How NFT Creators Earn Royalties on Resales

When you buy an NFT, you’re not just buying a digital image or audio file-you’re buying a token tied to a smart contract that might be paying the original creator every time it changes hands. That’s the power of NFT royalties. Unlike traditional art, where an artist sells a painting and never sees another dollar from its resale, NFT creators can earn a cut of every future sale-automatically, forever-thanks to code running on the blockchain.

How NFT Royalties Work

NFT royalties are built into the smart contract when the NFT is first created, or "minted." The creator sets a percentage-usually between 2% and 10%-that gets locked into the token’s metadata. When someone resells that NFT on a marketplace, the platform’s system checks the contract, calculates the agreed-upon percentage of the sale price, and sends that amount directly to the creator’s wallet. No invoices. No follow-ups. No middlemen.

For example, if an artist mints an NFT and sets a 7% royalty, and later someone sells it for 5 ETH, the artist automatically gets 0.35 ETH. That transaction happens in under 30 seconds on Ethereum, assuming the marketplace supports it. It’s passive income, triggered by market activity, not by the creator doing anything extra.

This system relies on standards like ERC-721 (the most common NFT standard on Ethereum) and EIP-2981, a newer protocol designed to make royalty reporting consistent across platforms. But here’s the catch: the blockchain doesn’t enforce royalties by itself. It’s the marketplaces that decide whether to honor them.

Why Marketplaces Are Split on Royalties

In 2022, OpenSea, the biggest NFT marketplace, started letting sellers bypass royalties on collections where the creator didn’t opt in. Then in early 2023, Blur-a trading-focused platform-dropped royalty enforcement entirely. Within weeks, Blur captured over half of all Ethereum NFT trading volume. Why? Because traders wanted to buy and sell without paying extra fees to creators.

Meanwhile, platforms like Foundation and Magic Eden kept enforcing royalties strictly. Foundation, for instance, requires all listed NFTs to honor the original royalty percentage. That’s why artists like Pak, who created the record-breaking "The Merge" collection, earned over $91 million in royalties from secondary sales by 2023. Their income wasn’t from selling 10,000 pieces-it was from every single resale after that.

