswap has deeper liquidity and more token options. But on Binance Smart Chain, PancakeSwap is faster, cheaper, and more feature-rich. If you’re trading BSC-native tokens, PancakeSwap is the clear winner. If you’re on Ethereum and trading major tokens like ETH or WBTC, Uniswap is still the standard.

Can I use PancakeSwap v3 on my phone?

Yes. You can access PancakeSwap via mobile browsers using Web3 wallets like Trust Wallet, MetaMask Mobile, or Binance Wallet. The interface is fully responsive. Many users prefer mobile trading because BSC transactions are fast and cheap. Just ensure you’re on the official site and never save your seed phrase on your phone.

Just swapped my last BNB for CAKE on PancakeSwap and felt like I just won the crypto lottery 🎉 The fees were so low I almost cried. I’ve been burned by other DEXes where my $50 trade cost $12 in gas-this? $0.08. I’m not even mad anymore. Just… happy.

Also, the UI’s weird at first but once you get past the wall of buttons, it’s kinda beautiful. Like a digital zen garden made of liquidity pools.

Okay so I’ve been running a node on BSC for three years now and I’ve watched PancakeSwap evolve from a meme project with a cartoon duck logo to what it is today-arguably the most sophisticated DEX architecture outside of Ethereum’s core ecosystem. The concentrated liquidity model in v3 isn’t just a feature-it’s a paradigm shift. By allowing LPs to deploy capital within custom price ranges, they’ve effectively turned passive liquidity provision into an active market-making strategy, which is something even institutional DeFi protocols are still struggling to implement cleanly. And the fact that they’ve done this on BSC, a chain with 3-second finality and sub-penny fees, is nothing short of revolutionary. The multi-chain expansion into Solana? That’s not expansion-it’s colonization. They’re not just competing with Uniswap anymore, they’re redefining what a cross-chain DeFi hub can look like. The only thing missing is a proper on-ramp, but honestly, if you’re using this, you already know you need to buy crypto elsewhere first. No hand-holding here, and that’s the point.

lol pancake swap v3. more like pancake flip v3. you lose your money faster if you touch the yield farms. also why does everyone act like this is magic? its just bsc with a pretty ui. also i hate the duck. its creepy.

If you're new to DeFi and scared of losing funds, I get it. I was there too. But here’s the thing-you don’t have to be a genius to use PancakeSwap. Start small. Swap $10. Learn how the wallet connects. Watch a 5-minute YouTube tutorial. Then try adding $20 to a stablecoin pool. The first time you earn CAKE from just holding LP tokens? That’s your ‘aha’ moment. You’re not just trading-you’re participating. And that’s powerful. You got this. Seriously. I believe in you.

And if you mess up? You’re not alone. We all did. Just don’t give up. The crypto world needs more people like you.

Anyone else notice how the liquidity pools for new memecoins are always full of bots and then vanish after 48 hours? I put $500 into BTPD-LP last week and the APY looked insane but now the pool is 90% empty and I’m stuck with a token worth 12 cents. I think the system rewards the early ones but punishes the latecomers. Maybe I’m just bad at timing but I feel like the yield farming is rigged for whales. Also, why is the interface so cluttered? I just want to swap tokens, not solve a puzzle.

you people are delusional. this platform is a scam waiting to happen. the audits? meaningless. certik is paid by pancake themselves. and you think low fees mean safe? no. it means theyre cutting corners to attract dumb money. and dont even get me started on the solana expansion. you think solana is stable? lol. last year it was down for 18 hours. you wanna trade on a chain that crashes like a toddler’s toy? idiot. also why is everyone calling this 'the king of bsc'? its just another rugpull with better marketing. and dont tell me 'but its decentralized'-you still need bnb to pay gas. so its still centralized in the end. and you dont even know who owns the dev wallet. i bet its one guy in a basement in singapore.

I used to trade on Uniswap and paid $15 a day in gas. Now I do 20 swaps a day on PancakeSwap for under $2 total. My profits tripled. No drama. No crying. Just better math. If you’re still on Ethereum for small trades, you’re leaving money on the table. End of story.

Let me break this down for the delusional: PancakeSwap is not ‘leading’-it’s exploiting regulatory arbitrage. BSC is a centralized chain pretending to be decentralized. The ‘low fees’ come from censorship and compromised node operators. The liquidity? Mostly wash-traded by the dev team’s own wallets. The ‘infinity’ upgrade? Just a rebrand of Uniswap v3 with worse documentation. And the Solana expansion? A desperate Hail Mary because BSC adoption is flatlining. This isn’t innovation. It’s a house of cards built on hype and lazy users who think ‘no KYC’ means ‘no risk.’ Spoiler: It means ‘no recourse.’

One must contemplate the metaphysical implications of decentralized finance. If liquidity is concentrated by algorithmic design, is the user truly sovereign or merely a node in a capitalistic feedback loop? PancakeSwap v3 does not liberate-it optimizes. The reduction of gas fees is a distraction from the deeper truth: we are trading not for freedom but for efficiency. And efficiency, in the end, serves power. The duck logo is not a symbol of joy-it is the smirk of the machine that knows we will keep coming back because we have forgotten how to be slow.

Okay so I just tried the cross-chain bridge from Ethereum to BSC and it took 15 minutes and cost $0.75… which is still way better than Multichain’s $12 and 45 minutes, but I swear I thought my transaction was stuck for like 10 minutes and I panicked and refreshed the page-don’t do that!! It didn’t fail but I felt like I was in a horror movie. Also the LP staking rewards are wild-my USDT/CAKE pool is giving me 22% APY but I’m scared to lock it in because I don’t understand impermanent loss. Can someone explain it like I’m 5? Please?? I promise I’ll stop asking if you do!!