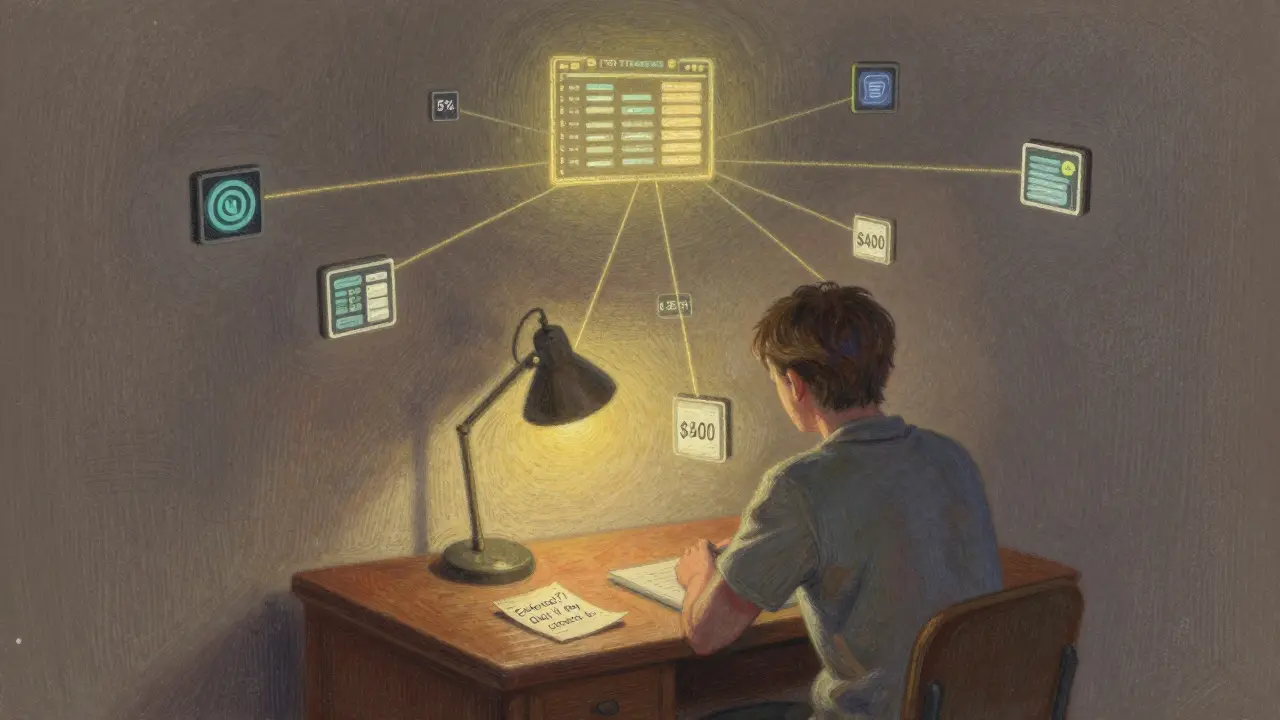

This split created a marketplace war. Traders flocked to royalty-free platforms for cheaper deals. Creators flocked to platforms that protected their income. The result? A fractured ecosystem where the same NFT can earn its creator $0 on Blur but $400 on Foundation, depending on where it’s sold.

What Royalties Mean for Creators

For digital artists, musicians, and designers, royalties turned NFTs from one-time sales into long-term revenue streams. Before NFTs, most digital creators made money from commissions, licensing, or Patreon. Now, a single piece can keep paying out for years.

According to NFT Plazas’ 2023 creator survey, 5-15% of a typical NFT creator’s total income now comes from royalties. For some, that’s their main source of income. A generative artist might sell 100 NFTs for $500 each-netting $50,000 upfront. But if 300 resales happen over the next two years at an average of $2,000 each with a 5% royalty, that’s another $30,000. That’s a 60% return on top of the initial sale.

It’s not just about money. Royalties also give creators more control over how their work is used. When a collector buys an NFT, they’re buying the token, not the copyright. Royalties act as a built-in incentive for collectors to support the artist-because they know the artist benefits too.

The Downsides and Controversies

But royalties aren’t perfect. Research from SSRN in 2022 showed that for every 1% increase in royalty rate, primary market prices dropped by about 0.8%. Why? Buyers anticipate paying more in royalties later and adjust their upfront bids accordingly.

There’s also the "royalty dilemma"-higher royalties reduce liquidity. A 15% royalty might sound great to a creator, but it makes the NFT less attractive to resell. A 2023 INFORMS Journal study found that collections with royalties above 10% saw 15.7% less trading activity than those with lower or no royalties.

And then there’s the legal gray zone. NFT royalties are not legally binding contracts. They’re code. If a marketplace ignores them, there’s no court system to enforce them. Rarible’s terms of service even state that creators grant the platform royalty-free rights to their content. So while the smart contract says "pay 7%," the platform’s rules might say "we don’t have to."

Reddit threads are full of stories like u/ArtByMia’s: she lost $3,200 in expected royalties when her collection was listed on Blur. She had no way to stop it. No recourse. Just code that didn’t get followed.

How to Set Up Royalties as a Creator

If you’re an artist or developer looking to earn royalties, here’s how to get started:

- Choose a platform that enforces royalties-Foundation, Magic Eden, or SuperRare are safe bets.

- Use a minting tool like Manifold Studio or TokenMint that lets you set the royalty percentage during minting (e.g., 500 basis points = 5%).

- Make sure your NFT uses EIP-2981 standard if possible-it’s the closest thing to a universal royalty standard.

- Link your wallet correctly. Royalties go to the wallet address you specify when minting.

- Track sales through the platform’s dashboard. Foundation and Magic Eden show real-time royalty payouts.

Gas fees on Ethereum can cost $1-$5 per mint, but tools like Polygon or Solana reduce that to pennies. Just remember: if you mint on Solana, royalties work differently. Solana doesn’t use EIP-2981-it uses token metadata programs, and enforcement depends on the platform’s implementation.

The Future of NFT Royalties

The industry is trying to fix the fragmentation. In early 2023, the Royalty Registry launched-a decentralized database that stores royalty terms independently of any marketplace. If a platform supports it, it checks the registry before processing a sale. It’s not perfect yet, but it’s a step toward standardization.

Another idea? Staking. Harvard D3 researchers proposed a model where marketplaces must lock up crypto assets as collateral to be allowed to list royalty-protected NFTs. If they ignore royalties, they lose their stake. It’s a financial penalty for bad behavior.

Meanwhile, legal systems are catching up. California’s AB-2281 bill, introduced in March 2023, aims to recognize NFT royalties as enforceable under state law. The EU’s Digital Markets Act is also looking at whether they qualify as "unfair commercial practices."

By 2025, most experts agree royalties will settle around 5% as the industry standard. But the real question isn’t the percentage-it’s whether creators will still have a way to earn from their work in a market that increasingly favors traders over artists.

For now, the choice is yours: build on platforms that respect your work-or build on platforms that don’t. The code is there. The money is there. But the will to pay it? That’s still up to the marketplaces.

Frequently Asked Questions

Do NFT royalties work on all blockchains?

No. Ethereum uses standards like EIP-2981 to standardize royalties, but other chains like Solana and Polygon handle them differently. Solana relies on token metadata, and enforcement depends entirely on the marketplace. Some chains don’t support royalties at all. Always check if your chosen platform and blockchain support the royalty system you want to use.

Can I change my royalty rate after minting?

No. Once an NFT is minted, the royalty percentage is permanently encoded in its smart contract. You can’t update it. That’s why it’s critical to set the right rate before minting. If you’re unsure, start with 5%-it’s the current industry sweet spot.

What happens if I sell my NFT collection to someone else?

The royalty goes to the original creator’s wallet, no matter who owns the collection. Even if you buy a collection and resell it, the original artist still gets their cut. The royalty is tied to the token’s origin, not its current owner. This is why collectors can’t "steal" royalties by acquiring a collection.

Are NFT royalties legal?

They’re not legally enforceable like traditional contracts. They’re smart contracts-code that runs on a blockchain. If a marketplace ignores them, there’s no legal system that can force them to pay. Some governments, like California, are trying to change that, but right now, enforcement depends on marketplace goodwill.

Why do some NFTs have 0% royalties?

Some creators set 0% to make their NFTs more attractive for trading. Others are forced to by platforms that don’t support royalties. In 2023, Blur and other trading-focused platforms made 0% royalties the norm for high-volume collections. It’s a trade-off: lower upfront prices for buyers, but no ongoing income for creators.

Can I earn royalties from NFTs I buy and resell?

No. Royalties only go to the original creator-the person who minted the NFT. If you buy an NFT and resell it, you get the full sale price (minus platform fees), but you don’t earn any royalty from that sale. The royalty is always paid to the first artist or developer who created the asset.

NFT royalties are the closest thing we’ve ever had to a fair system for digital creators. Before this, artists got paid once and then watched strangers flip their work for 10x the price. Now, if your piece gains traction, you actually benefit from its success. It’s not perfect, but it’s a damn sight better than the old model.

Platforms like Foundation and Magic Eden are doing the right thing. They’re protecting the people who actually make the art. The ones who spend nights coding, painting, or composing just to share something meaningful.

And yeah, some traders hate it. They want to game the system. But that’s not the point. The point is sustainability. If creators can’t earn long-term, the whole ecosystem collapses. We’ll be left with nothing but empty hype.

Also, EIP-2981 is the way forward. Standardization is critical. Right now, it’s chaos-same NFT, different royalties depending on where you sell. That’s not innovation, that’s negligence.

Creators should always mint on chains and platforms that enforce royalties. Don’t get lured by cheap gas on Solana if the marketplace ignores your cut. It’s a trap.

I’ve seen too many artists get burned. One guy I know minted on Blur because it was trending. Lost $12k in expected royalties over six months. He’s not making art anymore.

It’s not just about money. It’s about respect. If you buy an NFT, you’re buying a piece of someone’s soul. Honor that.

Let’s be real-royalties are just a fancy way for artists to demand free money from people who bought something they already owned. If I buy a digital image, it’s mine. Why should I keep paying the original artist every time I flip it? That’s not ownership, that’s rent.

And don’t give me that ‘support the creator’ nonsense. If your art is worth reselling, you already got paid. Stop acting like you’re owed a cut of every transaction. It’s greedy.

Blur isn’t the villain. They’re the future. Free markets don’t come with strings attached. If you want to make money from resales, go start a Patreon. That’s what artists did before crypto.

Also, EIP-2981? That’s just another blockchain bro trying to force his ideology on everyone. No one needs another standard. The market will decide what works.

California trying to make this legally binding? That’s socialism for tech. Get real.