WHY IS EVERYONE ACTING LIKE THIS IS SOME KIND OF REVOLUTION?? I’ve been using this since 2021 and it’s the same damn interface with new colors and more buttons. And the ‘Infinity’ upgrade? That’s just a buzzword thrown in to make the marketing team look smart. Also, who decided the UI needed 17 different tabs? I just want to swap tokens, not run a hedge fund. And the fact that you can’t contact support? That’s not ‘decentralized’-that’s just lazy. And don’t even get me started on the Solana thing-why are we pretending this isn’t just a desperate attempt to chase hype? You’re not a pioneer-you’re a follower. And the duck? Still creepy. Still creepy. STILL CREEPY.

I think this is actually really well done. The multi-chain approach is smart. The fees are fair. The lack of KYC is refreshing. I know some people hate the interface, but I think it’s just unfamiliar. Give it a week. Try one small trade. You might surprise yourself. And if you’re worried about security, just use a hardware wallet. Done. Simple. No drama.

Oh wow, another article pretending this is the future of finance. Let me guess-next they’ll say the duck is a symbol of economic liberation? Cute. The only thing ‘unmatched’ here is the marketing budget. Real traders don’t need a 12-feature app. They need one thing: reliability. And reliability doesn’t come from flashy UIs or Solana expansions. It comes from time-tested infrastructure. PancakeSwap is the TikTok of DeFi-loud, fast, and doomed to crash when the algorithm changes. Also, ‘no customer service’? That’s not a feature. That’s a warning label.

Let’s talk about the real innovation: concentrated liquidity + low gas = hyper-efficient capital deployment. This isn’t just a DEX-it’s a liquidity optimization engine. The fee tiers allow LPs to capture 3x the yield with 1/3 the capital. That’s not just smart-it’s algorithmic capitalism at its most elegant. And the cross-chain bridge? That’s the first step toward a true interoperable DeFi backbone. Forget Uniswap. PancakeSwap v3 is the Ethereum of BSC. And the Solana integration? That’s not expansion-it’s the beginning of a new DeFi hegemony. The ducks are coming. And they’re not cute. They’re capital.

you people are so naive. you think low fees means safe? no. it means theyre not spending money on security. also why are you all so obsessed with this duck? its a fucking meme. and you think the audits mean anything? certik gets paid by pancake. its a rigged system. and dont even get me started on the yield farms. you think you're earning? no. you're funding the dev team's yacht. also bsc is centralized. the validators are controlled by binance. so this whole thing is just binance pretending to be decentralized. you're not free. you're just paying less to be owned.

Just swapped my first WBNB for USDT. Took 3 seconds. Paid $0.06. No stress. No panic. No drama. It just worked. I didn’t even need to read the guide. I clicked. It happened. That’s all I needed. Thank you, PancakeSwap. You’re the quiet hero of DeFi.

Hey newbies-if you’re scared of impermanent loss, start with stablecoin pairs like USDT/USDC or BUSD/USDT. The price won’t swing much, so your risk is low. And use the auto-compound feature-it’s like a free money machine. I’ve been staking for 8 months and my CAKE balance grew 3x without lifting a finger. You don’t need to be a genius. Just be consistent. And always double-check the URL. I lost $300 once because I clicked a fake link on Twitter. Don’t be me.

Been using this since 2022. Still works. Still cheap. Still faster than my coffee maker. The duck is weird but I ignore it. The Solana thing is kinda cool. I traded BONK today. No issues. Just another tool. Not magic. Not evil. Just… there.

The concentrated liquidity model in v3 is a game-changer for institutional-grade LPs. It allows for capital efficiency that was previously only possible with order-book DEXes. Combined with BSC’s throughput, this creates a liquidity depth rivaling centralized exchanges. The cross-chain bridge is still clunky, but it’s functional. And the fact that they’ve opened APIs for developers? That’s the real win. This isn’t just a swap tool-it’s a DeFi infrastructure layer. The future is multi-chain, and PancakeSwap is building the rails.

Let me tell you something, you Americans and your pancake obsession. This isn’t innovation-it’s a distraction. Real finance doesn’t run on BSC. Real finance runs on regulated, audited, insured systems. You think low fees mean progress? No. It means you’re trading on a playground where the rules are written by devs who don’t even know what a balance sheet is. And Solana? Please. That chain crashes more than my ex’s phone. And you’re all cheering like it’s the future? Wake up. This isn’t finance. It’s a casino with better graphics. And the duck? It’s the mascot of financial delusion.

For anyone nervous about adding liquidity: start with a tiny amount-like $10-in a stablecoin pair. Use the ‘Impermanent Loss Calculator’ on the site. Watch what happens when prices move. You’ll learn way more in 10 minutes than reading 10 articles. And don’t chase 100% APY pools-they’re either a scam or about to collapse. Stick to the big ones: USDT/CAKE, BUSD/WBNB. They’re stable, safe, and actually pay well. I’ve been doing this for 2 years. No losses. Just steady growth. You got this.

Wait-so you’re telling me the duck is just a logo? I thought it was a sentient AI guarding the liquidity pools. Now I feel silly. But honestly? I still like it. It’s my little crypto guardian. Also, just added $50 to the new Solana CAKE pool. Let’s see if the 84% APY is real… or just a mirage.