So let me get this right the artist gets paid every time someone sells the thing they made even if they didn’t do anything to make it more valuable wow what a scam

if i buy a jpeg and then sell it for more because i posted it on twitter and got 100k likes why should the artist get a cut

also why is everyone acting like this is some revolutionary idea it’s just a tax on trading

blur is the only platform that makes sense

artists need to stop being entitled and start marketing their own work

Y’all are missing the point. This isn’t about art. It’s about control. Creators want to own the resale value of their work forever. That’s not capitalism. That’s feudalism with smart contracts.

And don’t tell me about ‘fairness’-the buyer pays the price. If they want to flip it, they should keep 100%. No one owes the artist a cut. You got paid upfront. Move on.

Also, why are we even talking about Ethereum? Solana’s faster, cheaper, and doesn’t force this garbage on users. The market’s already voting with its wallets. Blur’s volume proves it.

Stop romanticizing artists. Most of them are just lucky. If their NFT blew up, it’s because the community liked it, not because they’re geniuses.

And yeah, the 15% royalty collections? They sit unsold for months. That’s not a feature. That’s a bug.

From a protocol standpoint, the fragmentation of royalty enforcement represents a critical failure in composability across the NFT stack. EIP-2981 was designed as a standardized interface for royalty payment, but its non-mandatory nature creates a negative externality wherein marketplaces externalize the cost of creator compensation.

The Royalty Registry initiative is a promising on-chain oracle solution, but it lacks economic incentives for adoption. Without a slashing mechanism or bonded collateral, it remains a declarative registry rather than an enforceable protocol.

Furthermore, the economic modeling from INFORMS suggests that higher royalty rates induce lower primary market liquidity-a classic deadweight loss scenario. The optimal royalty rate isn’t moral-it’s marginal. The 5% equilibrium observed empirically aligns with Nash equilibrium in bilateral bargaining under asymmetric information.

Until we implement a decentralized governance layer that penalizes non-compliant marketplaces via staked collateral, we’re merely rearranging deck chairs on the Titanic.

Hey everyone-just wanted to say this is one of the most important conversations we’ve had in crypto this year 💪

Creators aren’t asking for handouts. They’re asking for dignity. For years, digital artists were treated like freelancers who got paid once and vanished. Now, they can actually live off their art. That’s huge.

And if you’re buying an NFT because you love the artist? You should want them to keep making more. That’s the whole point. It’s not a tax-it’s a loop of love.

Use Foundation. Use Magic Eden. Support the people who pour their soul into their work. The rest? They’re just flipping JPEGs.

Also, if you’re new to this-don’t panic. Start small. Mint on a platform that respects creators. Your future self will thank you 🌱

Look, I’ve been in this space since 2021. I’ve seen the hype, the crashes, the rug pulls, the fake influencers. But this royalty thing? This is the one thing that actually gives me hope.

Because for the first time, the person who made the art gets to benefit from its success-not just the first buyer, not just the middleman, not just the platform.

And yeah, some people will say ‘it’s not fair’-but fairness isn’t about what’s easy. It’s about what’s right.

I’ve had artists cry in DMs because they got $800 from a resale after selling their first piece for $50. That’s not a bug. That’s the system working.

Blur? That’s a casino with a logo. Foundation? That’s a home.

Choose your side.

Let’s talk about the quiet heroes here-the generative artists, the indie musicians, the pixel designers who never had a chance before NFTs.

Before this, they were invisible. Now, one piece can fund their rent for six months. One resale can pay for their kid’s school supplies. That’s not ‘greed.’ That’s survival.

And guess what? People who buy these NFTs? They know. They’re not stupid. They’re choosing to support. That’s why collections with royalties sell out faster.

Don’t call it a tax. Call it a thank you.

And if you’re a trader who hates it? Cool. Go buy a stock. At least stocks don’t come with art.

It is of considerable interest to observe that the evolution of NFT royalty structures represents a paradigmatic shift in the economic ontology of digital intellectual property. Whereas traditional copyright law relies upon centralized enforcement mechanisms and jurisdictional limitations, blockchain-based royalties introduce a decentralized, immutable, and automated compensation framework that is, in principle, resistant to human intervention.

However, the current market fragmentation-whereby certain platforms unilaterally opt out of royalty enforcement-constitutes a form of institutional arbitrage, wherein the collective action problem of creator compensation is subverted by the pursuit of short-term liquidity gains.

It is therefore imperative that the development of a universally recognized, cryptographically verifiable royalty registry be accelerated, ideally in conjunction with a staking-based governance model that incentivizes compliance through economic disincentives.

Without such a framework, the promise of the NFT ecosystem as a sustainable vehicle for digital creativity will remain unfulfilled, and we shall be left with a market dominated by speculation rather than substance.

royalties are a scam and everyone who supports them is delusional

blur is winning because people are smart

artists arent entitled to money every time someone resells

if you want to make money stop making art and start trading

also why is everyone on ethereum its so slow and expensive

solana ftw

and stop calling it art its just a jpeg

So let me get this straight the artist gets paid every time someone flips their jpeg and we’re supposed to be impressed

congrats you made a vending machine that takes money from buyers

also why is everyone acting like foundation is some holy temple when they charge 15% in fees

the real scam is that we all thought this was about art

turns out its about who can outsmart who with smart contracts

lol

Canada has a different view on this. We don’t believe in perpetual royalties on digital goods. Once you sell something, you’re done. The buyer owns it. Full stop.

It’s not about being anti-artist. It’s about property rights. If you want ongoing income, license it. Don’t embed it in a token.

Also, EIP-2981? That’s an American solution to an American problem. The rest of the world doesn’t care.

I’m from India and we don’t have much money here but I still bought an NFT because the artist was from my city and I wanted to help.

When I resold it, I paid the 7% royalty because I knew it meant he could eat next month.

That’s not a tax. That’s community.

Also, I didn’t even know what a smart contract was before this. Now I do. And I’m proud to be part of it.

As someone who’s been minting since 2020, I can tell you this: royalties saved my career.

I was a freelance designer making $20/hour. Now I make $3k/month just from resales on my 2021 collection.

It’s not glamorous. It’s not loud. But it’s real.

I don’t care if Blur doesn’t pay. I don’t list there. I don’t even look at their site.

My wallet is full because I chose to build on platforms that believe in artists.

And yeah, I still use emojis. 😊

royalties are a joke

the only people who care are the ones who made one nft and got lucky

most artists make nothing

and the ones who do? theyre not even the best ones

the best ones are still doing commissions on etsy

stop pretending this is fair

its just a new way to scam people into thinking theyre supporting art

Let’s be brutally honest: royalties are a psychological weapon disguised as economics.

They make buyers feel guilty. They make creators feel entitled. They make platforms choose sides.

It’s not about fairness. It’s about control.

And the worst part? Most collectors don’t even know how much they’re paying. They just click ‘buy’ and assume it’s normal.

That’s not innovation. That’s manipulation.

Also, EIP-2981? More like EIP-2981: ‘Expecting Impressive Payments’

🤡

I’ve been a collector for 4 years. I’ve bought hundreds of NFTs.

I pay royalties every time because I believe in the people behind the art.

It’s not about the money. It’s about the story.

When I see an artist’s name pop up in my wallet because someone resold their piece? I smile.

That’s the magic no one talks about.

It’s not blockchain.

It’s humanity.

If you’re a creator: set your royalty at 5%. Don’t go higher. Don’t go lower. 5% is the sweet spot.

Use EIP-2981. Mint on Foundation or Magic Eden.

Don’t mint on Solana unless you’re 100% sure the platform enforces it.

Track your payouts. Reinvest some into your next project.

This isn’t get-rich-quick. It’s get-rich-slow-and-steady.

And if someone says royalties are unfair? Tell them to go make their own art and see how it feels to get nothing.

royalties are the reason this space is dying

people arent buying because theyre tired of paying extra

the artists who want royalties are the same ones who cant sell without crying about it

if your art is good it will sell anyway

stop being a victim

and why is everyone on ethereum its so slow and expensive

use solana

or just stop making nfts

Let’s cut the crap. This isn’t about art. It’s about power.

Creators want to control what happens to their work forever. That’s not creative. That’s controlling.

Buyers want freedom. Marketplaces want volume.

And the blockchain? It’s just the stage.

Blur won because they gave people what they wanted: no fees, no guilt, no rules.

The rest? They’re just clinging to a dream that never existed.

Art doesn’t need royalties. It needs attention.

And attention? It’s free.

Reading all this… I’m reminded of the early days of the internet. People said websites would kill publishing. Then blogs. Then social media. Each time, creators feared being erased.

But the ones who adapted? They thrived.

NFT royalties aren’t perfect. But they’re the first time digital creators have ever had a built-in, automated way to earn from their work long-term.

Yes, traders will always try to game the system. That’s not new.

The real question is: do we want a world where art is only profitable for the first buyer?

Or one where the person who made it keeps being rewarded?

I know which one I choose.

And I’m not backing down.